DD Digest: Tech Layoffs Abound + Apple’s Supremacy

A quick fix of the latest financial happenings.

Good morning, investors!

If this is your first time with us, don’t forget to subscribe here. If you enjoy today’s issue, please hit the heart button at the end of the report.

Without further ado…

One Way For Tech Companies to Save Money: Layoffs

Since peaking in November, the Nasdaq 100 is down about 34%. Meanwhile, the S&P 500 is “only” down about 25%. Considering roughly six out of every ten companies in the Nasdaq 100 index belong to the technology sector, that’s not much of a surprise — with rates rising and a recession looming, investors have dumped their tech holdings.

One way tech companies can combat rising interest expenses and bolster their bottom lines? Slash SG&A by firing people in droves.

And that’s a route many have already taken — including notable companies like Tesla, IBM, Coinbase, Peloton, and Carvana.

Through June, 320 tech companies have initiated layoffs, impacting 61,397 employees, according to TrueUp. Almost two-thirds of that slashing has taken place in the last two months.

Will more companies follow suit?

Two Graphs of Apple’s Supremacy

Apple. The pinnacle of the tech world.

There are plenty of reasons why AAPL has the largest market cap in the world (usually) — one is that it practically prints money.

How much money, Carter?

Last quarter, Apple generated $97.3 billion of net sales. iPhones, Macs, iPads, AirPods, Apple TVs, Apple Watches — the company produces a lot of highly sought-after products that people routinely buy and replace as new generations launch.

But their services business is nothing to sneeze at either. Over the last decade, Apple has steadily expanded its services, which include its advertising, AppleCare, cloud, digital content, and payment segments.

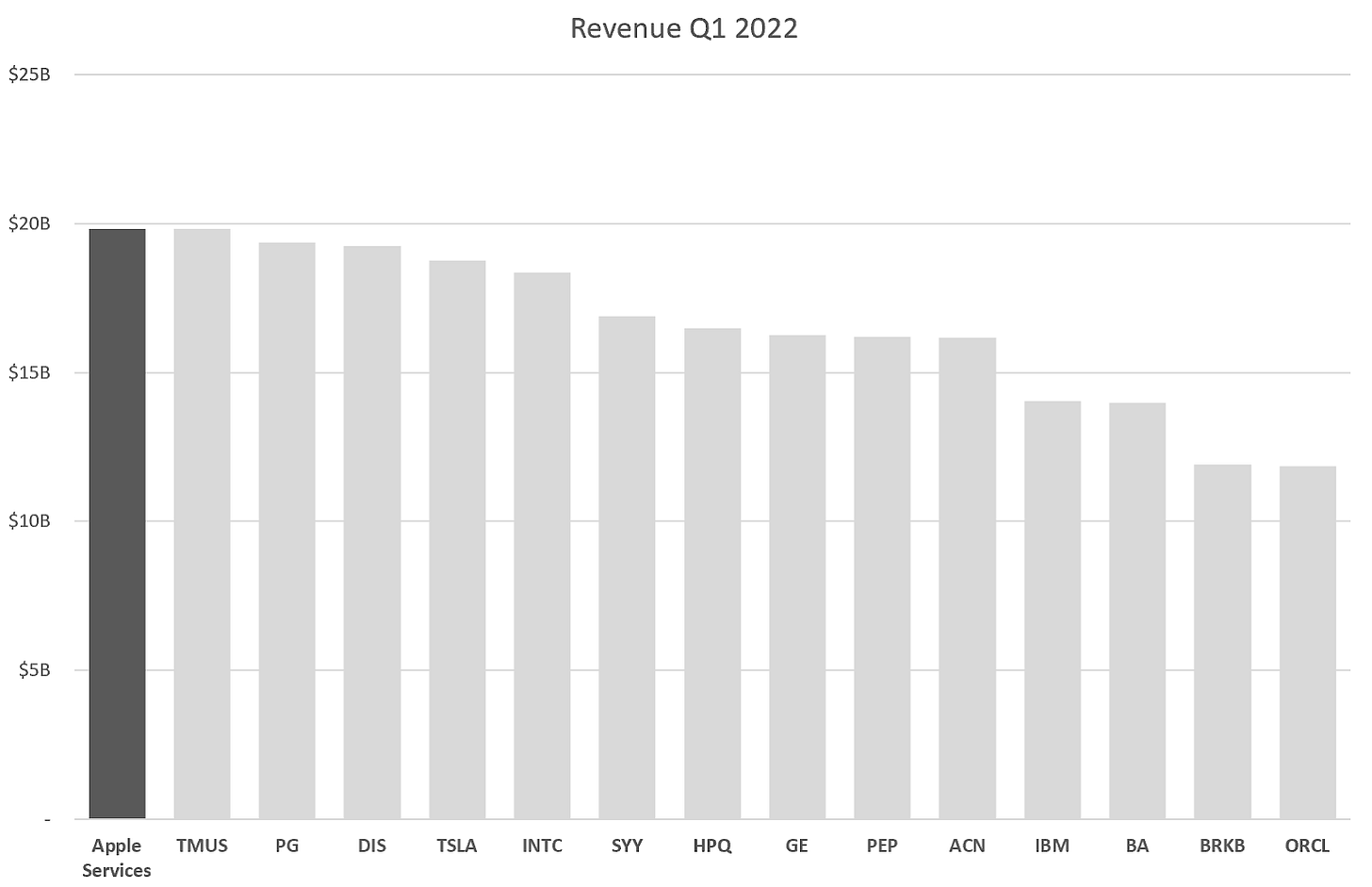

Just how successful are Apple’s services? Alone, they generate more revenue than many of the world’s largest companies.

In terms of free cash flow, no one even comes close to touching Apple. It’s head and shoulders above every other company.

Apple stock has lost about a quarter of its value since peaking at about $183. Interestingly enough, it’s trading at roughly the same price that it did this time last year. Can it bounce back to all-time highs? It certainly generates enough money to continue reinvesting in its business lines, buy back shares, and issue dividends.

I’m not betting against them.

Three Eye-Opening Tweets

And finally, we close with three eye-opening tweets.

The best performing stock over the last 20 years: Not Apple.

SaaS is…cheap?

Remember when Carvana nearly hit $400?

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.