Stock Update: Airbnb (ABNB)

“The biggest change to travel since the advent of commercial flying.”

Good morning, investors!

Today, we’re following up on a company that empowers people to “belong anywhere”: Airbnb.

If this is your first time with us, feel free to subscribe here. If you enjoy today’s newsletter, please hit the heart button at the end of the report.

Without further ado…

Airbnb Inc (ABNB)

Nearly two years into the pandemic, it’s now clear that we are undergoing the biggest change to travel since the advent of commercial flying. Remote work has untethered many people from the need to be in an office every day. As a result, people are spreading out to thousands of towns and cities, staying for weeks, months, or even entire seasons at a time. For the first time ever, millions of people can now live anywhere.

This glowing synopsis of the travel industry is the opening paragraph of Airbnb’s 4Q shareholder letter. It appears that people are finally scratching their pandemic-induced travel itches. The monumental shift to remote work infrastructure and more lenient corporate policies have enabled people to mix business with pleasure — and thanks to Airbnb’s sprawling network of hosts, practically anywhere is an option.

ABNB stock is down this year (although it was up 8% a week ago), but that’s largely a result of broader market sell-offs and, more recently, escalating war tensions in eastern Europe. The latter is still unfolding and poses a significant threat to economic activity everywhere. Nevertheless, we’re here to focus on Airbnb.

Let’s take a look at key trends listed within Airbnb’s 4Q shareholder letter:

A travel boost to small towns and rural communities. Non-urban gross nights booked increased nearly 45% relative to Q4 2019. (2019 is a better benchmark since 2020 results were suppressed by the pandemic.)

Cities are recovering too. Globally, urban gross nights booked almost reached Q4 2019 levels; in the US, the same figure exceeded Q4 2019.

What pandemic? Gross nights booked grew by roughly 40% in December 2021 relative to December 2020. Moreover, at the end of January, there were 25% more nights booked for the upcoming summer than in January 2019.

Extended getaways. On theme, the average trip length for Airbnb patrons has increased by about 15%; stays that exceed a week represent almost half of all gross nights booked. Moreover, long-term stays (28+ nights — talk about a vacation) represented 22% of gross nights booked in Q4.

I’m Flexible. The company’s latest product feature, I’m Flexible, allows users who aren’t tied to dates or locations to search Airbnb for the best spots.

Naturally, the company’s financial results are just as promising. There’s no doubt that Airbnb suffered amidst travel restrictions in 2020, so it’s more appropriate to judge last quarter’s results against 2019 (i.e., pre-pandemic). Here’s a side-by-side comparison of Airbnb’s revenue, net income, and free cash flow over the last three 4Qs. (Note that I’ve removed share-based compensation from 4Q20, which was when ABNB went public, to get a more realistic comparison.)

Although pandemic restrictions still linger, it’s fair to say Airbnb bounced back last year. 4Q 2021 was the company’s most (and only) profitable fourth quarter to date — a positive sign for earnings growth this year and going forward.

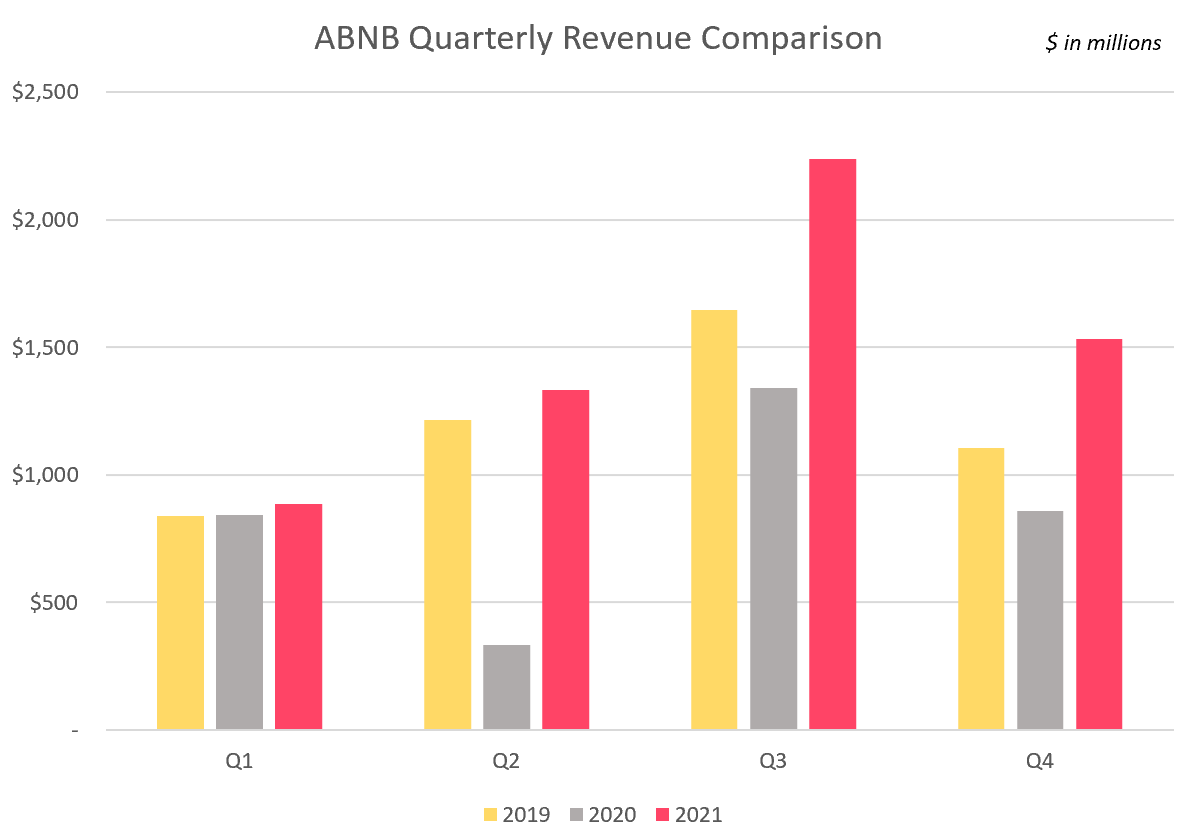

As a travel company, Airbnb is subject to seasonality (its third quarter routinely outperforms all others). To get the full picture of Airbnb’s comeback, I’ve outlined the company’s growth by quarter over the last three fiscal years.

2021 revenue and free cash flow exceeded 2019 levels in every quarter. The same can almost be said for net income, with the exception of Q1.

Free cash flow generation is particularly encouraging. In the 4Q shareholder letter, company management reiterated that 2021 was all about bolstering its core service in anticipation of the travel rebound. In 2022 and beyond, Airbnb wants to (a) expand its extended-stay offerings to “make it easier to live on Airbnb,” (b) add more hosts, and (c) personalize the guest experience. An influx of free cash flow should empower the company to execute its strategic goals.

Shares of ABNB closed at $158.26 on Thursday. Wall Street’s consensus price target is $205.83.

News Roundup

For your reading pleasure:

Dow drops 700 points after Russia attacks Ukraine, sending oil spiking and investors fleeing risk

The chip shortage is so bad GM dropped heated seats in winter

These crypto enthusiasts are trying to raise $4 billion to buy the Denver Broncos

Earnings Call Quote of the Week

“By the way, we just passed 31,000 orders.”

During Fisker’s 4Q earnings call on February 17, Henrik Fisker was explaining the average selling price of the company’s Ocean reservations. At one point, he figured he’d slip in a key performance metric: his inaugural EV model’s reservation totals. In August, that figure was 17,500, so Fisker’s marketing appears to be paying off.

Assuming those reservations hold true, that’s $1.7 billion of revenue. Henrik would later add:

“I mean, seeing the rate that we're running in at now is 31,000, I don't see any problem in easily getting way past our goal of 50,000 reservations this year — in fact, probably a lot higher.”

Shares of FSR closed at $11.86 on Thursday.

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.