Good morning, investors!

Today, we’re following up on Coinbase.

If this is your first time with us, feel free to subscribe here. If you enjoy today’s newsletter, please hit the heart button at the end of the report.

Now, without further ado...

Why Is Coinbase Stock Dropping?

“2022 is an investment year.” — CFO Alesia Haas on Coinbase’s 4Q earnings call

Coinbase has endured a drubbing ever since its direct listing last April. Shares of COIN have shriveled by 65%.

What’s going on?

There are several forces at play.

Catalyst #1

For starters, the direct listing format was an ideal exit point for Coinbase’s pre-IPO shareholders — like CEO Brian Armstrong — and a horrific entry point for the general public. Here’s an excerpt from our initial COIN DD report:

Coinbase chose to go public via a direct listing, so it didn’t undergo the traditional underwriting process that helps evaluate and price a stock. As a result, Nasdaq offered a “reference price” of $250 per share, which was based on recent private market trades and the input of investment firms. However, the expectation was that COIN would open at an even higher price — and it did.

Within minutes of listing, COIN surged to almost $430.

Roughly a week later, it tumbled below $300.

So, Coinbase’s valuation before entering the public markets was about $250, and despite the initial pop, it eased back to around this level in the following months before jumping yet again in October to about $343.

Which brings us to our second and third catalysts.

Catalysts #2/3

As a tech company, Coinbase has suffered alongside the broader sell-off. No surprise there.

Moreover, COIN shares tend to move in tandem with the crypto market, and for good reason considering Coinbase operations are reliant on crypto trading volume. Just like stocks, cryptos have been crushed since November too — Bitcoin is down nearly 50%.

That’s exactly why the company is trying to untether itself from this volatility through subscription-based revenue. (FY21 subscription revenue hit $517.5 million compared to $45 million in FY20.)

Catalyst #4

Coinbase did so well last year. Just look at their top- and bottom-line growth.

Now, Coinbase is flushed with capital — $7.1 billion of unrestricted cash as of 12/31.

But how could all of this growth possibly drive COIN shares down?

When the company released its Q4 shareholder letter, it announced a plan to aggressively reinvest profits in its business. Coinbase expects to hire 6,000 employees in 2022, particularly for its technology and development teams. To give you an idea of how ambitious this is, Coinbase had 3,730 employees at the end of 2021 — and 1,249 at the end of 2020.

So, management plans to nearly triple the company’s workforce (again).

That won’t be cheap. Coinbase estimates between $4.25 and $5.25 billion of expenses related to this buildout (including $1.5 billion of stock-based compensation), dwarfing previous years.

Coinbase has the capital to exponentially grow without jeopardizing liquidity. Still, margins could take a pretty large hit. Coupled with a potential lull in trading amidst recession fears (the average retail investor typically avoids riskier assets when markets are falling), Coinbase faces some near-term profitability concerns.

Management projects monthly transacting users (MTUs, a key business metric) between 5 and 15 million — a very broad range with significant implications for revenue.

If we perform to the middle or the high end of this range, we expect to be profitable. If we perform on the low end of this range, we plan to manage our business such that our Adjusted EBITDA loss would be no more than $500 million. Against our $7 billion of cash that we ended the year with, we think this is a very manageable loss if we choose to take it because the investment for the long-term is the most important thing we can do because we're in the early days of crypto.

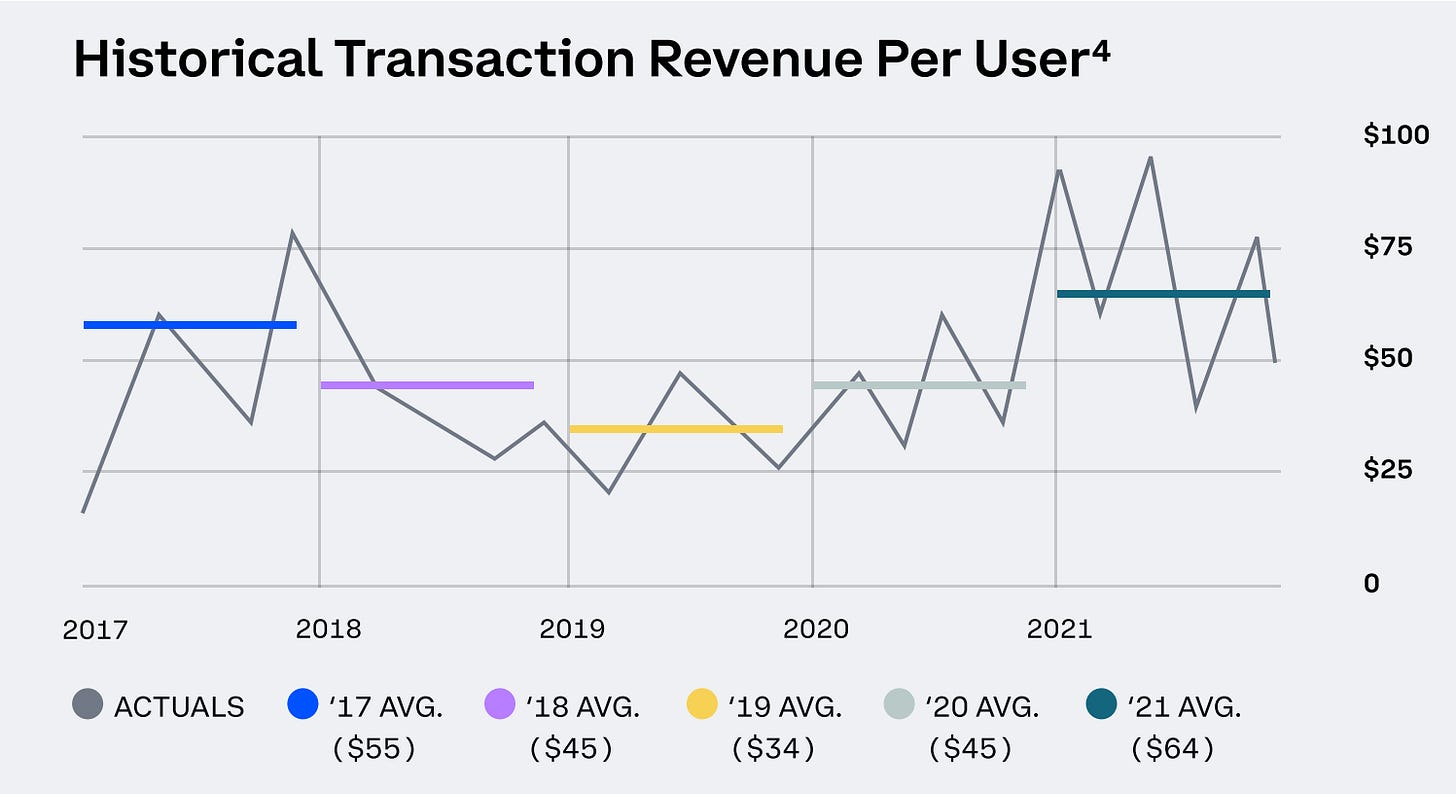

Along the same lines, management expects its average transaction revenue per user (ARPU) to revert back to pre-2021 levels, which averages out to $45 per MTU.

So, what does this look like from a financial standpoint?

Using a few assumptions and Coinbase’s outlook, we can set some parameters for Coinbase’s 2022 performance.

Management guidance:

MTUs = 5 million low end, 15 million high end

ARPU pre-2021 levels = $45 per MTU

Transaction expenses = “low 20%s” (I’ve assumed 22%)

Sales and marketing expense = 12 to 15%

Technology & Development (T&D) + G&A = $4.25 to $5.25 billion

Assumptions:

Net revenue (Institutional) grows relative to 2020, but down significantly compared to 2021

Same for “other revenue” (i.e., crypto sale gains)

Other expenses relate to impairments, assuming this essentially cancels out other revenue.

Based on our inputs, Coinbase projects to operate at a loss in FY22, which Brian Armstrong already teed up as a realistic possibility when he mentioned managing adjusted EBITDA to no more than a $500 million loss.

Still, these are investments — ones that should allow Coinbase to continue expanding its market share. Here’s CFO Alesia Haas’ response to a question about this very topic: (Lightly edited for readability)

The investments that we're making in our investment platform — for example, adding new assets, adding payment rails — we expect those to impact our 2022 revenue. As we've seen, the continued diversification of assets on our platform contributes to near-term revenue generation. For example, in 2021, we saw more revenue come from the long tail of crypto than from Bitcoin and Ethereum.

Other investments that we're making, for example, in the dApp platform and NFTs. I don’t think they will have as material of an impact in 2022. They’re more long-term bets that we think will have significant impacts on the longer-term revenues of our company. Similar to international, it'll take us…quarters or years to see those investments turn into meaningful revenue streams. So we think they’re the right long-term investments to make.

Last, we're putting a lot of effort into just increasing the reliability, the stability, and the infrastructure on our platform…the volume pickup from 2020 to 2021 was extraordinary.

To read more about Coinbase’s specific investment plans, check out the Looking Ahead section of its shareholder letter.

Shares of COIN closed at $114.25 on Thursday. Wall Street’s consensus price target is $278.18.

Further Reading

For your (crypto) reading pleasure:

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.