Good morning, investors!

Welcome to Market Movers, our coverage of stocks that are either gaining or losing momentum. Today, we’re narrowing our focus on a single stock — RGLD.

If this is your first time with us, feel free to subscribe here. If you enjoy today’s newsletter, please hit the heart button at the end of the report.

Without further ado…

Gaining momentum: Royal Gold, Inc (RGLD)

Royal Gold, Inc (RGLD) is an aptly named royalty company for precious metals — primarily gold.

Mining is a very complex, capital-heavy, time-consuming operation. Building out the necessary infrastructure to mine metals from the earth isn’t exactly a breeze — not to mention getting permits and hiring local labor.

But Royal Gold sits in a unique (and comfortable) position. It’s essentially a specialized financier, funding mining exploration and production projects. In return, the mining operators give Royal Gold a shiny slice of the pie.

Royal Gold generates revenue from two sources: streams and royalties.

Metal stream agreements grant the company the right to purchase physical gold, silver, or copper produced from the mining operations of its partners. The price is determined at the onset of the agreement and is usually much lower than market value. To give you an idea, for one of its mining projects, Royal Gold pays its operator the lesser of $435 per ounce or the prevailing market price at the time. For reference, the current price of an ounce of gold is roughly $1,950. That’s a helluva profit.

Royalties give the company the right to a percentage of revenue or metals produced from its mining projects. In other words, the operators mine, market, and deliver the metals to their customers — then Royal Gold receives a royalty.

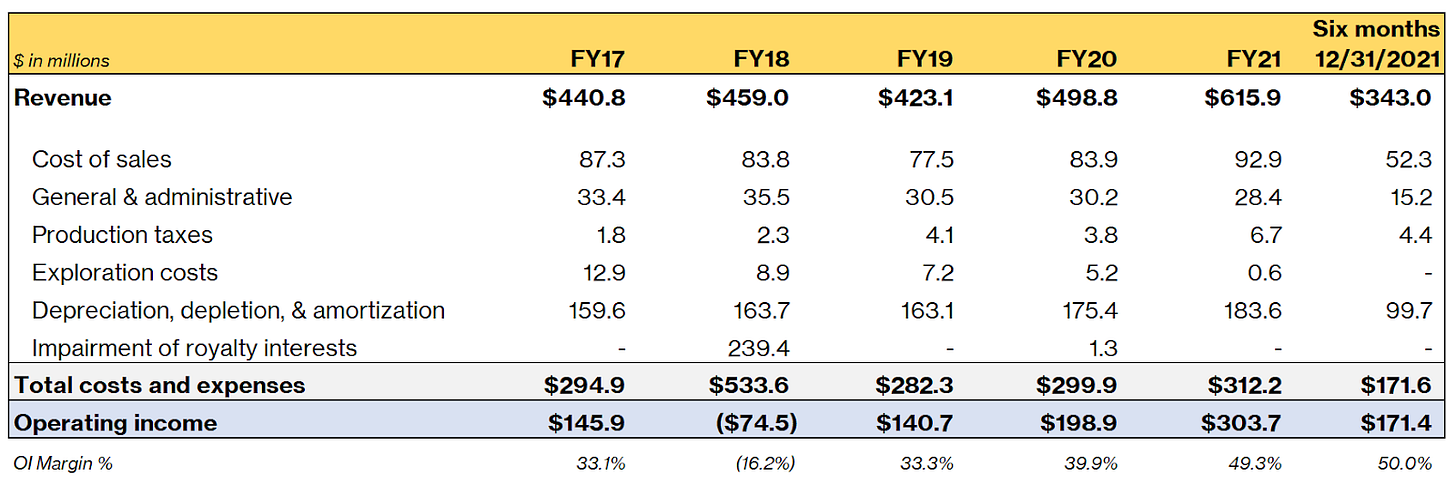

Because Royal Gold is a specialized financier and not involved in operations, it is susceptible to third-party operating risks. By that, I mean it isn’t directly overseeing the day-to-day mining of these precious metals, which can come back to bite the company. For instance, one particular mine that straddled the border of Chile and Peru didn’t comply with environmental standards, and the Chilean government ultimately sanctioned and shut down the project. This resulted in a major impairment for Royal Gold back in 2018, as you’ll see in their financials.

Still, Royal Gold’s operations are quite lucrative. Note that RGLD’s FY21 ended on 6/30; more recently, the company changed its fiscal year from 6/30 to 12/31, so FY22 will conclude on 12/31/22.

Operating margins are quite healthy, and that’s including significant levels of depreciation, depletion, & amortization, which are non-cash expenses.

Royal Gold reinvests much of its profits in additional projects. At any point in time, the company has several acquisition opportunities in review. Even with sizable acquisitions — which then produce additional streams of revenue — the company generates steady amounts of free cash flow.

Note that Royal Gold invested heavily in various Streams in 2016 — $1.3 billion to be exact. I share this to illustrate that RGLD may, occasionally, invest heavily in mining projects.

So, why is RGLD up 36.4% in 2022?

When times are tough economically, people often look to gold as a safe haven. But investing in a financier like RGLD can assuage some of gold’s volatility and produce better long-term returns, especially since it issues a quarterly dividend.

Here’s a return comparison of gold and Royal Gold over the last five years — RGLD appreciated by 115% compared to gold’s 55% return.

Considering the compounding uncertainty of the war in Ukraine and its impact on broader economies, many investors have flocked to gold and related entities — hence the recent spikes in the chart above. (It also doesn’t hurt that RGLD is raking in profits.)

Shares of RGLD trade near the stock’s all-time high (it closed at $141.28 on Thursday). For that reason, there’s probably a better entry point on the horizon. Wall Street echos that sentiment, as its consensus price target is $138.50.

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.