Good morning investors!

Today’s spotlight rests above a promising player in the electric vehicle industry — an automaker that’s never produced an all-electric vehicle.

Fisker Inc.

If this is your first time with us, feel free to subscribe here. If you enjoy today’s newsletter, please hit the heart button at the end of the report.

Now, without further ado...

What is Fisker?

Fisker Inc. (FSR) is an American electric vehicle automaker founded by Henrik Fisker and Geeta Gupta-Fisker (no relation — just kidding, they’re husband and wife). You could argue that a more apt description is “soon-to-be” EV automaker because they haven’t produced a single all-electric model yet.

But that hasn’t stopped investors from clamoring for shares.

Fisker went public via a SPAC merger in October 2020, opening at $9.25 on its first day. Since then, its stock peaked at $31.96 — but it’s down to $14.53 as of yesterday’s close.

Why are people buying Fisker stock?

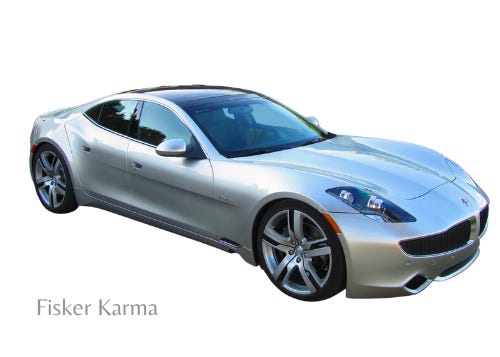

Although it hasn’t produced an electric vehicle, Fisker (the company and the couple) isn’t new to the auto industry. In 2008, Fisker Automotive debuted one of the first luxury hybrid vehicles: the Karma.

The Karma was a low-production model (only about 2,500 models were produced), but it was well-received by the car community. Top Gear named the Karma its Luxury Car of The Year in 2011. Production of the Fisker concluded in 2012 when the company’s battery supplier went bankrupt.

Additionally, before launching Fisker Automative in 2007, Henrik worked at BMW, Ford, and Aston Martin; he’s credited with designing numerous luxury cars, such as the BMW Z8, Aston Martin DB9, and Aston Martin V8 Vantage.

A decade and a half later, Fisker is back — and it’s entering the all-electric space, which has been a hotbed for investor capital over the last few years.

Fisker’s first play? The Ocean.

What is the Fisker Ocean?

The Fisker Ocean is a mid-size electric SUV that boasts 545 horsepower and 350 miles of battery range. Its MSRP ranges between $37,499 and $69,900, depending on the option (Sport, Power, and Extreme) and excluding any tax rebates.

However, Fisker will also offer a unique leasing option under its Flexee program. Ocean-leasers will have indefinite contracts, meaning someone could return an Ocean one month into their contract — or one year, three years, five years, and so on. (There is a 30,000 annual mile limit though.) Pricing for an Ocean lease starts at $379 per month with a one-time $2,999 initiation and activation fee. In case you’re curious, you could own the Sport edition for roughly 91 months (or 7.5 years) before surpassing its MSRP.

But you won’t find the Fisker Ocean on the road for some time — production doesn’t commence until November 2022.

How does Fisker make money?

They don’t...yet.

At least, nothing substantial — it earned $21,000 in Q2. So, the better question is: “How will Fisker make money?”

The Ocean, among other veiled vehicle projects, will be the primary driver.

As of August, approximately 62,500 people had registered an account on the Fisker app, while more than 17,500 had paid a $250 deposit (90% refundable) to reserve an Ocean. Assuming 100% retention and all purchases are the base model, that’s $656.2 million of future revenue. While a perfect retention rate is unlikely (i.e., every reservation converting into a sale), we’re also excluding additional reservations up until its November 2022 launch.

Fisker expects 25,000 reservations by the end of 2021 and 50,000 by the end of 2022. So far, Fisker has managed to amass its Ocean reservations without spending any money on marketing campaigns. The first major campaign will launch this November at the LA Auto Show.

In terms of production, Fisker plans to exceed 5,000 Ocean models per month in 2023, which would help surpass its initial forecast of 40,000 models for the year.

Who will manufacture Fisker cars?

Not Fisker.

The company will implement an “asset-light” business model, designing and marketing its vehicle lineup while leaning on established manufacturing companies and their plants for production. The company has dubbed this concept-to-production process “Fisker Flexible Platform-Adaptive Design” (FF-PAD). Doesn’t exactly roll off the tongue, but it’s expected to reduce costs by $2 – $4 billion relative to the traditional Original Equipment Manufacturer (OEM) platform.

The Ocean — as well as another unnamed model — is being developed by Magna Steyr, an automotive manufacturer in Austria that has produced vehicles for BMW, Mercedes Benz, and Aston Martin. Magna has a vested interest in Fisker’s success, as it acquired a hefty number of warrants last October, representing a 6% ownership of Fisker at the time. The two parties finalized a long-term manufacturing agreement in June.

Here are Henrik Fisker’s comments on the partnership during the company’s latest earnings call:

[The agreement] covers planning and launch phases, annual volumes, complete assembly costs and quality metrics over the program's entire lifecycle. It covers all facility investments, a clear path to startup production in November 17, 2022, and a rapid ramp up to full gun rate production for quality vehicles in 2023.

Fisker expects its FF-PAD program to not only accelerate the development of new vehicles but also ensure the latest technology is incorporated into upcoming models.

Today, if you buy a brand new vehicle, most likely that technology was selected three, four years ago. But in our case, we have brought it as close as 18-months before we launched the vehicle, that's probably similar to some electronic industries like the smartphone industry.

Speaking of smartphones, earlier this year, Fisker announced a similar arrangement with Foxconn, the Taiwanese manufacturer that produces the majority of Apple’s iPhones. Together, Fisker and Foxconn will design and produce two vehicles by 2025, the first of which has been labeled Project PEAR (Personal Electric Automotive Revolution). This model is intended to be a cost-conscious alternative to the Ocean with a starting price under $30,000, excluding incentives.

In total, Fisker plans to offer four vehicles by 2025, including the Ocean. The company is targeting an annual volume of 200,000 to 250,000 units by the end of 2025; this would represent about 1% of the total addressable market (TAM).

Additionally, Fisker has partnered with Electrify America and Allego, EV charging infrastructure companies in the U.S. and Europe, respectively.

How is Fisker funding its operations?

Designing, producing, and marketing a vehicle isn’t cheap. Where is this money coming from?

For starters, equity. The company’s reverse merger with Spartan Energy Acquisition Corp. netted Fisker $976 million after transaction fees. Thus far, this capital has easily funded Fisker’s operations and capex. Through the first half of 2021, Fisker’s operating cash burn was $56.9 million, not including $64 million of intangible asset purchases related to the Ocean’s production. As of June, Fisker still had $962 million of cash and equivalents on its balance sheet thanks to additional equity financing.

That cash balance doesn’t include the net proceeds from Fisker’s $667.5 million convertible notes issuance in August. Naturally, the “convertible” nature of this debt tends to give investors pause — at some point in the future, these debtors could convert the obligation to shares of FSR, which would create an influx of additional shares and dilute shareholder value for everyone else.

That said, it’s worth noting that this debt has high dilution floors. Also, the company has expressed its intention to pay off these bonds with cash beforehand, but that’s by no means a promise or guarantee.

The conversion would take effect in tiers; there isn’t any dilution until shares hit $32.57, which would represent a premium of 124% relative to Thursday’s close.

In other words, its stock would have to significantly appreciate before reaching the conversion’s strike prices.

What does Wall Street think?

Wall Street is somewhat mixed, but the consensus rating is “Overweight” for FSR with an average price target of $22.22 — an implied return of almost 53%.

Can Fisker take over the Luxury EV market?

There are so many potential road bumps between now and the Ocean’s November 2022 launch. Fisker hasn’t proven that it can deliver on this asset-light model. Any design or production hiccups would adversely affect Fisker’s ability to deliver models on time. On top of that, reservations aren’t guarantees of sales. It’s one thing to put a $250 deposit down now, it’s another to drop another $37,000+ a year from now.

That said, consumer interest is clearly there — 17,500 reservations at $250 a pop, without any marketing, is nothing to sneeze at. It’ll be interesting to see how high reservations jump once the company starts promoting the Ocean.

Assuming Fisker can market successfully and deliver on its asset-light model, near-term profitability wouldn’t be a farfetched idea.

Although Fisker could hit a few snags leading up to the Ocean’s launch (and afterward in terms of maintaining production and meeting demand), we’re bullish on Fisker from a long-term perspective.

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.