New meme stock just dropped (literally) + Are we really in a recession?

A quick fix of the latest financial happenings.

Good morning, investors!

If this is your first time with us, don’t forget to subscribe here. If you enjoy today’s issue, please hit the heart button at the end of the report.

Without further ado…

Add One More to the Meme Stock List: HKD

AMTD Digital is Asia’s one-stop comprehensive digital solutions paltform. At least, it is according to the company’s website.

On July 15, the Hong Kong-based company opened its arms to the public markets, pricing its IPO at $7.80 a share and debuting on the New York Stock Exchange under the ticker HKD.

On August 2, less than three weeks later, shares of AMTD Digital peaked at $2,555 before closing at $1,899.

I’ll do the math for you — that’s a 24,246% return.

To put this ascent in context, that’s a higher return than Apple has achieved since 2000 (21,169%). For a brief moment, AMTD Digital was amongst the 10 largest stocks in the world with a market cap of north of $400 billion.

So, what’s the deal with AMTD Digital? Why did its share price skyrocket out of the blue?

There doesn’t seem to be any credible justification for its meteoric rise, which is a cause for concern. The company doesn’t know either, allegedly, and issued a public thank you to its investors.

According to the company’s prospectus, it generates revenue from two sources: membership fees from its SpiderNet ecosystem and insurance brokerage services. A natural pair. The latter of which is, in my interpretation, the equivalent to a digital networking service.

Here’s the buzzword-riddled description of the SpiderNet:

Through a membership fee scheme, we provide our corporate clients with exclusive access to the AMTD SpiderNet ecosystem and its prestigious corporate members, prominent business executives and partners, creating strategic and synergistic opportunities. In addition, our digital solutions initiatives and programs in partnership with industry leaders and academic institutions serve to support industry professionals and foster next generation entrepreneurs in the region by equipping them with the latest trends and knowledge in the digital space. These entrepreneurs become permanent members of the AMTD alumni network. Our services help our ecosystem members to enhance connectivity, identify business synergies, and create valuable business propositions. We further deepen our relationship with corporate clients by facilitating synergies between their portfolio companies and other partners in the AMTD SpiderNet ecosystem and by connecting innovative minds, bright ideas, and smart ideas.

To warrant such a jump in its share price, surely the company generates billions of dollar in revenue, right?

Not quite.

In FY21, AMTD Digital generated only $25 million of revenue and $22 million of net profit — a suspiciously strong margin.

Meme stocks truly are a wonder to behold.

Two Signs That We Aren’t in a Recession…Yet

Recessions are only identifiable in retrospect. If you subscribe to conventional wisdom, we entered a recession after real GDP growth slumped year-over-year in Q1 and Q2, signifying two consecutive quarters of economic decline.

Alas, that’s not the official definition of a recession. While it may look like a duck and quack like a duck, the only ones who can decree the taxonomy of the duck-like creature are the fine folks at the National Bureau of Economic Research (NBER). Sans animal terms — unless the NBER says it’s a recession, it’s not officially a recession.

Here’s their definition:

The NBER's definition emphasizes that a recession involves a significant decline in economic activity that is spread across the economy and lasts more than a few months.

Still, could we possibly not be in a recession? There’s no doubt we’ve experienced economic decline.

As I’ve made abundantly clear, I’m not the one who can call the duck a duck, but if there’s one economic factor supporting the case that we are not in a recession and confounding the NBER, it’s a tight labor market.

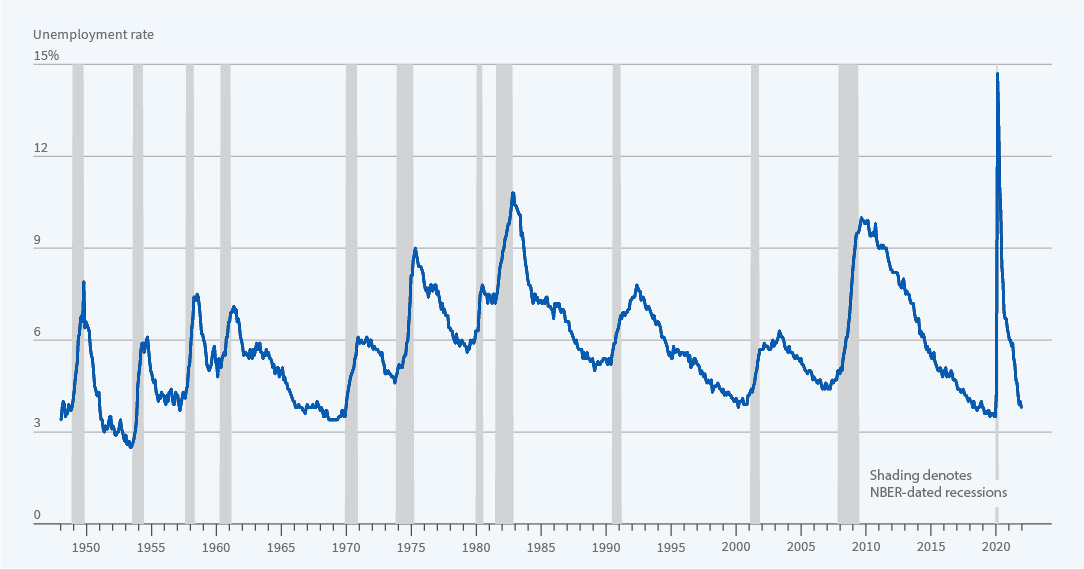

As you can see, we aren’t far from historical lows. Typically, a sign of a strong economy. And the NBER puts a lot of weight into the country’s employment rates when dating business cycles.

Because a recession must influence the economy broadly and not be confined to one sector, the committee emphasizes economy-wide measures of economic activity. The determination of the months of peaks and troughs is based on a range of monthly measures of aggregate real economic activity published by the federal statistical agencies. These include real personal income less transfers, nonfarm payroll employment, employment as measured by the household survey, real personal consumption expenditures, wholesale-retail sales adjusted for price changes, and industrial production. There is no fixed rule about what measures contribute information to the process or how they are weighted in our decisions. In recent decades, the two measures we have put the most weight on are real personal income less transfers and nonfarm payroll employment. (Emboldened for emphasis)

Rising unemployment rates have been inextricably linked to our nation’s history of recessions. But, in this case, the metric is actually falling. (Well, it’s stayed firm at 3.6% for a while — coincidentally, the latest jobs report releases later today.)

So, if the job market is any indicator, it’s very possible that we aren’t in a recession…yet.

Another historically reliable indicator is the 10-2-year Treasury spread, which measures the difference between the yields of 10-year Treasury notes and 2-year Treasury notes. When this spread turns negative, otherwise known as an inverted yield curve, short-term rates offer better returns than long-term rates, suggesting a foreboding long-term outlook.

An inverted yield curve doesn’t mean we’re in a recession, but it’s a nearly perfect indicator that a recession is coming in the next 6 to 24 months. Since 1955, an inverted yield curve preceded all 10 recessions with 1 false signal.

In case you missed the news, the 10-2-year spread turned negative briefly in early April and then again in early July (as of today, it’s -0.37%).

Three Eye-Opening Tweets

And finally, we close with three eye-opening tweets.

Tell FINRA to check with the NBER.

A prime example of human ingenuity.

Taxes, amirite?

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.

Great article Carter. You should jump on The Closingbell Show to discuss! We have 60,000+ in our community who'd love to learn from you. We recently had on Alex Morris, Ayesha Tariq and Tyler Okland :)