Good morning, investors!

Welcome to Market Movers, our coverage of stocks that are either gaining or losing momentum.

If this is your first time with us, feel free to subscribe here. If you enjoy today’s newsletter, please hit the heart button at the end of the report.

Without further ado…

Gaining momentum: Teradata (TDC)

For decades, Teradata Corporation (TDC) was known for its data warehousing software. That image started to change in 2013 when it launched Teradata Cloud. And even more so when the company shifted to a cloud-based subscription model a few years later, a major but necessary strategic move.

Now, a bevy of Fortune 500 companies, such as Coca-Cola and Verizon, rely on the company’s flagship subscription product: Vantage. This analytics platform software allows businesses to oversee all of their data — and use all of their preferred data tools and coding languages — on a single platform. It’s also designed to work in any cloud environment (on-premises, private, or public).

But you may still be wondering, why the shift?

Under the old revenue model, companies like Teradata sold perpetual licenses — customers paid an upfront fee to access the latest data software/hardware. Then they’d upgrade after a few years when better products became available — or not. This model led to staggered cash flows and a lack of predictability. (Neither of which are ideal.)

A 2017 Forbes article by Joe Harpaz provides a succinct example that aptly describes the appeal of a subscription service instead of the old perpetual licensing model:

As a simple case in point, take a look at sales of Microsoft Office, the ubiquitous suite of business processing software that includes Microsoft Word, Outlook, PowerPoint, and Excel. There was a time not too long ago when, if you wanted Microsoft Office, you spent around $350 to buy a CD-ROM, which came with a perpetual license for you to download the software and use it on your PC for as long as you’d like. Under that model, Microsoft would roll out new updates to the software every couple of years and hope that users would buy the new versions every three years or so. This year [2017], that model officially started to die as sales of Microsoft Office 365, the digital subscription version of the software, surpassed sales of traditional Office software for the first time.

Naturally, shifting to a subscription model appeased Teradata’s stakeholders — who like predictable revenue — and embracing cloud services enabled the company to stay competitive.

But it came with (expected) consequences.

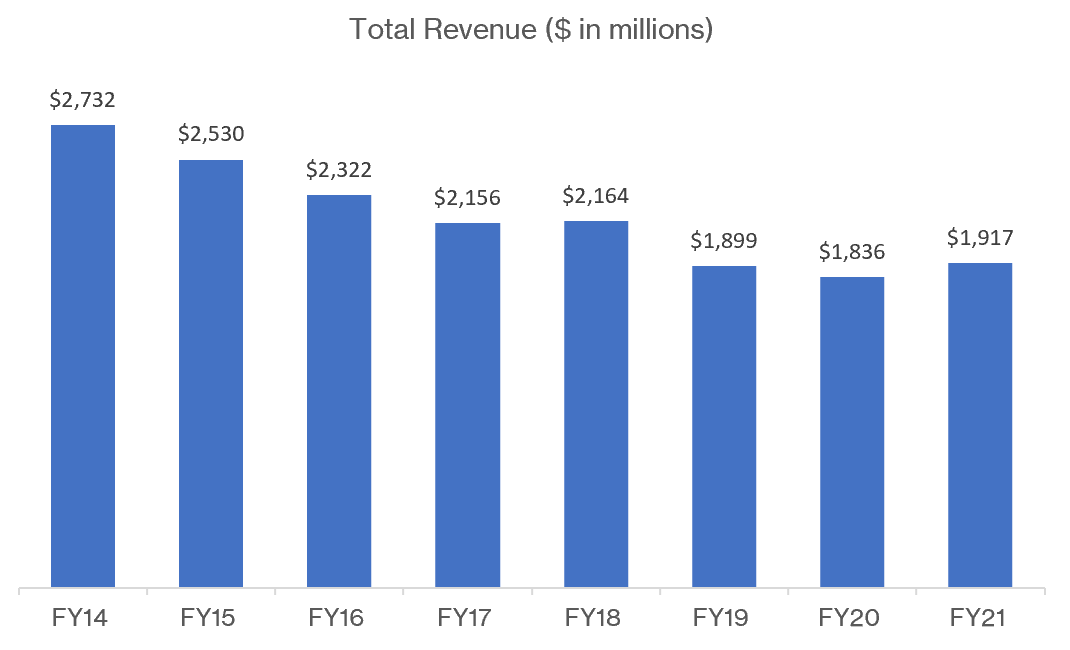

Revenue dropped. A lot. Perpetual licensing agreements involve large upfront payments — subscriptions space them out. Instead of receiving large, sporadic revenue bumps, the company recognizes revenue in equal installments over the course of its contracts. Hence, the steady decline from FY14 to FY20:

As logical as that may be, investors don’t like when revenue falls. So it’s no surprise that shares of TDC steadily declined from the $60 – $70 range in 2013 to as low as roughly $20 in early 2020.

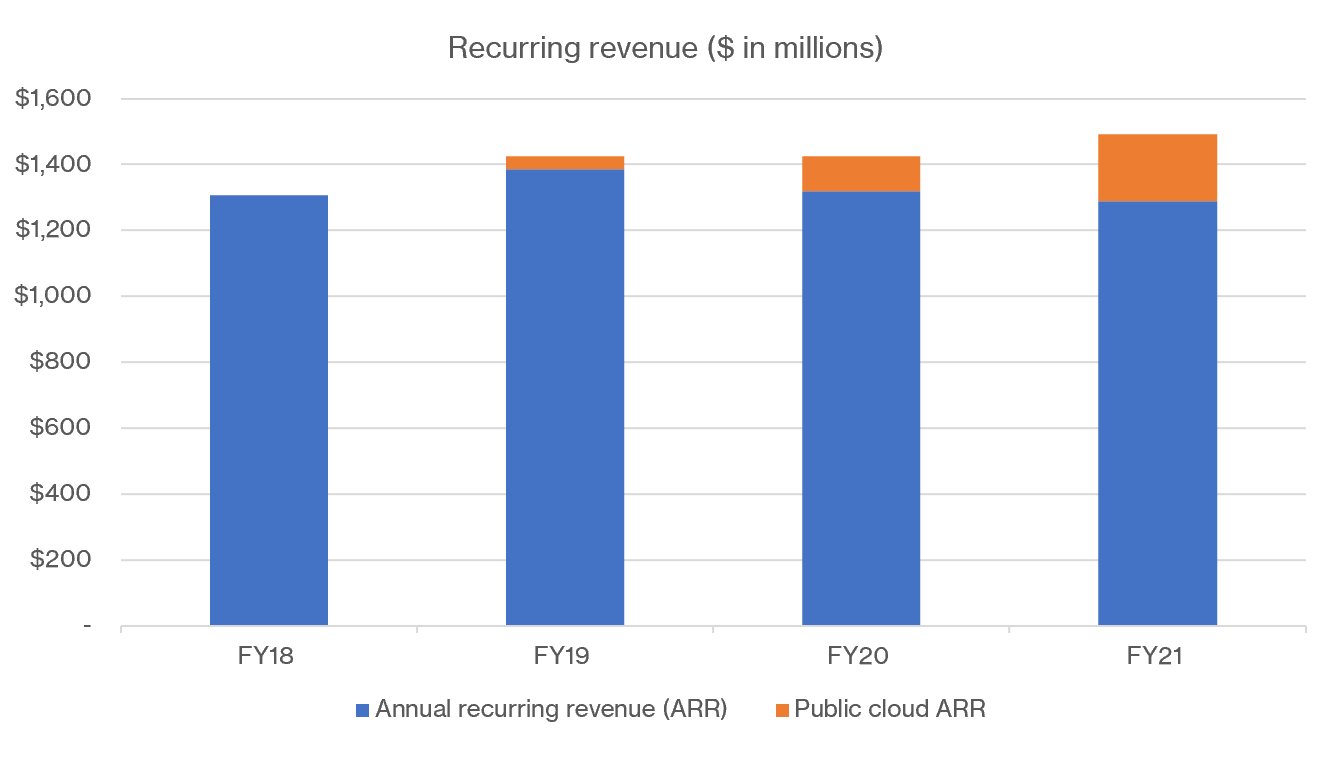

However, the market eventually realized Teradata could break the mold in February of last year when the company announced that its public cloud subscriptions grew from $40 million in FY19 to $106 million in FY20. That trend continued this past year; public cloud annual recurring revenue jumped again to $202.

Recurring revenue has, slowly but surely, picked up over the last four years — particularly Teradata’s public cloud subscriptions. During the company’s investor day in September, management outlined robust growth for this segment:

“This year we continuously focused on delivering on our commitments, including building our recurring revenue streams into sustainable and profitable revenue and free cash flow. All of which positions us to achieve over $1 billion in [Public] Cloud ARR and approximately $550 million in free cash flow in fiscal 2025 and deliver significant long-term value to our shareholders.” (Emboldened for emphasis)

The recent market sell-off didn’t do it any favors, but the company’s Q4 earnings release reinvigorated investor interest — for a few reasons. Despite a revenue dip relative to last year, the company managed to double its adjusted EPS expectations. From a true dollars standpoint, net income was up 7.7% in FY21 ($147 million vs. $129 million in FY20).

On top of that, company management announced the commencement of a $250 million share buyback program. So, shareholders should see some upward price momentum.

“While you may hear a lot about various cloud startups, let’s be clear on how Teradata stacked up in the application scenarios that Gartner [a technology research company] described as the most important:

Teradata is #1 in Cloud Data Warehouse…

#1 in Cloud Logical Data Warehouse…

#1 in Cloud Data Lake…

and #1 in Cloud Operational Intelligence.

We’ll be glad to walk you through where our competitors fall in the line behind us.”

—Steve McMillan, President and Chief Executive Officer, Teradata

Shares of TDC closed at $51 on Thursday; Wall Street’s consensus price target is $57.

Losing momentum: Teladoc (TDOC)

As its name implies, Teladoc Health Inc (TDOC) removes the “going” from “going to the doctor.” In other words, it enables digital doctor visits. Even before the pandemic, virtual health care was already a burgeoning industry. Most people recognized the convenience and were open to giving it a try.

And the company was churning out very impressive growth rates.

Then the pandemic happened.

Teladoc management couldn't have scripted it any better (at least, from a revenue standpoint), as the public health crisis accentuated the need for telemedicine.

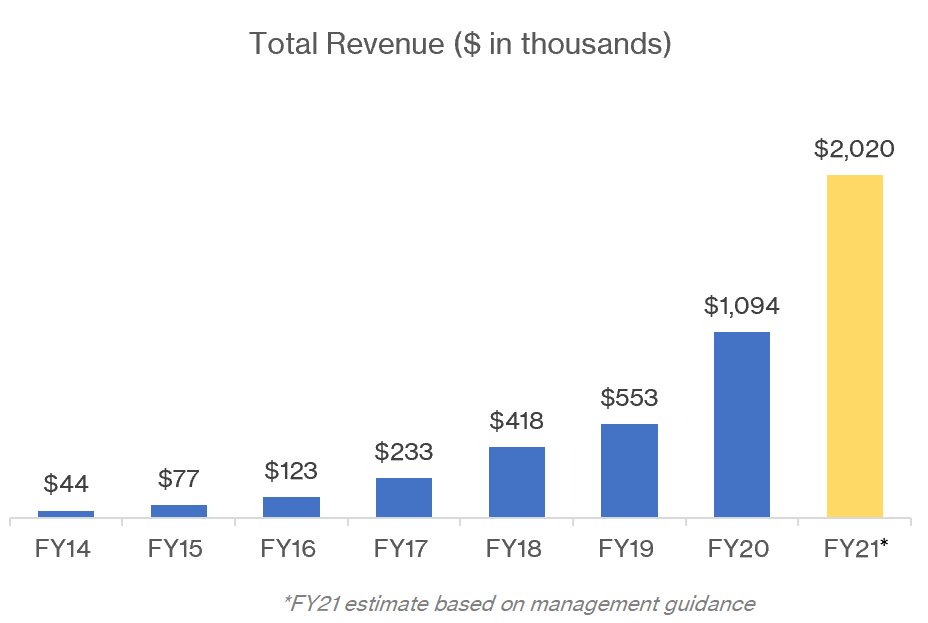

Assuming Teladoc hits its FY21 forecast, it will have almost doubled its revenue in back-to-back years. That’s insane growth.

So, it’s not a surprise that shares of TDOC jumped from $83 entering 2020 to an all-time high of $308 in February of last year.

Since then though…well, it hasn’t been pretty.

The rest of 2021 was brutal for TDOC, as it would lose a little more than 70% of its value relative to its peak price. This year has been much of the same story, as shares are down another 22% to $73.41.

What’s going on with Teladoc stock?

The tumble started with the company’s guidance for 2021 membership growth…or lack thereof.

Management projected its membership to be somewhere around 52 – 54 million members by the end of 2021. But they closed 2020 with 51.8 million members — so, after growing membership by 41% in 2020, the company expected growth to be somewhere between negligible and 4%.

It’s safe to say that a 41% growth rate wasn’t replicable, but the possibility of practically zero membership growth caused concern. Teladoc is a growth stock that routinely operates at a loss, after all, so no growth = a problem. (As of Teladoc’s 3Q earnings release, management expects to conclude the year somewhere between 52.5 and 53.5 million members. It was at 52.5 million as of 9/30.)

Apparently, investors didn’t like that. TDOC fell.

The drop resumed in May. While it was partially driven by worse-than-expected earnings, many investors were likely spooked by the uptick in telehealth competition.

“Telemedicine is a fantastic medium, but if it’s just late-night urgent care, it’s kind of a commodity,” stated Erik Sossa, former head of benefits for Pepsico, in an interview with the Wall Street Journal. Being a commodity translates to being easily replaced.

To add insult to injury, PepsiCo had recently parted ways with Teladoc, choosing LiveHealth Online (a competitor) instead.

And, of course, as social restrictions were lifted and people tried to resume whatever “normalcy” is anymore, a telehealth provider seemed to lose some of its appeal. The recent tech sell-off was the icing on the cake.

TDOC now trades around the same price as it was in late 2019.

However, not all hope is lost. During the company’s investor day in November, management shared revenue guidance for the next few years: $2.6 billion in FY22 with the hopes of eclipsing $4 billion by the end of FY23.

Membership increases or not, that would be incredible growth.

Wall street’s consensus price target for TDOC is $129.48 as of Thursday.

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.