Welcome to the newest segment of Due Diligence: Social Spotlight.

We’re shining a light on the backstories and fundamentals of social momentum stocks, otherwise known as “meme stocks.” This cultural phenomenon typically targets companies that could experience short squeezes and gamma squeezes, which are technical by nature. However, we want to provide insight into the fundamentals of the underlying businesses.

Forewarning: Our goal is to be objective and simply provide facts with insightful commentary — we aren’t sunshine pumpers or doomsayers. Note that our analysis is from a fundamental perspective and does not opine on potential technical events or risks.

Today, we’re looking at Clover Health (CLOV).

What Does Clover Health Do?

Clover Health is a tech-focused health insurance company. Clover’s proprietary software — the Clover Assistant — provides data and insights to physicians so that they can make more informed decisions, which should lead to better patient outcomes and lower health care costs.

The key question is how?

Clover is an insurer, granting it access to a robust database of health information, including claims, medical charts, labs, pharmacy, electronic health records, and socioeconomic data. This is where the “tech-focused” aspect comes into play. Using a centralized platform, the company ingests, cleans, and synthesizes this health data to produce clinically-focused models. In turn, the platform (i.e. the Clover Assistant) provides data-backed suggestions to physicians at the point of care.

Here’s an example of the Clover Assistant’s interface for the end-user (i.e. physicians), per the company’s investor presentation.

How Does Clover Health Make Money?

While Clover could dabble in commercial insurance in the future, the company’s revenue is almost entirely derived from government-sponsored payments. Clover also makes commissions from reinsurance agreements (less than 1% of revenue in FY20). Currently, Clover offers Medicare and Medicare Advantage plans — let’s start with the latter.

Medicare Advantage

The Centers for Medicare & Medicaid Services (CMS), a government agency, pays Clover for each of its Medicare Advantage members in the form of monthly premiums. In turn, the company assumes the risk of medical expenses and administrative costs. The Patient Protection and Affordable Care Act (ACA) requires Clover to spend at least 85% of premiums on healthcare services, covered benefits, and quality improvement efforts. Practically speaking, the company’s gross profit margin for Medicare Advantage premiums is capped at 15%. As a result, the onus is on the company to accurately predict, price, and manage medical costs to ensure profitability.

Relatively speaking, the company’s membership is still quite small — as of March 31, the company had 66,348 Medicare Advantage members across 108 counties in 8 states — but most members are concentrated in two metro areas of New Jersey. The company expects its Medicare Advantage membership to reach 68,000 to 70,000 members by the end of FY21.

Medicare

Direct Contracting is a newer Medicare model that commenced earlier this year. Participating insurers — known as Direct Contracting Entities (DCEs) — receive stable monthly payments from CMS. In turn, DCEs can use these payments to (1) invest in technological innovation and analytical tools, (2) increase staffing and resources, and (3) reimburse providers. Clover elected to assume 100% of the risk and, therefore, 100% of savings or losses (less a small percentage discount payment to CMS, in the event of savings).

The company only recently gained authorization to offer original Medicare plans (April 2021) through its Direct Contracting program, so Medicare membership data hasn’t been released yet. That said, the company anticipates somewhere between 70,000 to 100,000 beneficiaries by the end of FY21.

So, long story short, Clover plays a pretty pivotal role in the health care process — albeit in a very small area of the country. That’s all well and good, but why are so many short-sellers targeting Clover?

Why Are Short-Sellers Targeting Clover Health?

Although Clover Health was founded in 2014, it only recently completed a reverse merger with a special purpose acquisition company (SPAC) by the name of Social Capital Hedosophia Holdings Corp. III. What a name. Chamath Palihapitiya, a venture capitalist, was one of the SPAC’s most notable sponsors.

The combination closed on January 7, 2021; Clover started trading on the Nasdaq under the symbol CLOV the next day.

Almost one month later, a research firm — Hindenburg Research — released a lengthy report alleging that Clover Health engaged in misconduct and misinformation.

While the report digs into a variety of alleged issues, the “lead story” relates to a Department of Justice investigation:

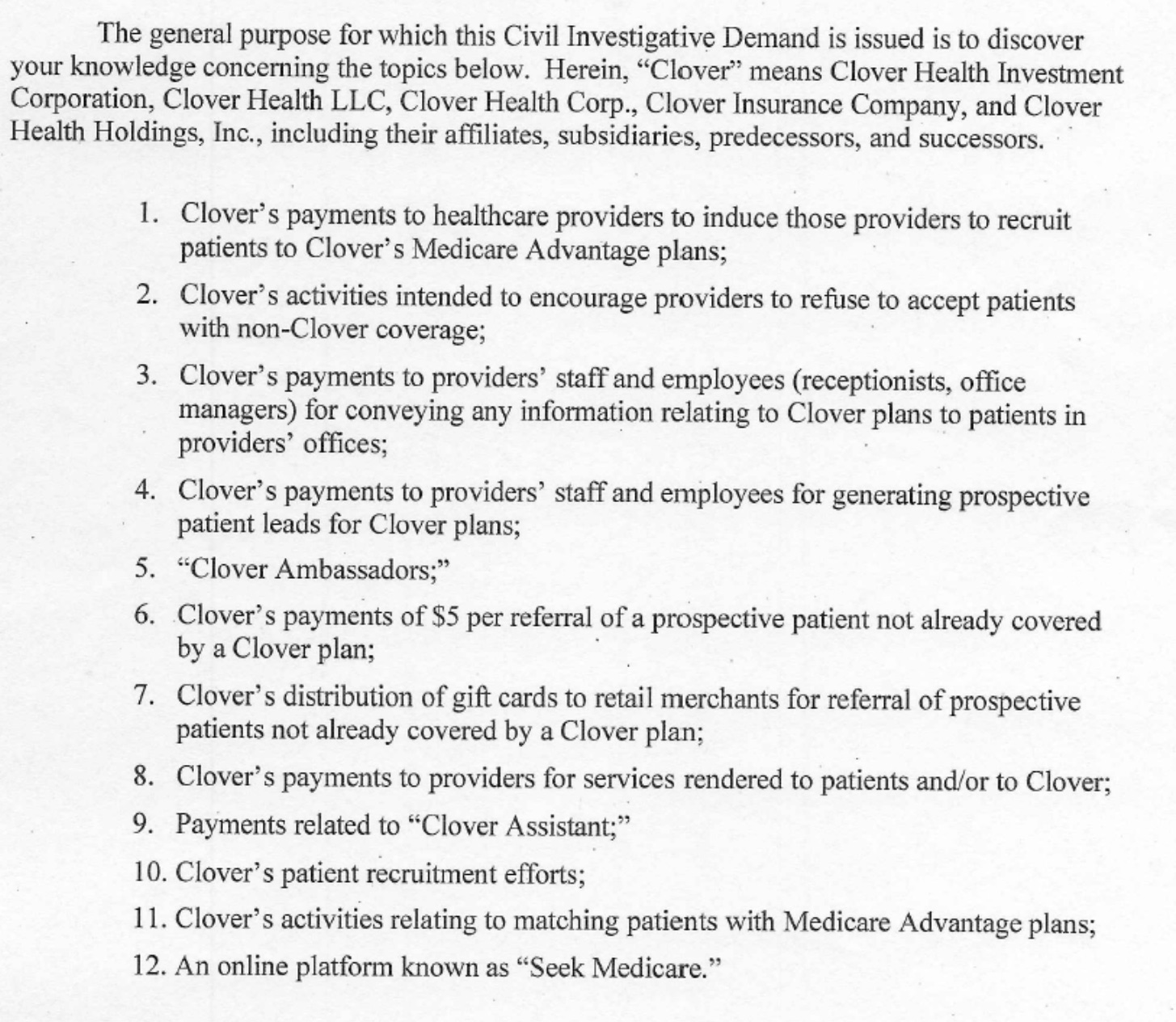

“Critically, Clover has not disclosed that its business model and its software offering, called the Clover Assistant, are under active investigation by the Department of Justice (DOJ), which is investigating at least 12 issues ranging from kickbacks to marketing practices to undisclosed third-party deals, according to a Civil Investigative Demand (similar to a subpoena) we obtained.”

The report then divulges a scanned image of the Investigative Demand that outlines the 12 issues:

Since short sellers aren’t required to disclose their positions, it’s impossible to determine exactly who’s shorting Clover Health and for what reasons, but this report is widely believed to be the initial catalyst.

How Clover Health Responded

The report pressed Clover Health to answer 18 questions. The next day (February 5), Clover’s CEO Vivek Garipalli and President Andrew Toy issued a response. While you can find each question and answer in the public filing, we’ll share the first one, as it directly relates to the DOJ investigation.

1. Did Chamath and/or Clover know about the ongoing DOJ investigation? If so, why was it concealed from investors?

Chamath and Clover were fully aware of the DOJ inquiry.

To be clear, Clover does not believe it is, or has been, in violation of any rules or regulations related to the inquiry.

We went through both an IPO and de-SPAC due diligence process, and this subject received extensive focus and attention. Consistent with the views of Clover’s outside counsel, Social Capital’s outside counsel, and independently retained outside counsel of third parties, including IPO underwriters’ counsel, we concluded that the fact of DOJ’s request for information was not material and was not required to be specifically disclosed in our SEC filings.

How could a DOJ inquiry not be considered material information? As heavily regulated organizations participating in Medicare Advantage, Clover and its peers receive frequent requests for information from regulatory bodies. These are typically confidential. We promptly respond to these requests as and when they come in. As the short selling firm points out, the DOJ also often reaches out to ex-employees, including by civil investigative demands, as part of their information-gathering process.

Clover Health believes it has made all appropriate disclosures, which were reviewed and vetted by outside counsel to all parties.

Clover has not received any civil investigative demands or subpoenas from the Department of Justice.

Clover has received a request for information from the Justice Department, to which, as we do with all requests from regulatory bodies, we responded. This was on a voluntary basis.

Clover has conducted a detailed review of matters potentially addressed by the DOJ request for information and has concluded that it is in compliance with all laws and regulations material to its business.

Up until the publishing of the short selling report yesterday morning, Clover was unaware of any other ongoing investigations of the Company, its officers, or any companies with which they are affiliated.

Following the report yesterday, Clover received notice of an investigation from the SEC. We believe this inquiry is based on the short selling report issued yesterday morning.

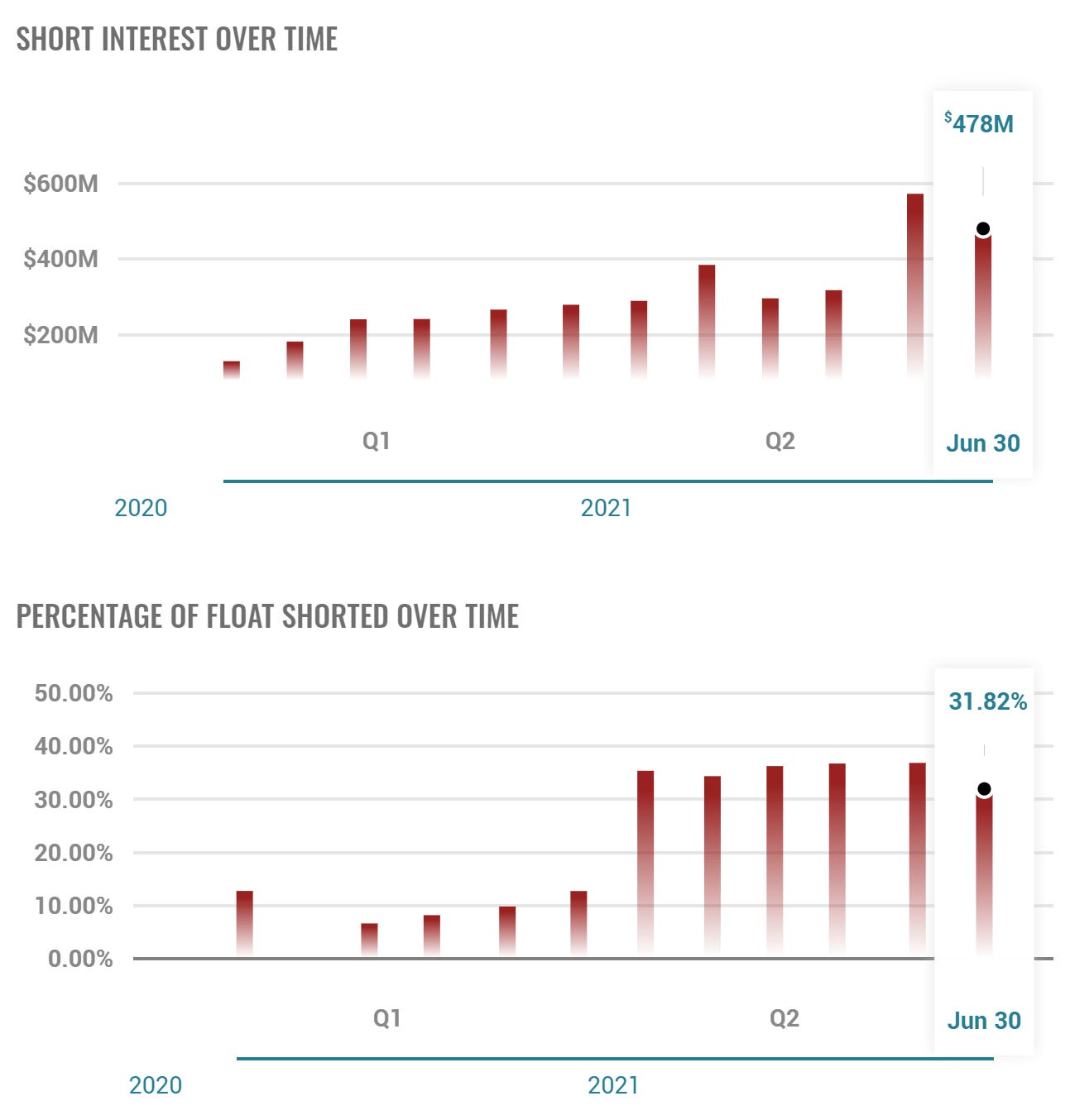

Since the report was released, Clover Health has steadily attracted more and more short sellers. (It also didn’t help that the company’s year-over-year net loss nearly doubled in 1Q21.) CLOV experienced a sizable bump in short interest — the number of shorted shares relative to the total number of outstanding shares. Here’s a visual overview from MarketBeat.

It became a prime candidate for meme stock status — and meme stock investors did not fail to deliver. On June 8, shares of CLOV spiked by as much as 109% and claimed the highest trading volume on U.S. exchanges for the day.

Financial Overview

So, with the backstory on the table, how does Clover Health look from a financial perspective? Since Clover only recently become a public company, we don’t have much history beyond the last two fiscal years and the first quarters of this year and last year.

We’re going to focus on the company’s operating results, as opposed to its bottom line (net income), for a couple of reasons: (1) it’s more indicative of the company’s operational health and viability and (2) Clover’s net income is muddled by fair value adjustments of warrants and gains/losses on derivative instruments (both of which are non-cash).

Revenue highlights

As we mentioned earlier, practically all of Clover Health’s revenue has been generated by Medicare Advantage premiums. Going forward, Medicare will factor in too.

Other income includes reinsurance agreements and interest income (which we don’t really view as revenue, but this is how the company reports it).

In FY20, Clover’s membership increased by 36.3% to 58,056, which drove the premiums increase of 45.7%.

In 1Q21, Clover’s membership increased to 66,300, again driving the increase in net premiums earned.

Expense highlights

The bumps in premiums are positive signs, but the bigger concern is the company's operating expenses. We’ll address “net medical claims incurred” (i.e. health care costs) in the “key performance metrics” section.

The SG&A line includes salaries, benefits, general, and administrative expenses — pretty much the company’s overhead. From FY19 to FY20, SG&A remained relatively steady. In 1Q21, that figure ballooned by 109% year-over-year to $104.6 million — that said, $42.7 million of that is related to stock-based compensation, which is a non-cash expense. This expense was tied to the company’s reverse merger.

Key performance metrics

Clover tracks the efficiency of its business model by comparing net premiums earned to its net medical claims incurred. This metric is known as the medical care ratio (MCR), which pretty much calculates the gross profit of the company’s Medicare Advantage plans. If the ratio is less than 100%, the Clover Assistant platform is doing its job — premiums exceed health care costs. If the ratio is above 100%, there’s a problem and the company is guaranteed to generate a loss (at least until it rolls out additional insurance offerings and revenue sources).

The last two quarters indicated a problem, as Clover’s MCR was 109.3% and 107.6% in 4Q20 and 1Q21, respectively. In its earnings release, management attributed the steep ratios to higher levels of COVID-19 specific care and related costs. Clover stated that normalized MCR — which nets out the impact of COVID-19 — would have been 89.5% for 4Q20 and 95.4% for 1Q21.

Similarly, FY20’s normalized MCR would have been 90.5%.

Regardless, it’s a concerning trend — especially since the company expects normalized MCR to be between 94% and 97% in FY21. This suggests that actual MCR will be higher than 100%, meaning Clover’s medical claims expenses alone exceed its primary and only legitimate source of revenue.

Liquidity and capital resources

Clover Health’s operations burn through cash (almost $93 million in the first quarter of 2021 alone), however, Clover’s business combination with the SPAC generated plenty of capital ($666.2 million of net proceeds) to sustain losses — at least, for the time being. As of March 31, the company had cash, cash equivalents, and short-term investments of $683.6 million.

From a debt perspective, Clover had a $26.1 million term loan outstanding and $20.8 million of convertible notes at the end of the quarter, which are minimal relative to the company’s cash on hand.

Primary Clover Health Strengths

Market potential. Despite generating a new revenue record of $200 million in Q1, Clover barely makes a dent in the Medicare Advantage market, which is expected to reach $590 billion by 2025. The potential for growth is there.

Additional revenue sources. The company needs to scale its premium earnings to be able to absorb overhead and other operating expenses. It’s working within tight margins thanks to federally mandated spending requirements. Clover is branching into the Medicare market with its Direct Contact program, which will provide predictable revenue to the company. Although it will be required to spend most of its Medicare premiums on innovation, staffing, and quality of care improvements, it should help the company expand its platform and increase its membership.

Liquidity. As of March 31, Clover had $683.6 million of cash, cash equivalents, and short-term investments on its balance sheet. Moreover, the company has minimal debt and, thus, minimal debt expenses.

Primary Clover Health Risks

Note that these are operational risks and have nothing to do with the stock’s short-term volatility.

Deep losses. As of today, Clover is not a profitable company. It’s also not close to becoming one. The company anticipates the continued investment of significant funds toward scaling its business, including its software, technology infrastructure, clinical care programs, overhead, and so on. Until the company (a) effectively and consistently manages Medicare and Medicare Advantage health care costs and (b) adds additional sources of revenues, the company will continue incurring deep losses.

Revenue concentration. Although Clover has tens of thousands of members, it really only has one source of revenue: the government. Medicare funding depends on numerous factors, such as economic conditions and budgetary constraints. Obviously, these are very much outside of Clover’s control. Reductions in funding for Medicare programs would be bad news for Clover’s growth potential.

Member concentration. At the end of FY20, 96% of Clover’s members were residents of New Jersey. Any changes to the health insurance landscape — whether that be from increased competition or regulatory changes — would significantly and adversely impact Clover’s operations.

Is Clover Health...Healthy?

It’s normal for growth-oriented companies to turn out net losses while they scale operations. The question is whether they can optimize costs and reach critical mass. For Clover, this means the company needs its membership to rapidly expand and, subsequently, management needs to leverage its data to profitably manage health care costs while maintaining sustainable levels of overhead. Entering the Medicare market as a DCE should help scale, but the questions surrounding cost management still stand.

From a liquidity standpoint, the company has plenty of cash to sustain losses...for now. Burning through nearly $100 million per quarter won’t cut it, though. Could Clover raise additional capital if necessary? The company’s debt levels are low, so debt capital markets are a viable option. Like other meme stocks, Clover could also issue more shares while there’s fervent demand from retail investors — although this would dilute shareholder value. Additional support from existing stakeholders isn’t out of the question either.

Only time will tell if Clover’s ailing from a temporary cold...or something untreatable.

If you haven’t already, don’t forget to subscribe to the Due Diligence newsletter to receive these reports in your inbox.