Market Movers #13: VIRT + VRM

Exploring the recent performances of Virtu Financial and Vroom.

Good morning, investors!

Welcome to Market Movers, our coverage of stocks that are either gaining or losing momentum.

If this is your first time with us, feel free to subscribe here. If you enjoy today’s newsletter, please hit the heart button at the end of the report.

Without further ado…

Gaining momentum: Virtu Financial (VIRT)

Virtu Financial (VIRT) is a market maker. In case you’re unfamiliar with this concept, take a look at an excerpt from my Robinhood Due Diligence report:

Market makers are firms that continuously quote both sides of a transaction: the price they’re willing to pay for a stock (i.e., the bid) and the price they’re willing to sell a stock for (i.e., the ask). The difference between the two prices is known as the bid-ask spread. These firms are integral to the investing process because they help keep markets liquid.

When retail investors make trades through a broker (such as Robinhood), the broker sends orders to a market maker to execute the trades. In exchange, the market maker pays the broker a rebate for the volume activity (and, indirectly, insight into buy/sell orders). The rebate is based on a percentage of the bid-ask spread. This is how the PFOF model works.

Market makers provide liquidity to markets, which makes them an essential component of our financial system. The profitability of market making coincides with trading volume and volatility, so financial results can vary significantly from year to year (as you’ll see below). More volatility = broader bid-ask spreads = more profits.

Considering the influx of new traders over the last couple of years, it’s been a good time to be a market maker.

Considering Virtu is responsible for roughly 25% of retail order flow, it’s been a good time to be a Virtu shareholder.

Just this year, shares of VIRT are up 18.6%.

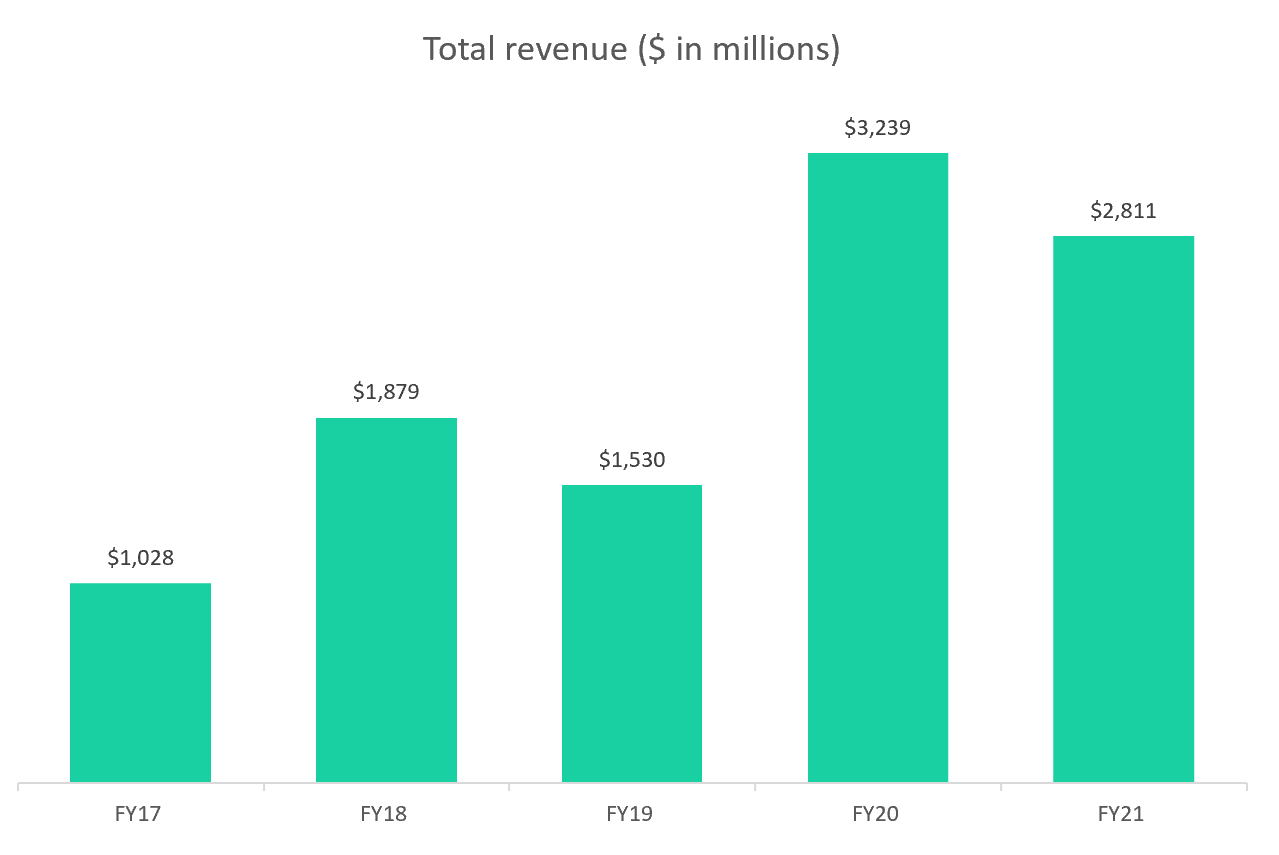

What’s happening? Well, this year’s share appreciation can be attributed to smashed earnings expectations. But the underlying catalyst is Virtu’s top-line growth (thanks to more trading) and margin optimization after a couple of strategic acquisitions over the last five years.

Virtu has several sources of revenue. Trading income — their profits from bid-ask spreads — is easily the largest (75% of FY21 revenue), followed by trade commissions (17%; usually from institutional investors), as well as licensing fees for some trading technology solutions. The company also generates interest income from the securities it buys and sells.

Here’s a look at Virtu’s disaggregated revenue sources:

Needless to say, the company’s revenue results are unpredictable and contingent on market activity (stagnant markets = tighter spreads). Fortunately, the meme stock revolution and retail trading surge have stimulated trading and market-making activity — a trend that is likely to continue. Equally as important, Virtu has kept operating expenses steady over the last three years while it assimilated the acquisitions of Knight Capital and ITG.

An interesting caveat (and not totally uncommon) is that Virtu Financial Inc is a holding company that only owns 63% of Virtu Financial LLC, the operating company. The other 37% is owned by a mix of parties, including the company’s founder, Vincent Violi. What impact does this have? Virtu Financial LLC makes sizable distributions to noncontrolling interest holders, which eat into VIRT’s bottom line. That said, VIRT also pays a quarterly dividend to its common shareholders ($0.24 a share).

Increased trading activity and recent volatility bode well for Virtu, which is well-positioned to continue raking in profits in the near term.

Shares of VIRT closed at $33.69 on Thursday. Wall Street’s consensus price target is $36.10.

Losing momentum: Vroom Inc (VRM)

“So how do investors get comfortable owning the shares here, given an already tough labor logistics, capacity environment? And how do you plan to fund the business if the stock — if the share is not rerate in such an environment?” — Rajat Gupta, J.P. Morgan Analyst, on VRM’s latest earnings call

These were the opening questions of the Q&A portion of Vroom’s 4Q earnings call. Leading up to them, Rajat referenced the company’s cash burn and liquidity concerns.

Not exactly a promising sign.

Vroom Inc (VRM) is an online marketplace for buying, selling, and trading in used vehicles. In case you’re unfamiliar with them, it’s the same business model as Carvana, which is a direct competitor.

In Vroom’s case, “losing momentum” grossly underestimates the company’s recent stock movement.

Year to date, VRM is down 74.4%. Over the last year? Shares have withered by a stomach-churning 92.2%.

Why is Vroom crashing and burning?

If you’ve read the news at any given point in the last week, month, or year, you’d know the world is undergoing a helluva supply chain crisis. The auto industry experienced its fair share of economic fallout.

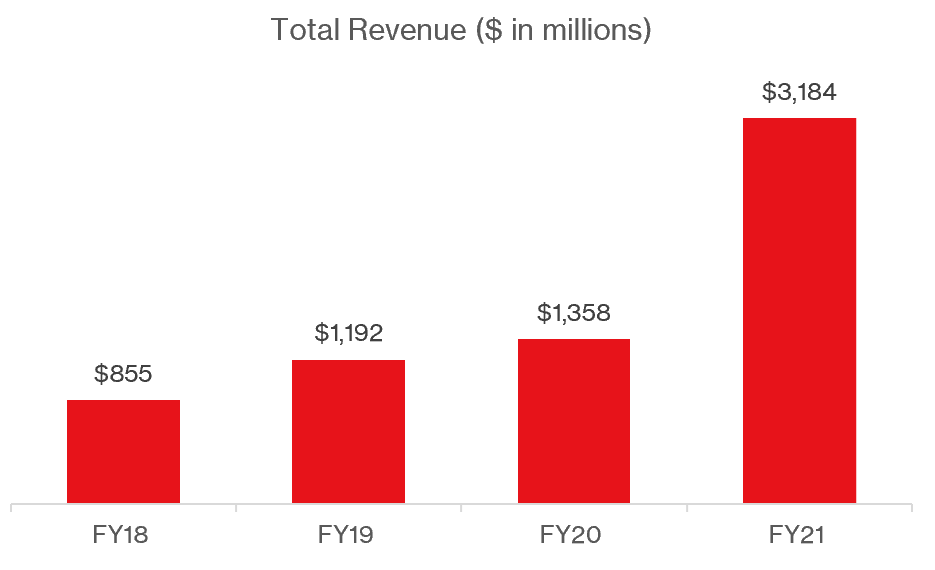

Yet, simply glancing at Vroom’s revenue growth would imply the opposite.

Unit sales jumped by 89.1% in 2021, from roughly 63,000 to almost 120,000.

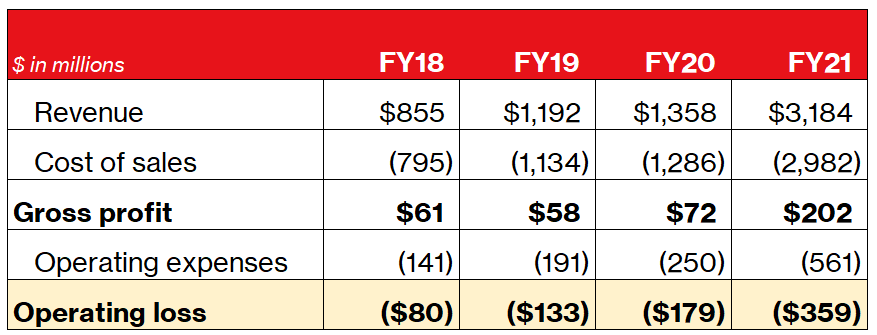

But revenue growth is deceivingly high. Even as an online business, Vroom operates in a low-margin industry — used cars. And it shows in their financials. It’s more insightful to focus on gross profit, which accounts for the high cost of sales for vehicles (i.e., acquiring, transporting, and reconditioning for resale).

Not quite as glowing. The company’s operating losses have been moving in the wrong direction as the platform’s user base has expanded.

Vroom needs to facilitate a lot of unit sales to achieve profitability.

To give you an idea, for Vroom to achieve breakeven operating results (not even net profits), it would have to generate $8.8 billion of revenue — based on a gross profit margin of 6.3% and operating expenses of $561 million in FY21. That’s assuming operating expenses don’t budge. In other words, Vroom’s current sales staff, logistics team, and broader corporate infrastructure would have to handle nearly triple the volume of work.

Maybe that’s not impossible.

There are roughly 40 million used car sales per year. Vroom accounted for 119,073 sales in 2021 — not even close to 1% of all sales. So, taking the glass-half-full perspective, there’s plenty of market share potential for Vroom, even in a competitive industry.

If we look at this in terms of unit sales, Vroom’s e-commerce segment is its real money-maker. It accounted for almost 75,000 unit sales in 2021 — up 40,000 from 2020. Vroom’s gross profit per unit (GPPU) for its e-commerce segment was $2,206. So, ceteris paribus, Vroom would need to sell roughly 255,000 units through its online platform to cover its existing operating expenses. That seems like a stretch in the current labor-strapped, component-strapped, oil-strapped, war-stricken environment.

But, again, it’s not impossible.

Vroom acquired United Auto Credit Corporation in the fall, which will give the company its own lending arm. Currently, the platform connects users with third-party financing options. Going forward, Vroom will be able to offer more competitive rates, which, theoretically, should lead to more conversions and better economics for the company. (Assuming it has enough liquidity to get to that point.)

“[United Auto Credit Corporation] does business with 8,000 dealers across the country. They're going to continue to grow that dealer base. And then we'll get the benefits of converting them into a fully captive lender, which, we believe we'll have comparable economics when we fully transition to a captive lender like Carvana has, which would afford us an opportunity to increase our GPPUs between $800 to $1,200 a vehicle from a financing perspective.” —Bob Krakowiak, Chief Financial Officer of Vroom (lighted edited for clarity)

Long story short, Vroom needs to find ways to improve its gross profit margin and keep SG&A honest during a harsh period for auto-related businesses. In the near term, things aren’t likely to get much better for Vroom — but, long term, it gets a little more interesting. Especially considering shares of VRM closed at $2.86 on Thursday.

Wall Street’s consensus price target is $5.38.

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.