The Big Picture

While it’s long been a target of short-sellers, GameStop recently received much-needed reinforcement from hordes of retail investors. Coupled with steep short interest and an influx of buy-orders, GameStop’s share price surged into the stratosphere, reaching a high of $483 in January 2021.

Meanwhile, from an operational standpoint, GameStop is in the middle of an extensive — but vital — business model overhaul. The video game retailer operates a vast network of physical storefronts in an increasingly digital industry. That’s a problem, but the gaming behemoth’s Reboot initiative could help the company overcome an outdated business model.

Is it too little too late?

The Business

GameStop Corp. (GME) is the world’s largest video game retailer with roughly 5,500 brick-and-mortar stores spread across 14 countries — although the U.S. accounts for two-thirds of the company’s stores.

GameStop sells three types of products:

Hardware and Accessories. Hardware includes new and pre-owned game platforms, including consoles and PCs. Accessories include controllers, gaming headsets, virtual reality products, and memory cards. This category accounted for 42.1% of FY19 sales.

Software. New and pre-owned video game software, as well as in-game digital currency, downloadable content (“DLC”), and full-game downloads via in-store or the e-commerce platform. This category accounted for 46.5% of FY19 sales.

Collectibles. Licensed merchandise related to the video game, television, and movie industries. This category accounted for 11.4% of FY19 sales.

Buy-sell-trade program

GameStop is well-known for its buy-sell-trade program, which enables gamers to trade in used games, accessories, and even consoles for cash or in-store credit. The company even buys some defective products, which it then processes through refurbishment centers to test, repair, relabel, repack, and redistribute the products back to stores.

Vendors

GameStop buys new products from a variety of manufacturers, software publishers, and distributors. As of FY19, the company’s top five vendors are Nintendo (28% of new product purchases), Sony (18%), Microsoft (6%), Electronic Arts (5%), and Take-Two Interactive (5%). GameStop established price protections with its primary video game vendors — this reduces the risk of GameStop’s video game inventory becoming obsolete.

Collectively, GameStop’s top five vendors accounted for 62% of the company’s new video game purchases last fiscal year. It’s important for a retailer to avoid concentration risk (i.e. an overreliance on one or two vendors for products). If the vendor ends the relationship or goes out of business, then the retailer’s operations could take a hit.

Loyalty program

GameStop’s loyalty program, PowerUp Rewards, has 42 million members in the U.S. as of February 2020. Of this total, 5 million have paid subscriptions. Outside of the country, the company’s loyalty program has an additional 22.2 million members. The paid program grants members additional discounts on used merchandise and a subscription to the Game Informer magazine.

Magazine

GameStop publishes the world’s largest print and digital video game publication — Game Informer. The publication features game reviews, tips, news, and industry developments. The company sells subscriptions online and via its stores. PowerUp Rewards Pro members receive a copy of Game Informer, which the company credits as a key benefit of the loyalty program.

The Narrative

Founded in 1996, GameStop has been a leader in the video game industry for quite some time. However, the retailer’s strength — an expansive physical footprint that offered widespread convenience to consumers — became a weakness in the digital age.

In 2013, the Xbox One, PlayStation 4, and Nintendo Switch revolutionized the gaming marketplace, as each console launched digital storefronts. Digital marketplaces not only offer convenience to gamers but also cost advantages to video game developers, who don’t have to worry about manufacturing physical copies of games or splitting revenue with brick-and-mortar stores.

GameStop’s bread and butter is its buy-sell-trade program, which ultimately resells used games at higher prices than the company acquired them for. Used games are lucrative, high-margin products for GameStop — but a shift to digital marketplaces eliminates the prevalence of physical copies. In other words, there’s nothing to trade back to GameStop when gamers buy games digitally.

While this didn’t spell immediate doom for the video game retailer, GameStop’s annual sales began an ominous descent in FY16. Since peaking at $9.4 billion in FY15, the company’s sales have dropped 31% to $6.5 billion as of FY19 (see Exhibit A below). Note that GameStop’s fiscal year ends after each January in order to capture holiday sales and returns; so “fiscal year” 2019 actually concluded in January 2020.

Exhibit A: Net Sales (FY13 - FY19)

The latest fiscal year’s results won’t be released until the end of March. However, the downward trend is likely to continue due to the COVID-19 pandemic’s economic impact. Consumer electronics are discretionary expenses, which took a universal hit starting in March 2020.

Downtrodden sales aren’t a huge surprise though — the company initiated a major business model shift that prioritizes store closures and cost-efficiencies. In May 2019, GameStop management launched the “Reboot” initiative to transform and reinvigorate operations. The four pillars of “Reboot” are, verbatim:

Optimize the core business. Improve the efficiency and effectiveness of operations across the organization, including cost restructuring, inventory management optimization, adding and growing high margin product categories, and rationalizing the global store base.

Become the social/cultural hub for gaming. Create the social and cultural hub of gaming across the GameStop platform and offerings.

Build a frictionless digital ecosystem. Develop and deploy a frictionless consumer-facing digital omnichannel environment, including the recent relaunch of GameStop.com, to reach customers more broadly across all channels and provide them the full spectrum of content and access to products they desire, anytime, anywhere.

Transform vendor partnerships. Transform our vendor and partner relationships to unlock additional high-margin revenue streams and optimize the lifetime value of every customer.

These are ambitious goals for a retailer with a large physical footprint. However, the company has made decent progress thus far.

Pillar #1: Optimize the core business

To increase margins and migrate toward a digital-first business, GameStop promised to cut expenses and sell non-core assets. Since launching the Reboot, the company’s “optimization” strategy prompted:

782 net store closures (management expects 1,000 by the end of FY20)

The permanent reduction of SG&A by $295 million (based on management estimates)

The sale of Simply Mac (an unprofitable business investment)

The discontinuation of underperforming operations in Denmark, Finland, Norway, and Sweden

The sale of corporate aircraft

On top of that, the company’s balance sheet is actually quite healthy. As of October 31, 2020, GameStop had $445.9 million of unrestricted cash and cash equivalents — compared to $485 million of outstanding debt. Further, the holiday season falls within GameStop’s fourth quarter, which is usually the company’s strongest earnings period; available cash should see a notable increase (especially since the latest generation of consoles launched too). That’s already been partly evidenced by the fact that the company redeemed $125 million of debt in December.

Pillar #2: Become the social/cultural hub for gaming

It’s harder to evaluate and quantify the second pillar’s progress. In our opinion, a growing loyalty program is likely the best indicator. (We’ll get updated figures at the end of March.)

Pillar #3: Build a frictionless digital ecosystem

GameStop’s sales are trending in the wrong direction — and the pandemic’s impact on consumer spending won’t help matters; however, it accelerated the development and implementation of the company’s e-commerce initiative. As a result, GameStop’s e-commerce sales increased 430% through the third quarter of 2020.

Pillar #4: Transform vendor partnerships

GameStop already works with the world’s most prominent video game software developers — but they’re trying to build upon these relationships to increase revenue.

In October 2020, GameStop announced a multi-year strategic partnership with Microsoft. The deal’s primary benefit (from GameStop’s perspective) is lifetime digital revenue share. For every Xbox console sold via a GameStop store, Microsoft will share digital revenue generated by that console (e.g. game downloads, DLC, and subscriptions). So, if I buy an Xbox Series X from GameStop and proceed to buy games via Xbox’s digital marketplace, GameStop will get a cut of those game sales.

The Competitors

Although GameStop is the largest video game retailer — it’s not the only one that sells video game hardware and software products. The company also has to contend with Walmart, Target, Best Buy, and Amazon, which have extensive networks of physical stores and/or online platforms to facilitate gaming sales.

Data as of 3/11/2021

Your eyes do not deceive you — GameStop currently trades for a much higher price tag than Walmart, Target, and Best Buy (Amazon is obviously in a league of its own) despite the fact that GameStop’s:

Market cap is billions of dollars lower

EPS is deep in the red (while everyone else is profitable)

Revenue is a sliver of these other companies

The High-Level Finances

Note that all dollar amounts are illustrated in millions.

Revenue

GameStop’s revenue has experienced a steady decline since FY15 concluded. The primary reason is the gaming industry’s shift to digital, which limits GameStop’s foot traffic and used game sales. The secondary reason, at least since May 2019, is the company’s commitment to closing stores. While the goal is to cut costs and optimize operations, fewer stores (unsurprisingly) equals fewer sales.

EBITDA

EBITDA (earnings before interest, taxes, depreciation, and amortization) is a metric used to gauge a company’s operating performance. A company’s operations can appear worse due to certain non-cash expenses, such as depreciation and amortization.

We’ve adjusted GameStop’s EBITDA to also account for significant non-cash impairments, which are primarily related to the impairment of goodwill. Simply put, in accordance with accounting policies, GameStop evaluated its business segments and determined their fair market values were less than what the company’s books stated.

Even with these add-backs, it’s clear that GameStop’s earnings/margins are also headed in the wrong direction.

Net Loss

After years of positive bottom lines, GameStop has endured significant losses in the last two fiscal years. While that’s partially due to the non-cash impairments we mentioned, GameStop is still a far cry from being a profitable company.

The Primary Strengths

Social momentum. Who would have guessed that a video game retailer would claim more headlines in early 2021 than all of the FAANG stocks combined? While social momentum alone can’t constitute a worthwhile investment, it doesn’t hurt that GameStop is on more people’s radar. (Just look at its 90-day trading volume compared to its competitors; see “The Competitors” section.)

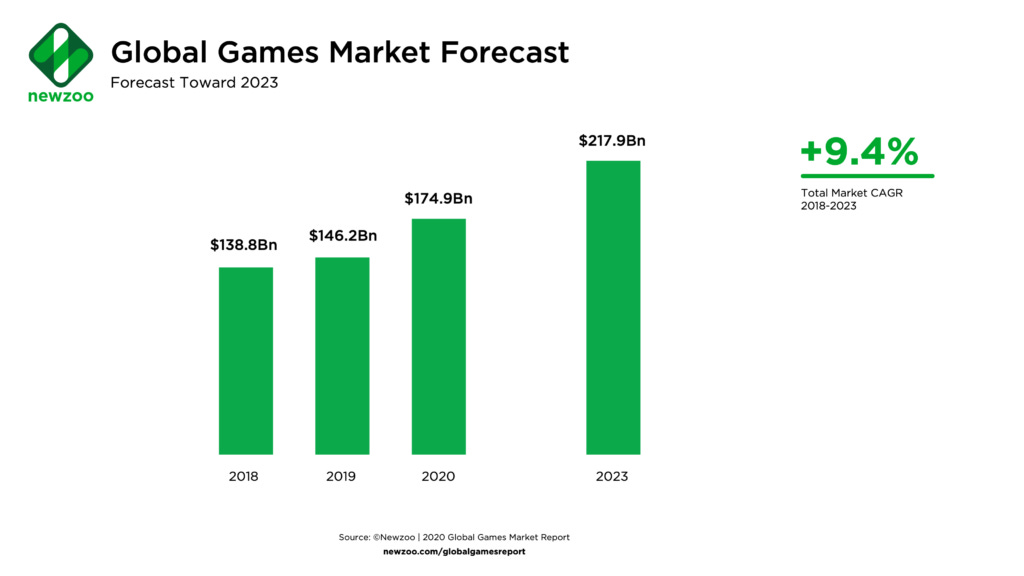

Market growth. The gaming industry isn’t getting any smaller — if GameStop can achieve its Reboot goals, there’s an opportunity to grow alongside a booming market. The research firm Newzoo anticipates that the global video game market will be valued at $218 billion by the end of 2023.

Cost control. GameStop’s reboot initiative emphasizes reduced costs — including store closures. Closing stores would likely reduce revenue, but it aligns with the shift digital and higher margins. Through three quarters in FY20, the company shed $316 million of SG&A relative to FY19.

Digital shift. The company is radically shifting its business model to prioritize digital channels and develop an omnichannel experience. GameStop revamped its online platform and mobile app, enhancing navigational features and adding flex-payment functionality. During 3Q20, GameStop’s e-commerce sales rose 257% and represented more than 18% of total net sales. Management attributed much of this success to improved fulfillment capabilities, such as same-day delivery in all U.S. stores.

Plenty of capital. GameStop has plenty of available capital to fund its initiatives. As of October 31, 2020, GameStop had $445.9 million of unrestricted cash and cash equivalents and $175.4 million of available borrowing capacity under their revolving credit facilities — and that’s before the holiday season and most lucrative quarter of the year.

The Primary Risks

Store closure flop. GameStop is closing a lot of stores, which will reduce operating costs. That’s only good news if the company can transfer frequent customers of the closed stores to other nearby stores or convert them to digital customers. Otherwise, the initiative could backfire and erode the GameStop customer base.

Technological advancements. Digital marketplaces have been around for almost a decade now, but that’s not stopping these platforms from increasing market share. If existing or new online marketplaces draw consumers away from GameStop, bottom-line results will continue to worsen.

Vendor reliance. GameStop is reliant on its vendor relationships. If any of their major vendors (like Nintendo or Sony) decide that selling products to GameStop does more harm than good, that’ll be a problem.

Competitor’s agendas. GameStop isn’t the only video game retailer — it also has to contend with Walmart, Target, Best Buy, and Amazon. If any of these retailers place a larger priority on video game products, that’s bad news for GameStop’s market share.

Prone to economic impact. Video games are discretionary purchases, so sales are susceptible to economic fallout and declines in consumer spending. Even though GameStop continues to prioritize its digital storefront, it still has an abundance of physical (and expensive) real estate.

Missing the boat. Many believe that shares of GameStop are overpriced after the influx of social momentum. The company’s Reboot is promising, but the financial tailwinds may not justify a triple-digit stock price.

The Street’s Opinion

The analysts that track and cover GameStop are hesitant to give GameStop their vote of confidence. Out of eight analysts, half think investors should sell at least some shares, while the other half advises a “wait-and-see” approach.

However, these analysts’ price targets are all well below current trading levels — but that’s to be expected.

Recent News

GameStop Announces Fourth Quarter and Fiscal Year 2020 Earnings Release Date

GameStop Announces Resignation of CFO and Succession Plan to Support Transformation

Power to the Payers?

Not many predicted GameStop’s meteoric rise from $2.57 to $483.00 per share; however, the massive gain was primarily the result of a short squeeze in January 2020.

Short squeezes occur when highly-shorted stocks’ share prices unexpectedly increase. Short-sellers (people who short the stock) are forced to cover their position by buying the stock they’re betting against. When short-sellers buy more shares, this increases the upward price pressure — so share prices rise even further.

Short squeezes are not based on fundamentals — they’re temporary, technical events. So, from a long-term perspective, will GameStop return power to the payers (i.e. investors)?

While GameStop’s stock price is unpredictable at this point, we’re cautiously optimistic that GameStop’s Reboot will produce a competitive e-commerce platform with better margins. If they didn’t have a sizable market share, a loyal customer base, and high-profile vendor relationships, it would be much easier to write GameStop’s efforts off as too little too late. That said, the company has a steep, uphill climb ahead.

Keep an eye on (1) e-commerce sales, which will validate or disprove the company’s omnichannel transformation; (2) store closures and their impact on margins, which will prove if GameStop is maintaining its customer base or eroding it by closing stores; and (3) capital raises — the company could take advantage of a high share price and issue more shares to bolster an already strong financial position.

Sources

Want our free stock coverage in your inbox? Sign up now so you don’t miss our reports.

Very good article. Thorough, great analysis, well written!