Good morning, investors (and that one lawyer who sees due diligence and shudders involuntarily at a potential work email)!

The stock market has seen better days. Fears of rising inflation and corresponding fed rate hikes (on top of the usual pandemic, supply chain, and geopolitical issues) have investors running for the hills.

However, one investor’s trash is another’s treasure. If we apply a glass-half-full perspective to the current downturn, we can locate a few severely undervalued companies.

So, today’s issue (and likely future ones) will explore several companies that have triggered a momentum indicator — the Relative Strength Index (RSI), which measures the magnitude of recent price changes to analyze overbought or oversold conditions.

Based on recent trading activity, stocks will generate an RSI between 0 and 100. Traditionally, scores below 30 indicate the stock is oversold, while scores above 70 indicate the stock is overbought. This measurement alone does not guarantee a rebound today, next week, or anytime in the future. That said, it can expose more appealing entry prices for long-term investors.

Let’s take a look at a handful of stocks that have slipped well below that RSI threshold of 30.

But first, is there someone you know who’s missing a little stock research in their life? What better way to brighten their day (and maybe even their portfolio) than to share this post with them?

Thank you!

Is Lyft Stock Oversold?

Lyft’s business model relies on two groups: riders and drivers. Unfortunately for the #2 ridesharing provider, neither group has recovered to pre-pandemic levels. Here’s a quarterly summary of active Lyft riders (in millions) since the first quarter of 2020.

Nevertheless, Lyft had a solid first quarter, narrowing its operating loss to $199.3 million (an improvement from $416.4 million in the first quarter of 2021). While Lyft has inched closer toward operating profitability, the current macroeconomic environment could reverse that trend in the near future.

On its Q1 call, the company warned investors of rising costs. The gasoline price surge makes driving strangers to and fro less appealing. In turn, Lyft has a tough choice to make — lift driver investments/incentives and eat into profits or lose drivers and risk losing business.

Lyft plans to take the latter approach, which is the impetus behind significantly lower adjusted EBITDA guidance for Q2: between $10 and $20 million compared to $55 million in Q1.

Ridesharing services like Uber and Lyft have become transportation staples, so it’s no surprise to see Wall Street so bullish about LYFT while it trades near its all-time low.

Is Netflix Stock Oversold?

The OG streaming platform can forever lay claim to the cultural phenomenon that is “Netflix and Chill.” However, investors are hesitant to believe Netflix will remain the preeminent platform for watching movies and shows.

This about sums it up.

The streaming giant is, well, still giant at 221.6 million paid memberships — but that’s not 221.8 million paid memberships. For the first time in at least a decade, the company lost subscribers on a net basis. It’s easy enough to rationalize that people aren’t stuck inside anymore, so fringe watchers no longer need the company’s services — but there’s also some uneasiness around pricing, especially during a turbulent period economically.

Here’s a clean overview of Netflix’s price hikes over the years from the Verge.

That premium plan…sheesh.

And Wall Street tends to echo that uneasiness, issuing 28 holds.

Is Amazon Stock Oversold?

Yes, even the eCommerce titan and cash-flow machine has taken a few blows — AMZN is down 43% since its 52-week high.

The tech sell-off theme is still in play here, but Amazon’s first quarter performance didn’t help matters, as the company reported weaker-than-expected retail revenue. On top of that, thanks to a $7.6 billion non-operating expense related to its interest in Rivian Automotive, Amazon reported its first net loss since 2015.

Even Operating cash flow was negative, down from $4.2 billion in 1Q21 to a cash burn of $2.7 billion.

Still, it’s Amazon. Does the miss warrant a 43% fall? Probably not.

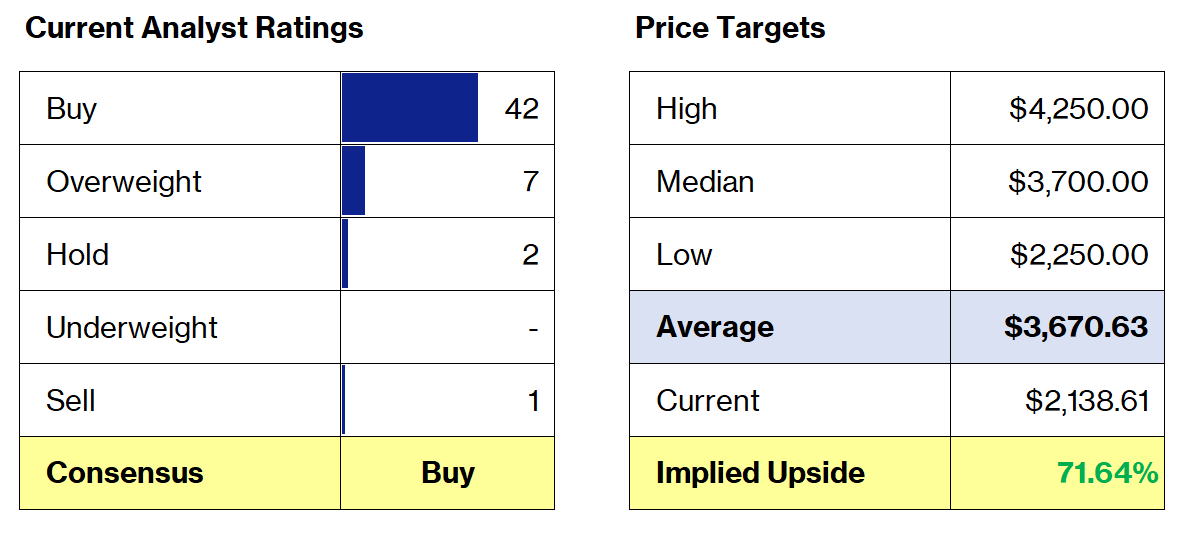

Wall Street agrees.

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.