Is Carvana going bankrupt?

A quick fix of the latest financial happenings.

Good morning, investors — and an early Merry Christmas!

As 2022 comes to a close, I’d like to extend my gratitude to you. Inboxes are personal, often cramped, and highly coveted digital real estate. Thank you for saving a little space for Due Diligence.

If this is your first time with us, don’t forget to subscribe here. If you enjoy today’s issue, please hit the heart button at the end of the report.

Without further ado…

Is Carvana Going Bankrupt?

It’s not the best time to be in the used car business. Elevated levels of inflation are eating into the savings of many Americans, while rising interest rates make financing car purchases extremely expensive. According to an Experian report, the average interest rate for a used car loan was 9.34% in the third quarter.

To put that in perspective, at this rate, a 5-year, $30,000 auto loan would cost nearly $630 a month, ignoring fees and taxes.

No, thank you.

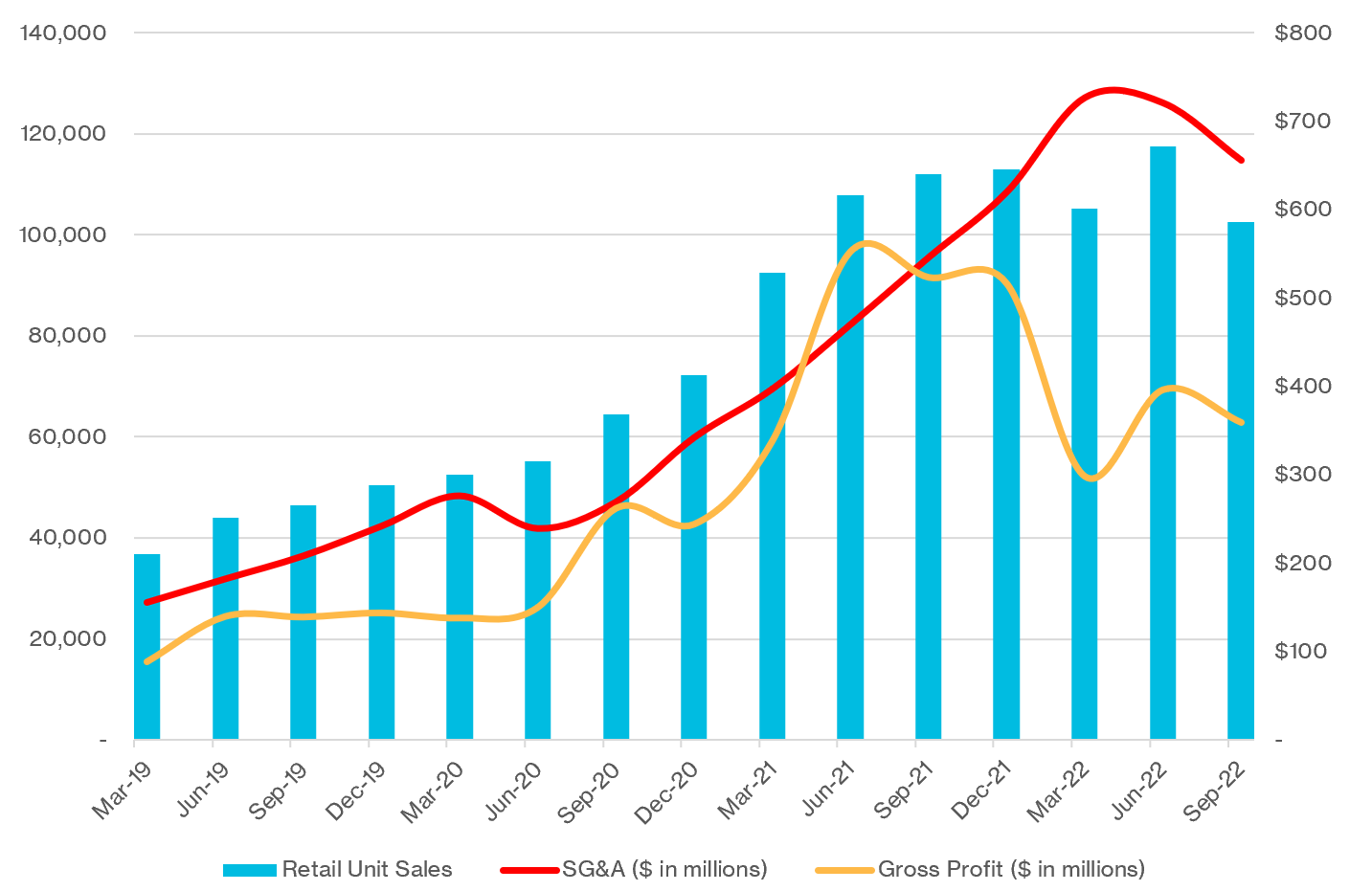

Like all used car dealers, Carvana is just as susceptible to macroeconomic headwinds as any used car dealer — perhaps even more so, considering its expansive logistics network. So, it should come as no surprise that their retail unit sales slipped this past quarter. While the company managed to reduce its total SG&A, its net loss widened from $439 million in Q2 to $508 million in Q3.

Companies can only burn through roughly half of a billion dollars per quarter for so long. And finding cost-effective financing is becoming increasingly difficult. Carvana just issued $3.275 billion of notes that mature in 2030, which carry an interest rate of 10.25%. That’s more than $335 million out the door every year — just to pay this particular loan back.

Enter stage right: bankruptcy concerns.

Carvana only has $316 million of unrestricted cash and cash equivalents remaining on its balance sheet. Granted, the company has plenty of borrowing capacity under existing debt facilities as well as unpledged assets that could be borrowed against, so it has options.

Still, the math isn’t in the used car giant’s favor, as Carvana’s short-term and long-term debt carry high interest rates. Here’s an overview of its long-term notes:

Carvana debtholders have started cooperating to gain negotiation leverage, and equity analysts have already raised concerns that shares could soon become worthless — or highly diluted, at best, in a restructuring.

Three Eye-Opening Tweets

And finally, we close with three eye-opening tweets.

Fun fact: the iPad is bigger than Google Cloud.

A worthwhile read on hidden debt.

People are struggling to save money.

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.