Good morning, investors!

Today, we’re following up on a company that may or may not be considered a meme stock: Palantir.

If this is your first time with us, feel free to subscribe here. If you enjoy today’s newsletter, please hit the heart button at the end of the report.

Without further ado…

Palantir Technologies Inc (PLTR)

“Bad times are very good for Palantir because we build products that are robust, that are built for danger.” —Alex Karp, Co-Founder and Chief Executive Officer of Palantir

Palantir stock has seen better days. It’s still up 45% relative to its 2020 IPO price, however, PLTR once traded around $35 a share, and now it’s $13.39.

What’s giving Palantir trouble lately? The broader tech sell-off did the company no favors, as shares dropped almost 49% from November to January. Then an earnings miss for Q4 didn’t help matters in February.

Is Palantir in trouble?

Aside from the fact that EPS is a convoluted metric for PLTR — since they have so many outstanding shares — I think charts and tables can give a reasonably definitive answer.

Here’s Palantir’s quarterly revenue output since the beginning of 2019. See a trend?

What’s driving this pattern?

Robust growth within both of the company’s operating segments, Government and Commercial. From Palantir’s earnings release:

Commercial revenue grew 34% year-over-year to $645 million.

US commercial revenue grew 102% year-over-year.

Government revenue grew 47% to $897 million.

Relative to 2020, Commercial customer count tripled to 147 customers.

US commercial customers increased from 17 in FY20 to 80 as of 12/31/21.

But what about Palantir’s inability to generate profits? Clearly, investors didn’t like the $0.02 EPS miss for FY21.

Well, that’s another quandary that a chart can shed light on.

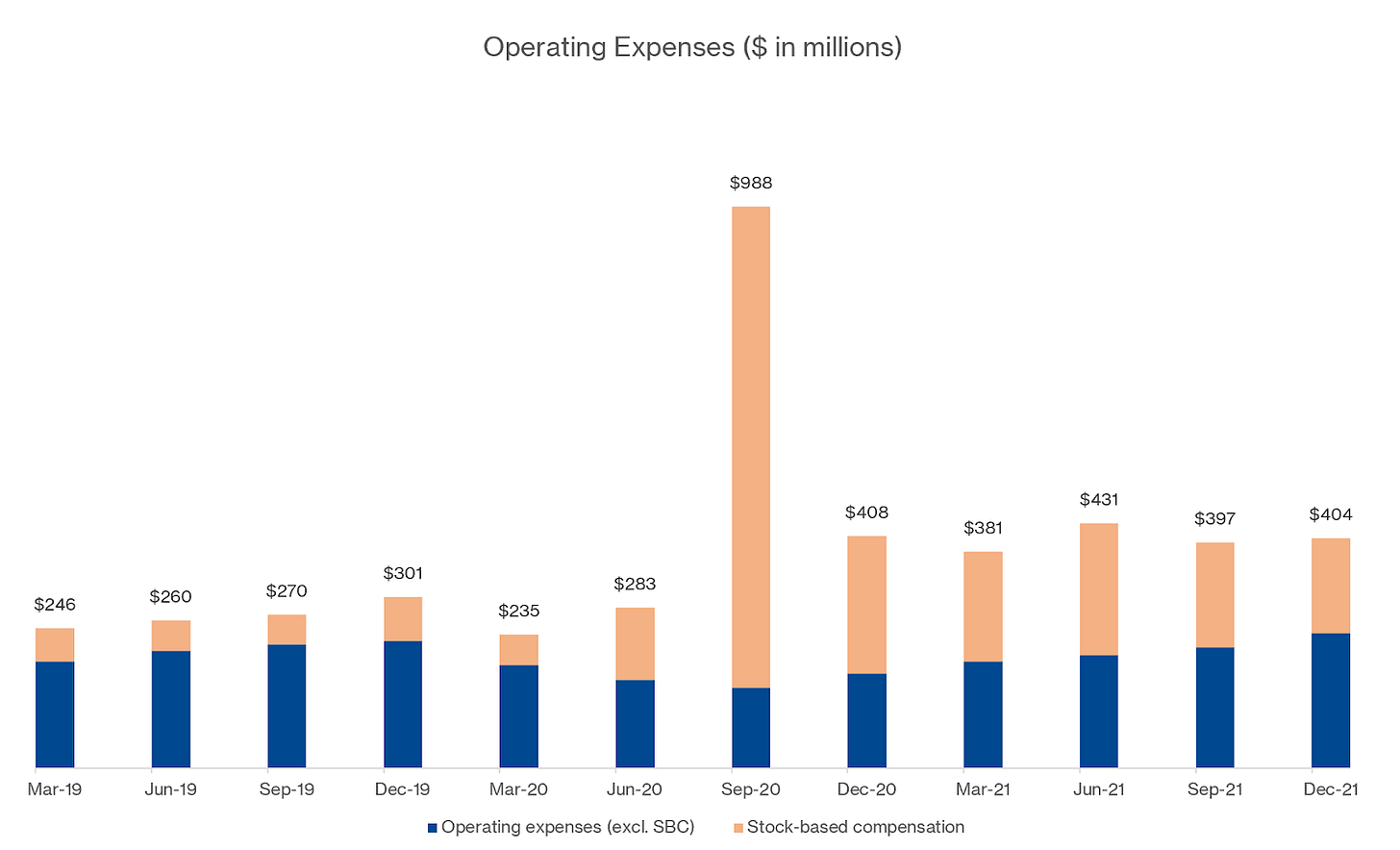

If you recall from my Palantir DD report, the company pays its employees very well, particularly in the form of stock compensation. So much so that stock-based comp has represented about 50% of Palantir’s total operating expenses each quarter since the company went public (ignoring the IPO quarter).

Although dilutive, this approach is common for growth-oriented companies.

As a percentage of gross profit, Palantir’s operating expenses (excluding share-based comp) have steadily declined since 2019, from 185% in 1Q19 to 70% — consistently — every quarter of this past year. Simply put, the company’s growth model (which emphasizes cash flow) is working exceptionally well. Its share-based comp just muddies the waters of profitability.

For further illustration, here’s Palantir’s reported operating income, inclusive of share-based compensation.

Consistent operating losses. However, here’s what Palatinr’s operating income would look like if we backed out share-based compensation.

Obviously, stock-based comp is still an expense — one that dilutes shareholder value. As investors, that’s important. But from the operational side of things, PLTR has less cash going out the door and more to invest in its business (as well as other businesses, which we discussed in Palantir’s DD report.)

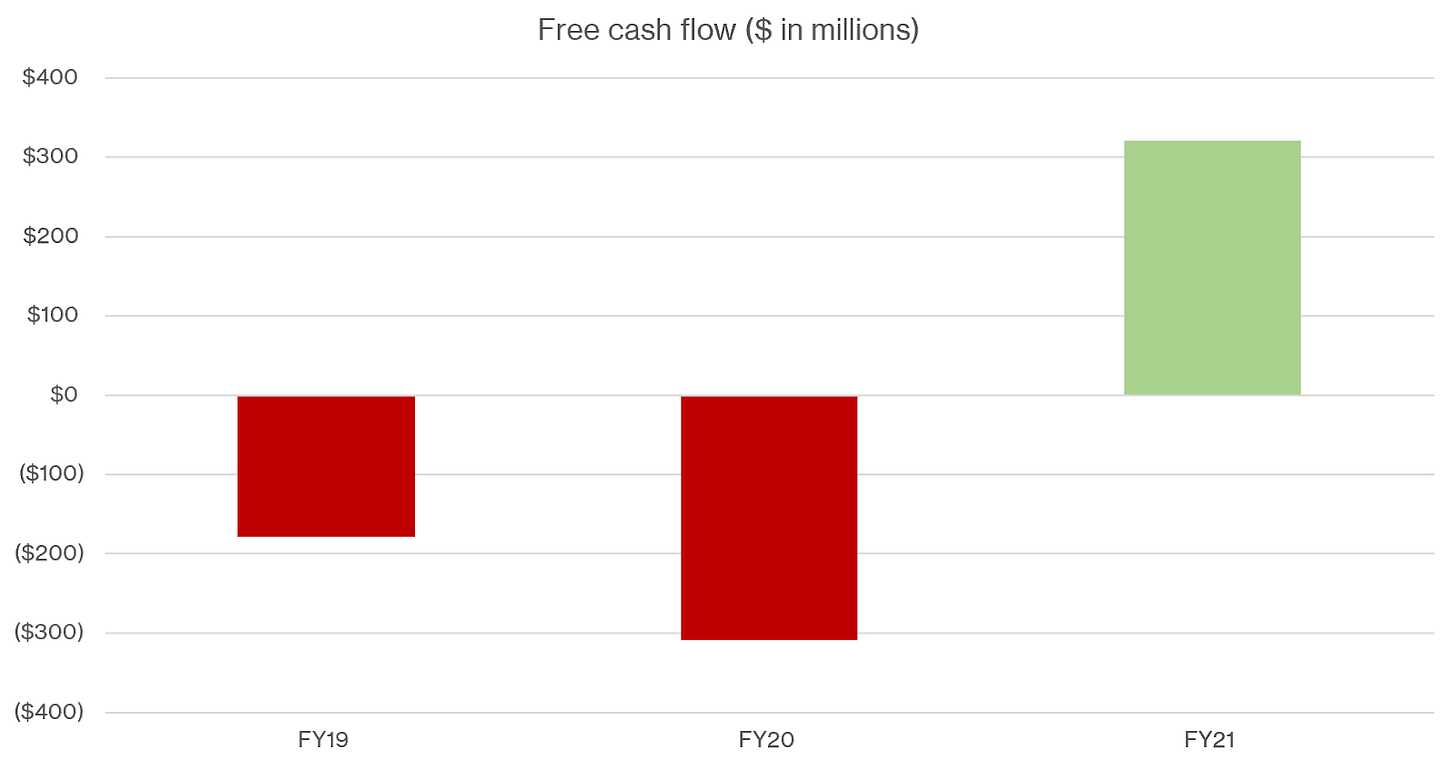

This leads us to our final chart…

Free cash flow.

“You can't be GAAP profitable if you're diluting people or your stock-based comp is not in conformity with other companies. So, you're seeing a normalization. This will change. It will change in the relatively near future.” — Alex Karp, lightly edited for readability

How long until this non-cash expense situation normalizes? Karp estimates a year and a half, two at most.

In September, I noted my hesitancies about Palantir’s exceedingly high outstanding share total, which made the company less appealing at its $26+ price tag at the time. However, the free cash flow reversal is a positive sign. With sustained success, it could open the door for opportunities to increase shareholder value — business reinvestment, investments in other businesses, perhaps a share-buyback program.

So, it’s a question of whether investors believe Palantir will continue growing the business as well as free cash flow so that, eventually, the company achieves profitability.

The charts seem to foretell good fortunes.

Shares of PLTR closed at $13.39 on Thursday. Wall Street’s consensus price target is $13.13.

News Roundup

For your reading pleasure:

Nvidia unveils new technology to speed up AI, launches new supercomputer

Maker's Mark Just Hopped On The NFT Bandwagon. Here's What We Know So Far

Earnings Call Quote of the Week

“We acknowledge we are not yet where we want to be with new client acquisitions and conversion…” — Elizabeth Spaulding, President of Stitch Fix, on the company’s 4Q earnings call.

Losing 161,000 active clients isn’t good for business. But that’s what happened to Stitch Fix during their second quarter of FY22. The culprits? Onboarding inefficiencies and iOS changes to privacy policies, which hurt the company’s targeted advertisements.

As a result, the company curtailed its marketing spend while it streamlines its onboarding process — coupled with less active users, management lowered revenue expectations for the year.

All that said, shares are still a far cry from what they were when I composed the SFIX Due Diligence report — and an even farther cry from its January 2021 high of $113.76. Although the latter was predominantly driven by the meme stock craze.

Shares of SFIX closed at $10.77 on Thursday.

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.