ETF Report: Global X Blockchain (BKCH)

Blockchain's future is bright. But is BKCH positioned well enough to profit from it?

Good morning, investors!

Cryptocurrency is famous (or infamous, depending on your opinion). It’s embedded in the financial world and spurred cultural revolutions. However, in many respects, crypto is still enshrouded in controversy and uncertainty.

Its underlying technology is another story.

Today’s ETF report discusses a few ways investors can add blockchain exposure to their portfolios, including the Global X Blockchain ETF.

If this is your first time with us, feel free to subscribe here. If you enjoy today’s newsletter, please hit the heart button at the end of the report.

Without further ado…

BKCH ETF Review

The Global X Blockchain ETF (BKCH or the “Fund”) is a passive fund that tracks the Solactive Blockchain Index (the “Index”). As you can probably guess, the companies comprising this index do business — one way or another — in the realm of blockchain technologies, including mining, transactions, applications, hardware, and integration (collectively, “Blockchain Activities”).

What is a blockchain?

A blockchain is a digital, decentralized ledger (i.e., a record of transactions) that’s publicly distributed across a computer network.

As the name implies, a blockchain is organized into “blocks” of data that are linked together. Blocks can only store so much data, so, once they’re at capacity, they close and link to the end of the chain. The end result is an ongoing, unchangeable record of transactions that’s time-stamped and secure.

The “decentralized” aspect means there isn’t a central authority overseeing the network — like the Federal Reserve oversees the dollar. Instead, it’s a community-based system. Miners dedicate their computing power to solving complex computational problems that help facilitate transactions through the ledger and create new coins.

Here’s a simple overview:

How is blockchain useful?

Blockchain is most prevalent in the crypto-sphere, as well as the financial sector. That’s because it enables the digitization and safekeeping of transactions. Tamper-proof and time-stamped records have a natural appeal to banks and related entities.

But blockchain’s usefulness extends beyond finance.

In a recent report, Deloitte identified trends within the blockchain industry, including a variety of use cases. Andre Luckow, the head of emerging technologies at BMW Group IT, recounted his experience with the design and deployment of blockchain at BMW. As a global vehicle manufacturer, BMW’s supply chain is very complex. So, Luckow and his team turned to blockchain to sort out the mess:

“Not so long ago, we still relied on spreadsheets and email. Fraud, limited visibility into second-tier suppliers, and mismatch of supply and demand were common issues that had the potential to cause production disruption and quality issues. My team started with a proof of concept that allowed the BMW Group and a handful of suppliers to share supply chain data more easily over a blockchain. Real-time visibility, shared among all supply chain members, prevented overstocking and shortages. The transparency not only benefited us with more information about part origins but also enabled our suppliers to uncover improvement opportunities.”

We’ll revisit Luckow’s perspective and Deloitte’s findings shortly.

What is the investment thesis of Global X Blockchain ETF?

As a passive ETF, the goal of BKCH is to mirror the performance of its underlying index. Neither the Fund nor the Index invests directly in cryptocurrency. That said, there are ETF products that (sort of) do — such as the Global X Blockchain & Bitcoin Strategy ETF (BITS). The BITS ETF invests in Bitcoin futures as well as equities found within BKCH.

What is the Solactive Blockchain Index?

The Solactive Blockchain Index (the “Index”) tracks the performance of blockchain companies, which it divides into three categories, ranked by priority in terms of security selection:

Pure-Play: The company generates at least 50% of its revenue from Blockchain Activities.

Pre-Revenue: The company’s primary business is based on blockchain technology — but it doesn’t generate revenue yet.

Diversified: The company generates less than 50% of its revenue from Blockchain Activities.

If there are less than 25 qualifying Pure-Play companies, Pre-Revenue companies are included until the Index reaches 25 holdings. The same process goes for Diversified companies.

To be eligible to join the Index, companies must have a greater than $200 million market cap and an average daily trading value of $2 million over the last six months. Moreover, at least 10% of a company’s shares must be publicly tradable (i.e., free float) or be worth $1 billion of market cap.

Lastly, there are a few specifications around weighting:

The Fund’s weighting is based on a modified market capitalization method. The max weight for an individual holding is 12% while the minimum weight is 0.3%.

The aggregate weight of companies that comprise at least 4.5% of the index can’t exceed 45% of the total index. At the moment, the Fund’s top 10 holdings are each greater than 4.5% of the index — and collectively almost 75%. So, the index will face extensive rebalancing in May.

The aggregate weight of Pre-Revenue and Diversified companies is capped at 10% of the total index. And each individual company within these categories can’t exceed 2% of the index.

What Companies Are in BKCH?

True to its investment thesis, the BKCH ETF consists of the same 25 stocks that are within the Index, which includes several large-cap stocks (e.g., Coinbase, Block, and PayPal) as well as quite a few small-cap stocks (e.g., Riot Blockchain, Hut 8 Mining, and Hive Blockchain).

Here’s a list of the top ten holdings within BKCH, organized by fund weighting. BKCH is very concentrated, as these companies account for nearly 75% of the entire fund.

Top 3 holdings of BKCH

The top three holdings of BKCH are Coinbase, Riot Blockchain, and Marathon Digital. Together, they represent over 35% of the Fund — as these companies rise and fall, so too does the Index.

It’s been a horrible year for each stock. But, then again, that sentiment holds true for most tech stocks out there right now.

Still, the Fund has taken a beating as a result, as it’s down 27.6% this year.

Coinbase (COIN) is one of the world’s most popular cryptocurrency exchanges. (Long-time Due Diligence readers should be familiar with Coinbase, as we covered it back in April 2021.) Just like any type of asset exchange, Coinbase enables individuals and institutions to trade crypto.

Coinbase generates revenue primarily via transaction fees, but it also makes money from ancillary sources like staking (in simplest terms, validating blocks), custodial accounts, and educational campaigns.

In case you’ve forgotten, last year saw the dawn of meme investments — one of which was dogecoin. The crypto markets experienced a flurry of activity, which helped Coinbase grow revenue by 514% — or $1.3 billion in FY20 to $7.8 billion in FY21.

Riot Blockchain (RIOT) is a cryptocurrency mining operation. It accumulates and deploys mining rigs, which are designed to solve the complex computer problems behind the data blocks on the Bitcoin blockchain. Upon solving these problems and completing blocks, the successful miner receives a reward. This is how RIOT makes money.

Last year, Riot significantly scaled its ability to mine Bitcoin, leading to unprecedented revenue levels for the company. In 2021, Riot generated $213.2 million of revenue, compared to just $12.1 million in FY20. One of the primary catalysts was its investment in mining facilities and rigs. In May 2021, it purchased Whinstone US Inc. from Northern Data AG (another company within the Index). Whinstone owns what is believed to be the largest single facility in North America dedicated to mining Bitcoin. Riot had 30,907 mining rigs as of 12/31.

Although it doesn’t generate a profit, Riot appears to be decently positioned to continue mining Bitcoin. However, the company has a rather peculiar history — one that’s worth delving into since RIOT comprises a sizable percentage of BKCH.

Before it overhauled its business, Riot operated under the name Bioptix and worked in medical diagnostics, which included animal testing as well as a diagnostic for acute appendicitis in children, adolescents, and young adults. The latter failed as it never received FDA approval. Bitcoin, and crypto as a whole, has a shady past. Perhaps it’s only fitting that Riot does too. But it’s still somewhat of a red flag.

Marathon Digital (MARA) is another cryptocurrency mining operation that prioritizes Bitcoin.

Like Riot, Marathon had an exciting 2021 — revenue grew from $4.4 million in FY20 to $150.5 million last year. Perhaps more importantly, Marathon invested more than a Brinks truck’s worth of cash ($709 million) in mining facilities and rigs, as the company aims for a total fleet of roughly 199,000 state-of-the-art bitcoin miners by the end of the year.

Marathon’s history is equally back-and-forth. Just read this timeline from MARA’s latest 10-K, which I’ve organized into a bulleted list and emboldened for emphasis:

On December 7, 2011, we changed our name to American Strategic Minerals Corporation [from Verve Ventures, Inc.] and were engaged in exploration and potential development of uranium and vanadium minerals business.

In June 2012, we discontinued our minerals business and began to invest in real estate properties in Southern California.

In October 2012, we discontinued our real estate business and we commenced our IP licensing operations, at which time the Company’s name was changed to Marathon Patent Group, Inc.

On November 1, 2017, we entered into a merger agreement with Global Bit Ventures, Inc. (“GBV”), which is focused on mining digital assets. We have since purchased our cryptocurrency mining machines and established a data center in Canada to mine digital assets. (MARA would eventually terminate the merger acquisition.)

Much like Riot, Marathon’s sizable investments in crypto mining are clear indicators that it’s a legitimate player in this space. Its track record of bouncing around just raises concerns from the perspective of a potential long-term shareholder.

The Appeal of Blockchain

“Blockchain and [distributed ledger technology] platforms have crossed the disillusionment trough of the hype cycle and are well on their way to driving real productivity.” — Deloitte article, Blockchain: Ready for business

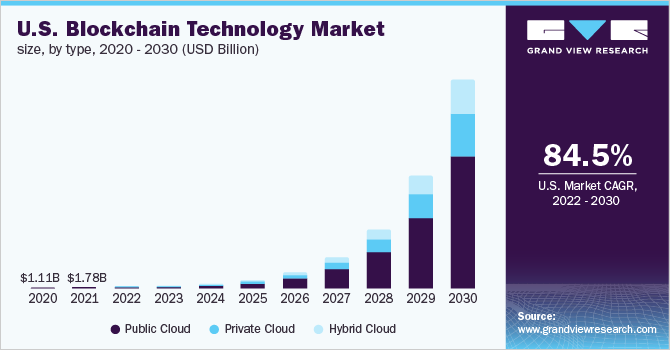

Blockchain’s future is bright. Cryptocurrency, decentralized finance (DeFi), supply chain management, digital identification — there is a budding list of use cases for this technology. One report estimates that the US blockchain market will grow at an astounding 84.5% compound annual growth rate through 2030. And the global market is anticipated to generate $1.4 trillion of revenue by the end of the decade.

Of course, there’s a lot of time between now and 2030.

Deloitte’s report outlined several applications of blockchain technology that are gaining traction:

Self-sovereign data and digital personal identity. In other words, reliable and secure ownership over personal data, which could impact access to public health information and even voting procedures.

Trusted data-sharing among third parties. This goes back to the earlier BMW supply chain example. Centralized technology can be limited by silos and privacy restrictions. However, blockchain enables companies to share data with ecosystem partners without jeopardizing security.

Grant funding. The transparency embedded in a blockchain ledger system alleviates the burden of monitoring and reporting financial results.

Intercompany accounting. Large enterprises typically have complex, multi-tiered corporate structures that can span ecosystems, industries, continents, etc. Blockchain simplifies intercompany clearance and settlement by validating transactions and maintaining an immutable record.

Supply chain transparency. Beyond simplifying data sharing, blockchain’s proven record-keeping capabilities also help companies maintain transparency during the procurement process.

Customer and fan engagement. Whether or not you see any value in NFTs, they’ve changed the world of collectibles. Entire communities have been built around these digital images.

Creator monetization. Blockchain and other DLT platforms allow creators to control and monetize their IP. For instance, BitClout — a decentralized social media platform — gives creators the ability to sell “creator coins” and profit from their content and reputation.

The Risks of Blockchain

In terms of broader application, blockchain is still in its infancy. However, the technology itself isn’t the most concerning risk. For all intents and purposes, blockchain has a variety of use cases and several industries, particularly financial services, have invested heavily in this technology.

But an investment in BKCH is also investing in the original and most prominent use case for blockchain — cryptocurrency.

Just following the money, I’m hardpressed to believe crypto will vanish anytime soon. At this stage, Bitcoin has a better chance of hitting $150,000 than it does tumbling to $0. Every subsequent dip (or even crash) begets a new wave of buy orders.

Still, Bitcoin and its fleet of altcoins are hardly stable assets. Uncertainty breeds volatility, and most investors still don’t have a firm understanding of this asset class. Plus, there are mounting concerns around the environmental impact and sustainability of crypto. Considering BKCH dips deep into the trough of crypto mining, its performance is highly correlated to crypto movements rather than the application of blockchain.

ETF comparison BKCH vs. Peers

There are plenty of blockchain ETFs to choose from, including active and passive funds. Here’s a side-by-side comparison of BKCH and several other funds.

Highlights

There are a variety of ways to evaluate whether a company falls within the thematic umbrella of “blockchain.” To give you an idea, there’s minimal overlap between BKCH and LEGR (NVIDIA and PayPal are the only two shared stocks). While BKCH focuses on companies that generate revenue via blockchain activities (mining, applications, transactions, etc.), LEGR selects from a pool of companies that either develop or use blockchain technology — so it doesn’t necessarily need to be a business’s primary means of operation. Hence why LEGR consists of companies like IBM, Oracle, and Walmart, which have successful, standalone businesses outside of the blockchain ecosystem.

BKCH is, by far, the most concentrated fund. It’s also the least expensive.

AS a whole, blockchain ETFs have grown in popularity, but they’re still small relative to other thematic funds.

BKCH Outlook

The future of crypto mining, particularly for bitcoins, is foggy. Crypto is unlikely to disappear anytime soon, and staking could very well replace proof of work and assuage concerns around environmental impact. But the long-term sustainability is questionable.

As a “blockchain” fund, BKCH slants toward mining operations. Out of its top 10 holdings — which, as a reminder, represent roughly 75% of the fund — 6 companies predominantly operate as crypto miners (7 if you include Canaan, which sells the hardware for it). That’s not exactly a surprise considering the Fund’s selection pool is driven by revenue from blockchain rather than the development of blockchain.

But its slant toward mining operations translates to a reliance on Bitcoin.

COIN holds roughly 8,000 bitcoins.

RIOT holds roughly 3,500 bitcoins.

MARA holds 3,321 bitcoins.

A rising Bitcoin tide lifts all crypto stocks. Conversely, they also retreat with a falling tide.

Investors can leverage a product like Global X Blockchain ETF to get indirect exposure to crypto, namely Bitcoin, but it’s not ideal for maximizing the diverse applications of the actual technology — which I think has a much more promising outlook.

To conclude, let’s revisit our BMW story from the Deloitte report, emboldened for emphasis:

“Looking back on the hype around blockchain in 2018 and the progress the BMW Group has made since, two things are clear. One, blockchain is transformative, and one day we will be using blockchain-based technologies without even realizing it because of the potential they have to build better business processes and customer experiences. Two, the transformation may take longer than anyone anticipated. Businesses need to adopt broader thinking as to which new markets or ecosystems can be supported and simplified through blockchain; they need to ask the right data-driven questions to find their appropriate use cases. If we push the technology forward from all sides, we’re bound to see even more great ideas surface.”

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report. If you haven’t subscribed already, you can do so here.