Good morning, investors!

Welcome to Market Movers, our coverage of stocks that are either gaining or losing momentum. Last week, we dove into Royal Gold — a specialized financier for precious mineral mining that’s gained a lot of momentum this year. Today, we’re exploring a company that’s been trending in the wrong direction but may have significant upside potential.

If this is your first time with us, feel free to subscribe here. If you enjoy today’s newsletter, please hit the heart button at the end of the report.

Without further ado…

Losing momentum: nVent Electric PLC (NVT)

nVent Electric (NVT) is an electrical component manufacturer that owns brands like Caddy, Erico, Hoffman, Raychem, Schroff, and Tracer. If it protects and connects critical electronics and equipment, nVent probably makes it.

The company divides its products into three segments:

Enclosures: metallic and non-metallic enclosures, cabinets, subracks, and backplanes.

Thermal Management: heat tracing, floor heating, fire-rated and specialty wiring, sensing, and snow melting and de-icing solutions.

Elecrical & Fastening Solutions: fastening solutions can range from bridle rings for cable management to clips for securing light fixtures to the ceiling.

Shares of NVT have taken a hit in 2022 — down 9.4% thus far.

Why? Certainly not because of operating performance.

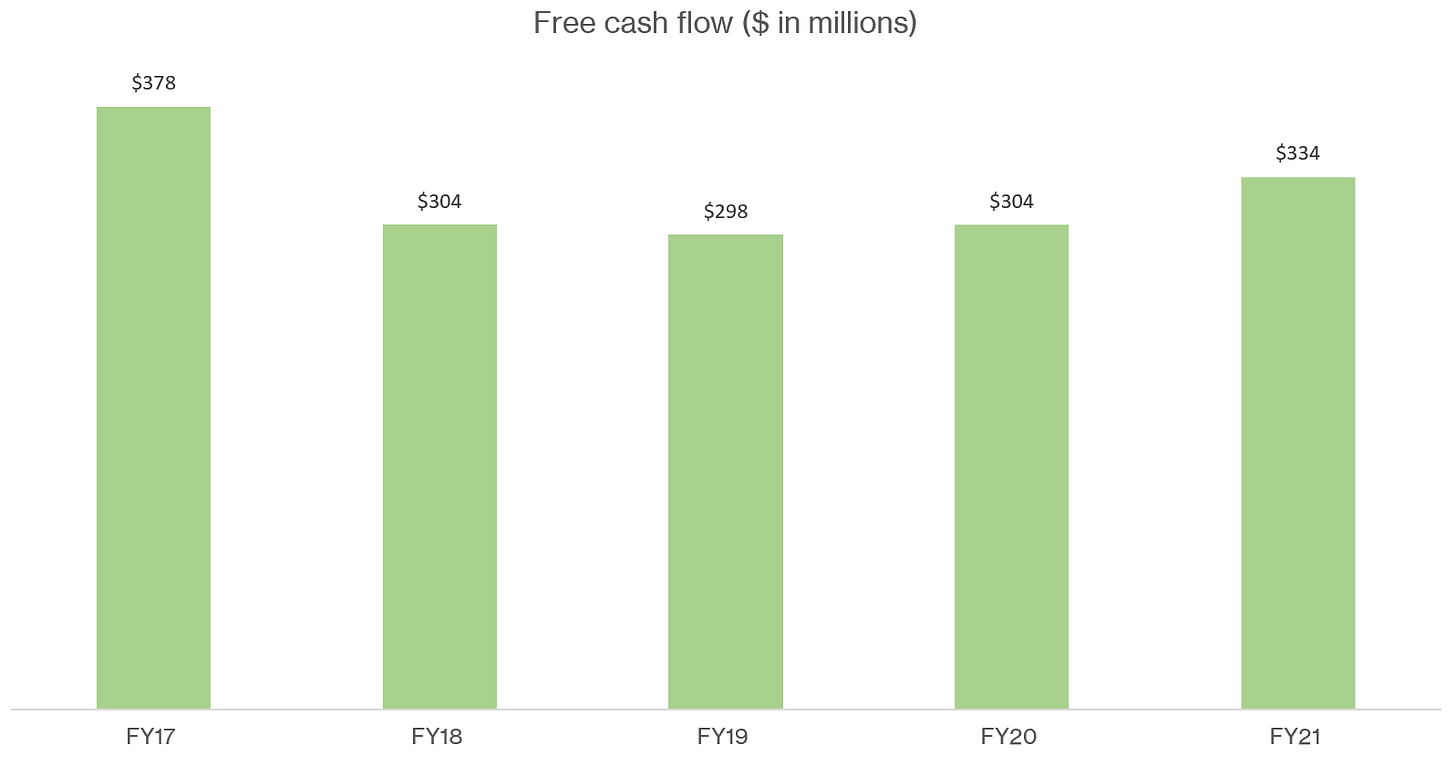

Last year, nVent generated $2.5 billion of sales — a 23% increase relative to 2020 — thanks to strong growth across each business segment as well as inorganic growth through strategic acquisitions. Moreover, the company’s Adjusted EPS rose 31% year-over-year to $1.96, and free cash flow was robust at $334 million.

So, what gives?

Like most of the market, NVT has seen its share price retreat due to the broader downturn.

Yet, the word “growth” was mentioned 70 times on the company’s latest earnings call. That’s because the company benefits from the broader electrification movement. Solar, data centers, data networking, automotive, oil & gas, infrastructure — these industries (and many more) all rely on electronics one way or another. nVent creates the oft-overlooked components that enable safety, constant up-time, and cost-efficiency.

Here are a few compiled quotes from CEO Beth Wozniak during the call:

With our Eldon acquisition and our global IEC Enclosures portfolio, we recently won a multi-million dollar deal for protection solutions in the food and beverage industry. We were able to provide the same solution in Europe and the US, selling globally and serving locally.

With infrastructure investments in universal broadband and fiber-to-home, we won a key project with one of the largest world Internet providers in the US, providing outdoor protection systems.

With increased data demands and reliability in data centers, we won a multi-million dollar project providing a highly resilient connection solution. With the move to renewables, we've won dozens of biofuel upgrade projects with our Thermal Management heat trace offerings.

Recently, we were awarded a large multi-million dollar project for one of the world's largest software companies with our advanced liquid cooling solutions. Since then, we have more than doubled these sales to over $200 million annually and expect to continue to grow high double digits.

It helps to have a physical tie to the electrification of everything. Since the pandemic, nVent has steadily increased quarterly revenue and expects momentum to remain strong for the current year, even with expected supply chain challenges and inflation headwinds.

The company prudently oversees its costs too, as operating income has averaged roughly 14% per quarter, excluding 3Q20 when the company recognized an impairment of goodwill after the pandemic tanked oil and gas prices.

Perhaps more importantly, nVent consistently generates ample free cash flow for acquisitions and dividends.

Is NVT stock a good buy?

nVent has demonstrated steady organic and inorganic growth across all verticals. Corporate costs appear stable relative to revenue, R&D isn’t excessive by any stretch of the imagination, and margins are solid. So, the company’s appeal is high.

How does NVT compare to its peers though? Based on a few key metrics, it’s in the middle of the pack.

The below table shows how NVT stacks up against other companies within the Electrical Components & Equipment sub-industry, with the exception of AZZ (Heavy Electrical Equipment).

Compared to peers, there may be other opportunities with higher upside, such as WIRE and ATKR.

That said, shares currently trade at $34.32, representing a PE ratio of 21.3. Looking ahead, NVT trades at 16x forward earnings for FY22, which suggests — all else equal — there’s a chance for NVT to hit mid-$40s over the next year.

Wall Street’s consensus price target for NVT is $42.83, implying an upside of nearly 25%.

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.