ETF Report: Global X Robotics & Artificial Intelligence

Are robotics really the future? If so, is BOTZ the best-positioned fund?

Good morning, investors!

We’re back with another ETF report. This time, we’re looking at a passive fund with exposure to a very active field: the Global X Robotics & Artificial Intelligence ETF.

If this is your first time with us, feel free to subscribe here. If you enjoy today’s newsletter, please hit the heart button at the end of the report.

Without further ado…

BOTZ ETF Review

The Global X Robotics & Artificial Intelligence ETF (BOTZ or the “Fund”) is a passive fund that tracks…don’t hold your breath…the Indxx Global Robotics & Artificial Intelligence Thematic Index (the “Index”). As these long-winded titles imply, we’re dealing with companies that strive to remove human intervention from various walks of life.

Industrial robotics is the *classic* use case (e.g., robot arms pulling indefinite shifts on an assembly line), but there are also medical, agricultural, professional, and transportive applications for our robot companions. To give you an example, a team at the University of Cambridge developed the Vegebot, which uses machine learning to harvest Iceberg lettuce.

The BOTZ ETF gives investors exposure to companies that prioritize the development and application of these types of machines by mirroring the holdings of the Index.

What is the Indxx Global Robotics & Artificial Intelligence Thematic Index?

Indxx is a frustratingly named index provider. The Indxx Global Robotics & Artificial Intelligence Thematic Index measures the general performance of a particular subset of the stock market — robotics and AI-focused companies. Currently, the Index consists of 38 stocks that play some sort of role in these technological spaces.

To qualify for the Index, companies must have “significant exposure” to the robotics/AI theme and a market cap of at least $300 million. Significant exposure is loosely defined as (a) deriving a “significant portion” of revenue from robotics/AI themes or (b) its primary business is focused on these themes.

Who runs the BOTZ ETF?

The portfolio managers behind BOTZ are John Belanger (COO of Global X ETFs), Nam To, Wayne Xie, Kimberly Chan, and Vanessa Yang.

What Companies Are in BOTZ?

The BOTZ ETF is composed of the same 38 stocks that are within the Index, which includes household names like Nvidia, ABB, and Intuitive Surgical as well as lesser-known companies such as AeroVironment and Ageagle Aerial Systems. (That said, Ageagle (UAVS) could get the boot once the index reviews its holdings in June; shares of UAVS are down roughly 93% over the last year. Fortunately, it’s the fund’s smallest holding at 0.07%.)

BOTZ’s prospectus specifically describes eligible companies as those “developing industrial robots and production systems, automated inventory management, unmanned vehicles, voice/image/text recognition, and medical robots or robotic instruments.”

Here’s a list of the top ten holdings within BOTZ, organized by fund weighting. As you can see, BOTZ is rather concentrated, as these companies represent two-thirds of the entire fund.

Top 3 holdings of BOTZ

BOTZ (and its underlying index) are weighted by market cap, as opposed to an equal weighting regardless of size. Naturally, this leads to concentration; the top three positions equate to 28.6% of the Fund. Since these companies predominantly drive performance, let’s explore them a little further, particularly how they’re involved in robotics.

NVIDIA is a well-known producer of computer chips and one of the largest companies in the world by market cap (hence why it claims such a high percentage of BOTZ). But did you know this semiconductor company is at the forefront of robotics and AI research?

For instance, NVIDIA’s hardware for self-driving cars, NVIDIA DRIVE, has been adopted by several auto manufacturers — most recently, Kodiak Robotics (a self-driving truck startup), Lotus (sports cars), QCraft (autonomous buses), and WM Motor (an EV startup). Beyond autonomous vehicles, the company is also responsible for lots of innovative research in robotics, testing actions like grasping and placement. And that’s just scratching the surface of what NVIDIA does in the robotics/AI space.

ABB is one of the leading suppliers of robotics and machine automation solutions. It also has its hands in various industries, including logistics, construction, and electronics. For example, ABB recently helped a medical machinery manufacturer automate the production of biomedical disposables for dialysis and infusions.

Intuitive Surgical produces robotics-assisted surgical systems (most notably, the da Vinci) to provide minimally-invasive surgeries and improve clinical outcomes — like taking lung biopsy samples. And the company is doing quite well. In 2016, Intuitive shipped 537 units and generated $2.7 billion in revenue. Last year, those figures were 1,347 and $5.7 billion.

The Appeal of Robotics

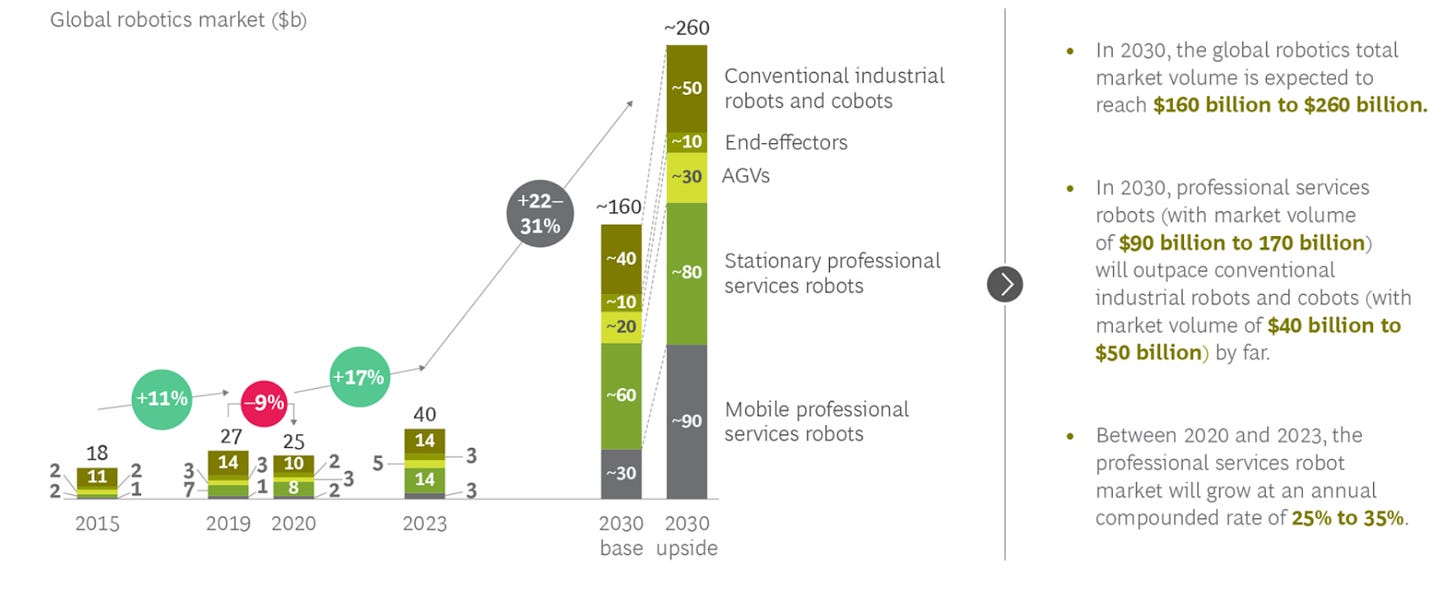

“We expect the global robotics market to climb from about $25 billion this year to between $160 billion and $260 billion by 2030, with market share for professional services robots hitting up to $170 billion and industrial and logistics robot sales topping off at about $80 billion.” — BCG Robotics Outlook 2030

Robotics is widely considered to be an emerging technology that will shape the future of mankind. Companies wouldn’t be pouring billions of dollars into it otherwise. If you want a firmer understanding of the potential application and trends of robotics, I highly recommend reading BCG’s robotics outlook. It provides trends that will guide industry growth as well as three market scenarios. The trends are as follows:

Professional services robots will dominate the sector (see chart below). Think activities like cleaning services, construction, and underwater exploration.

Changing consumer preferences and social trends will accelerate the need for advanced robotics solutions.

Robots will increasingly take over traditionally lower-paying and less skill-intensive jobs.

Artificial intelligence and other technological advances will enhance human-to-robot interactions.

Robot capabilities will include the ability to learn.

Semi-autonomous mobile machines will increasingly manage tasks in pre-mapped environments. Think vehicles that can drive autonomously in ideal conditions but not totally unassisted; BCG thinks these vehicles will account for 8% of new car sales in 2030.

Asian robotics companies, currently a small slice of the market, will be competitive with US and European manufacturers.

The Risks of Robotics

Based on R&D alone, robotics has a future. The trickier thing to forecast is how lucrative that future will be — and who will profit from it. Regarding the latter, robotics — like technology as a whole — is highly competitive and, therefore, susceptible to disruption and product obsolescence. Investing in a thematic ETF like BOTZ spreads your chips across the roulette table, upping your odds of having your number called.

Still, a lot still has to continue changing for this industry to prosper. There are scenarios in which robotics doesn’t meet its sky-high expectations. The simplest is a lack of social acceptance — if people don’t reach a high enough comfort level with autonomous equipment, scalability isn’t viable. While that’s not much of an issue in non-human-facing settings (like industrials and agriculture), it is a roadblock for an area like driverless cars (ba-dum-tsshh).

ETF comparison BOTZ vs. Peers

Investors have no shortage of options when it comes to robotics and AI ETFs. Here’s a side-by-side comparison of BOTZ and a few other funds.

Highlights

Each fund is passive but tracks a different index. For instance, ROBO is based on Robo Global’s own index of robotics and automation companies. Further, ROBO holdings are based on a modified equal weighting system, so you don’t have a scenario like NVIDIA for BOTZ.

BOTZ is far more concentrated than its peers with only 38 holdings. Naturally, that means the other funds have more exposure to other fields and applications of robotics.

From an expense ratio standpoint, BOTZ is right in between its peers.

BOTZ Outlook

The outlook for BOTZ is obviously dependent on the success of the robotics industry — and, more specifically, ten or so large-cap stocks. But that’s not necessarily a bad thing. For instance, assuming automated vehicles graduate from a niche experiment to some sort of standard, NVIDIA would be well-positioned to benefit.

On the other hand, it’s not exposed to as much of the robotics market, such as the agricultural side. To give you an idea, Deere & Company (i.e., John Deere) is a big player in agricultural robotics — but it’s outside of BOTZ’s investment scope. (John Deere is held by ROBO and ROBT though).

Regardless, the recent market sell-off of technology stocks has crushed these funds in 2022. In the near term, BOTZ and its peer ETFs could continue to have shaky performances, but now could also be a good entry point if your investment horizon is 2030 and beyond.

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report. If you haven’t subscribed already, you can do so here.