Is hydrogen a golden ticket to future prosperity?

Follow the money: Air Products commits $15 billion to clean hydrogen by 2027.

Good morning, investors!

If this is your first time with us, don’t forget to subscribe here. If you enjoy today’s issue, please hit the heart button at the end of the report.

Without further ado…

These days, hydrogen isn’t just an element, it’s a globally recognized buzzword that’s treated like a golden ticket to future prosperity.

Perhaps that’s true.

The hydrogen value chain is just that — valuable. While there’s plenty of money to be made across the entire sequence, upstream is the place to be. McKinsey estimates $45–$55 billion of EBIT in 2030 for upstream players, versus “only” $11–$14 billion of EBIT for midstream and downstream players.

And no one’s buying more golden tickets than Air Products, a major player in the upstream market for hydrogen production whose principal business is selling gasses and chemicals for industrial uses. Although the company is based in the small town of Allentown, PA, Air Products is anything but small — and it has invested heavily in numerous hydrogen projects.

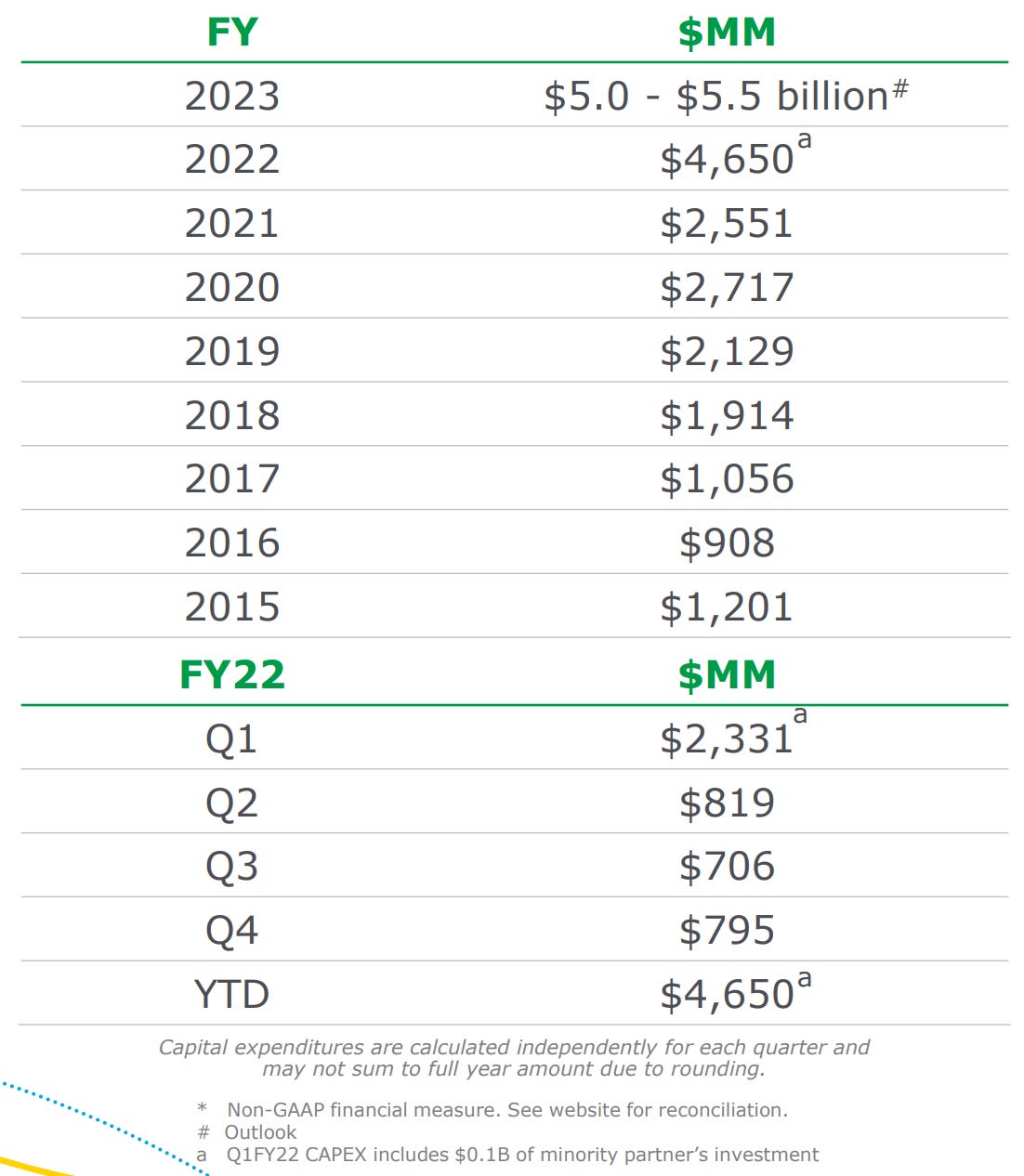

Since 2017, the company’s capital expenditures have increased nearly five-fold from $1 billion to $4.7 billion last year.

According to the company’s shareholder letter, Air Products plans to commit more than $15 billion to blue and green hydrogen mega projects by 2027, establishing itself firmly at the forefront of the hydrogen economy.

Let’s glance at a few of the company’s biggest projects.

Saudi Arabia: $5 Billion Production Facility in NEOM

Saudi Arabia is known for its oil prowess, second on the oil production podium with an 11% world share (below the United States). However, it’s a little too reliant on the world’s largest fossil fuel; it accounted for 77% of the country’s exports in 2021. The Saudi government recognizes that hydrogen is the future, which is why it plays a prominent role in its Vision 2030 initiative.

The Kingdom is revamping its economic infrastructure, building full-fledged “smart” cities — two of which are Neom and Jazan. (Perhaps you’ve heard of THE LINE, which will reside in the former.) Air Products has a hand in green energy projects in both cities. Here’s a summary from the 2020 press release:

Air Products, in conjunction with ACWA Power and NEOM, announced the signing of an agreement for a $5 billion world-scale green hydrogen-based ammonia production facility powered by renewable energy. The project, which will be equally owned by the three partners, will be sited in NEOM, a new model for sustainable living located in the north west corner of the Kingdom of Saudi Arabia, and will produce green ammonia for export to global markets.

Saudi Arabia: $12 Billion ASU/Gasification/Power Joint Venture at Jazan

Speaking of oil, Air Products secured a contract with Saudi Aramco, the world’s largest company, back in 2015. Under the agreement, the JV was “to build, own and operate the world’s largest industrial gas complex to supply 75,000 metric tons per day (20,000 oxygen and 55,000 nitrogen) to Saudi Aramco’s refinery and Integrated Gasification Combined Cycle being built in Jazan, Saudi Arabia.”

The JV recently completed a $12 billion acquisition of assets, so now it will own and operate the facility under a 25-year fixed-fee contract, supplying Aramco with clean energy.

USA: $4 Billion Mega-Scale Green Hydrogen Production Facility in Texas

Naturally, Saudi Arabia isn’t the only country making moves in the hydrogen economy. There are plenty of projects on our home turf — such as the largest green hydrogen facility in the US.

According to the press release:

The facility, which is targeted to begin commercial operations in 2027, will serve growing demand for zero-carbon intensity fuels for the mobility market as well as other industrial markets. It will yield a totally clean source of energy on a massive scale, and, if all the green hydrogen were used in the heavy-duty truck market, it would eliminate more than 1.6 million metric tons of carbon dioxide (CO2) emissions annually when compared to diesel use in heavy-duty trucks. Over the project lifetime, it is expected to avoid more than 50 million metric tons of CO2, the equivalent of avoiding emissions from nearly five billion gallons of diesel fuel.

We’ll keep an eye on Air Products and their investments going forward, a summary of which is outlined below:

Three Eye-Opening Tweets

And finally, we close with three eye-opening tweets.

SI in November 2022: Great. SI in January 2023: Terrible.

Speaking of failures…

The old guard remains resilient (hopefully)

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.