Market Movers #16: Carvana (CVNA)

Exploring Carvana's recent downtrend and its ambitious business plan.

Good morning, investors!

Welcome to Market Movers, our coverage of stocks that are either gaining or losing momentum. Last week, we dove into a few potentially oversold stocks, including behemoths Netflix and Amazon. Today, we’re exploring the so-called Amazon of used cars: Carvana.

If this is your first time with us, feel free to subscribe here. If you enjoy today’s newsletter, please hit the heart button at the end of the report.

Without further ado…

Carvana (CVNA)

Carvana is in a bit of a jam. Shares are down 86.3% this year — broader market headwinds are somewhat responsible, but Q1 results scared droves of investors away.

In case you’re unfamiliar, Carvana is one of the biggest online used car dealers. If we were to oversimplify its business model, the company buys used cars, reconditions them for resale, and then flips them for a higher price. (They also make money through vehicle financing and extras like gap waivers and vehicle service contracts — an area in which the company outperforms most of its peers.)

For that reason, gross profit is a more telling line item than revenue, which is why gross profit per unit sold (GPU) is a key metric for dealers like Carvana. It’s essentially how much the company earns from each car sale.

Last quarter, the company’s retail GPU nosedived while selling, general, & administrative (SG&A) expenses skyrocketed. GPU fell from $4,566 in Q4 2021 to $2,833 in Q1 2022; SG&A rose from $620 million to $727 million — or $5,486 to $6,912 per unit.

Long story short, Carvana didn’t make as much of a spread on each facilitated car sale, and overhead kept rising.

The culprits? Macroeconomic factors like Omicron, used vehicle prices, and interest rates. Closer to home, management also attributed the bad news to reconditioning and logistics network disruptions.

Here’s the company’s commentary from its shareholder letter:

Retail GPU was impacted by a more than $600 per unit increase in reconditioning and inbound transport costs relative to the prior year and a more than $100 per unit decrease in shipping revenue, driven by refunds to customers following extended delivery times. Retail cost increases in Q1 were primarily due to inefficiencies in the inspection and reconditioning centers and logistics network, which in turn were driven by Omicron, severe weather events and the extended timelines required to recover from these events, and due to lower retail units sold volume, which increased per unit cost.

We believe the factors impacting Q1 were transitory, and we expect to see retail costs move toward more normalized levels over the coming quarters as our logistics network normalizes, and our expense levels are better balanced with sales volumes.

And more elaboration:

We generally prepare for sales volume 6-12 months in advance, meaning we built capacity in most of our business functions for significantly more volume than we fulfilled in Q1. With our costs relatively fixed in the short-term, the lower retail unit volume led to higher cost of goods sold per unit (e.g., reconditioning and inbound transport costs), leading to lower GPU, and higher SG&A per unit. These effects combined with rapidly rising interest rates and widening credit spreads led to lower EBITDA margin.

Then the company released an updated plan in what seemed like an effort to assuage investor concerns.

To summarize, Carvana management announced that they’re shifting their top priority from growing GPU to optimizing the company’s infrastructure to become cash flow positive. More specifically, management will take an axe to SG&A expenses — which means cutting down its labor force. That same day, Carvana fired 2,500 employees (many of which were informed via a pre-recorded Zoom session). Woof.

Beyond questioning Carvana’s staffing methods, the next immediate reaction is, “Will this impact the company’s ability to buy, recondition, and sell cars?”

You’d think losing 12% of your workforce is bound to strain someone’s day-to-day responsibilities. Well, Carvana believes its workforce grew well beyond its sales volume. Perhaps that’s true — because the company’s employee count ballooned by 1868% in five years.

In addition to reduced headcount, management listed several opportunities to improve efficiency across the board, including but not limited to…

Internal benchmarking to boost employee performance companywide (i.e., hold everyone to the same standard as the top 20% of Carvana workers). Easier said than done.

Greater inventory visibility by relieving current logistics restraints that prevent the company from listing cars. Moreover, logistics improvements would reduce re-scheduling rates and delivery delays. Carvana plans to leverage its recent $2.2 billion acquisition of ADESA, a physical car auction business, to improve its processing network and reduce miles traveled.

In-sourcing certain activities that were previously outsourced, such as title and registration processing

Carvana is a tech-centric company, but the used car industry is still far from a lean, mean, operating margin machine.

How feasible is Carvana’s updated business plan?

Its goals are quite ambitious; it wants to drop from $4,780 to $3,000 of SG&A per unit sale on an annual basis. (SG&A per unit = how much overhead it costs to produce a single sale.)

Assuming 100,000 unit sales, that’s $300 million of SG&A. As a reminder, Carvana’s SG&A expenses in the first quarter of 2022 were $727 million. To reach its goal, it would have to trim that amount by almost 60% — or significantly raise sales volume at the same level of overhead.

Here’s how Carvana performed in this area for a few historical periods compared to its FY23 goal.

Carvana also provided a composite SG&A, which consisted of each SG&A line item’s best quarter, which totaled $3,891 of SG&A per unit sold. To reach its FY23 goal, Carvana would have to reduce each of these categories by a combined $891 per unit — or $89 million with 100,000 unit sales.

But, obviously, this is a fictitious quarter. The gap is much wider.

Is this realistic?

Let’s start with how the company has performed in this area over the last three years.

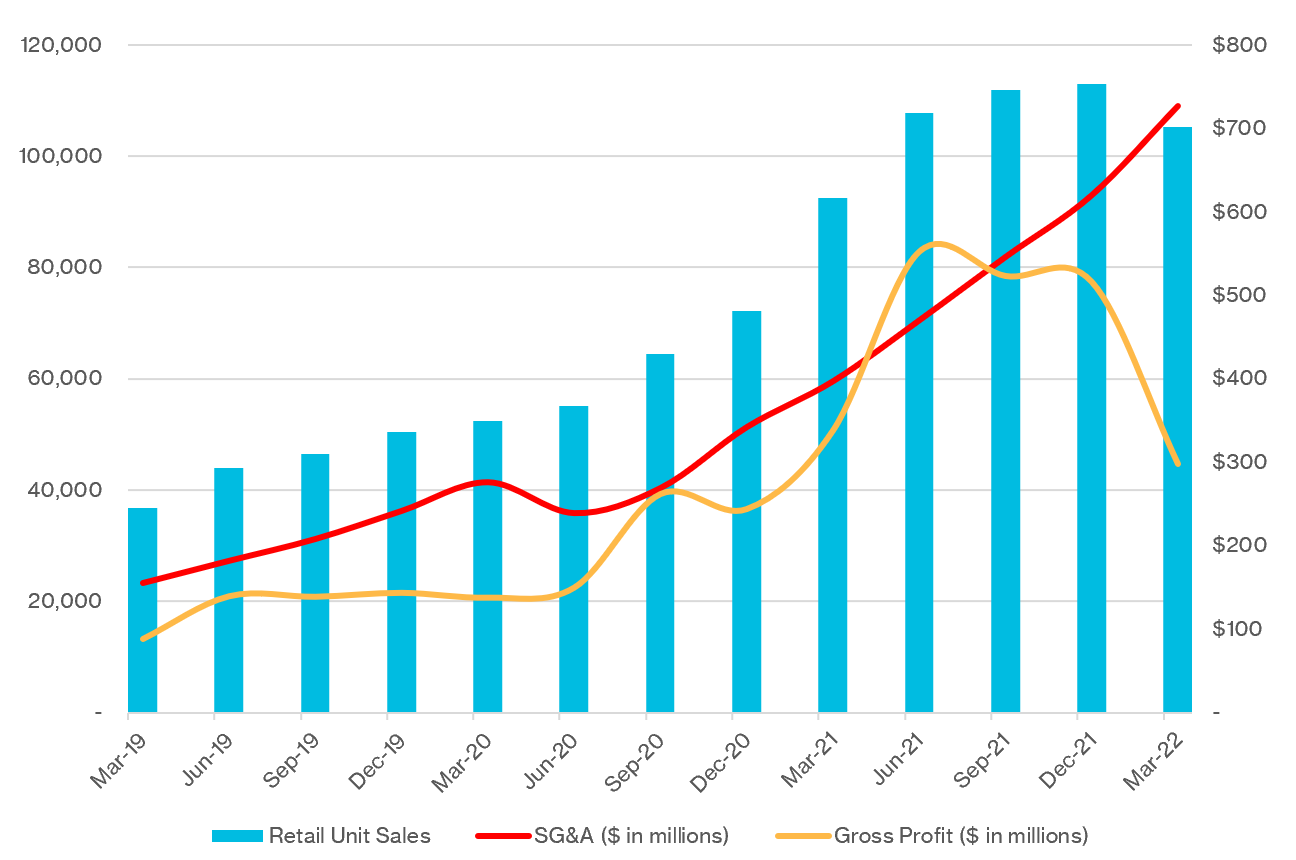

If only the yellow line were as steady as the red one.

Here’s the biggest takeaway from this chart: Yes, Carvana has managed to nearly triple its retail unit sales — but, as the red line shows, SG&A has outpaced gross profit (the lone exception was Q2 of 2021). The gap has widened severely.

Let’s look at this from another perspective. SG&A has exceeded gross profit by at least 30% in 7 of the last 13 quarters. That’s a lot of cash burn, even when you account for non-cash components like depreciation & amortization and stock-based comp.

Our final chart gives us one last perspective of the magnitude of Carvana’s ambitious operational reversal.

The company has sniffed profitability in the last year and positive cash flow could be on the horizon, but supply chain issues and rising interest rates don’t bode well for used car shopping in the near term.

In all walks of life, it’s generally wise to underpromise and overdeliver in order to set the bar low and pleasantly surprise people. This feels like the opposite. For the sake of Carvana shareholders, hopefully I’m wrong. Carvana shares closed at $32.88 on Thursday — not a bad entry point relative to its astronomical 52-week high of $376.83, but perhaps not the bottom for the nirvana of used cars.

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.