The Big Picture

You’re familiar with the world’s biggest names in tech — Apple, Google, Tesla, Amazon. But what enables these massive brands to produce such life-changing technology?

Semiconductors.

Semiconductor manufacturers like Intel and Samsung produce the computer chips that power our most advanced electrical devices. Smartphones, smart cars, smart homes, smart cities — you name it.

As you can imagine, these manufacturers need incredibly sophisticated equipment to create computer chips, and one company has, for the time being, monopolized the world’s most advanced semiconductor equipment.

That company is ASML.

The Business

ASML Holding NV (ASML) is one of the world’s leading manufacturers of semiconductor equipment. It provides chipmakers with the necessary hardware, software, and services to mass-produce nanoscopic patterns on silicon wafers, which are eventually turned into computer chips for electronic devices. The company is headquartered in the Netherlands but has offices in more than 60 cities across 16 countries and employs more than 28,000 people.

ASML’s customers are the world’s largest microchip manufacturers, such as Intel, Taiwan Semiconductor Manufacturing (TSM), and Samsung. ASML divides its customers into two groups:

Memory chipmakers

Logic chipmakers

Memory chips are useful for storing large amounts of data in small areas. Logic chips process information in electronic devices. In turn, they’re prevalent in data centers, smartphones, vehicles, personal computers, and so on.

Overview of semiconductors

Semiconductors are integral to technological advancements across just about every industry you can think of. Forewarning, the technical overview you’re about to read is from the perspective of a finance guy — not an engineer or scientist.

The oversimplified goal of semiconductor technology is to squeeze more transistors — which are minuscule electrical switches that allow devices to run computations — onto the layers (referred to as “wafers”) of a microchip. The more transistors, the more computing power. The more wafers, the more complex and powerful the chip.

In 1965, Gordon Moore, a co-founder of Intel, hypothesized what is now referred to as Moore’s Law: the number of transistors on an integrated circuit doubles every two-ish years. In other words, it’s a constant innovation race to produce smaller and more powerful microchips. The initial silicon transistors could be seen by the naked eye. Nowadays, chips the size of your thumbnail can contain billions of transistors.

When you put more computing power into a device, it can do more for the end-user. For instance, an iPhone 12 is far more advanced than an iPhone 4. The dashboard display of a 2021 vehicle model has far more features than a 2008 model. You get the idea.

For a high-level explanation and history of semiconductors, this BBC summary is quite helpful.

Semiconductor supply chain

It’s helpful to take a broader look at the semiconductor industry to gauge ASML’s role in the process:

Fabless companies design and sell semiconductor chips and hardware devices without actually creating those chips/devices. They outsource the fabrication (hence “fabless”) to a specialized manufacturer, otherwise known as a semiconductor foundry or Integrated Design Manufacturer (IDM). To reiterate, ASML sells its high-tech machines to these companies so that they can mass-produce the world’s supply of computer chips, which power electronic devices. For instance, TSM makes Apple’s iPhone chips, using ASML’s equipment.

How ASML enables “shrink”

Before we dive into ASML’s products and services, it’s helpful to review how ASML innovates its machines and contributes to shrinking transistors on microchips. We’ll avoid getting overly sciencey — let’s face it, we’re not lithography experts either — but here’s the company’s overview of “shrink” and how it contributes:

The long-term growth of the semiconductor industry is based on the principle that the energy, cost, and time required for electronic computations can be reduced by shrinking transistors on microchips. One of the main drivers of shrink is the resolution that systems can achieve, which is mainly determined by the wavelength of the light used and the numerical aperture of the optics. A shorter wavelength – like a finer brush used for painting – can print smaller features. A larger numerical aperture can focus the light more tightly, which also leads to better resolution. To enable shrink, what we do – lithography – is key.

ASML’s innovation is based on the following equation:

CD stands for critical dimension. This is the smallest structure that a lithography system can print.

Lambda (ƛ) is the wavelength of the light source — the smaller the wavelength, the smaller the structures that can be printed

NA stands for numerical aperture, which measures the entrance angle of the light — the larger the NA lenses and mirrors, the smaller structures can be printed

K1 relates to optical and process optimizations — ASML’s solutions help customers optimize this factor.

Altogether, ASML attempts to influence the variables in this equation to reduce CD.

Products and services

ASML provides the equipment — gigantic lithography machines — that enable foundries to mass-produce microchips. Their product portfolio includes numerous types of machines, but they can be segmented into three groups:

Extreme ultraviolet (EUV) lithography systems

Deep ultraviolet (DUV) lithography systems

Metrology and inspection systems, which help chipmakers achieve the highest yield and best performance in mass production

We’re going to focus on the first two.

ASML is the world’s only manufacturer of EUV lithography systems, which are the most advanced equipment available as of today. How advanced? As one researcher explains, ASML’s EUV system burns a transistor blueprint onto a silicon wafer “with a precision equivalent to shooting an arrow from Earth to hit an apple placed on the moon.”

EUV lithography uses light with a wavelength of just 13.5 nm — compared to DUV lithography, which uses 193 nm light. As a reminder, the smaller the wavelength, the smaller the structures that can be printed.

Before you jump to conclusions, yes — DUV lithography is still relevant. As of today, DUV lithography still produces the majority of layers in devices. Until EUV manufacturing ramps up universally, DUV will remain important for future devices.

The following table outlines ASML’s unit sales by machine type. As of the company’s last fiscal year, DUV systems still accounted for the largest piece of the net sales pie. Also, as you’ll quickly see, it pays to have sole possession of the world’s most advanced equipment; the average EUV lithography system carries a €144 million price tag.

Finally, the company also receives service revenue from its installed base of systems. As ASML’s systems proliferate around the world, the company makes more from system upgrades and customer support services, such as technical support and next-day parts delivery.

The Narrative

ASML and the semiconductor industry have two key storylines:

The need for more semiconductors

The next generation of lithography: High-NA technology

More semiconductors, please.

As we’ve mentioned, computer chips are in countless electronic devices across every industry. Naturally, demand for these chips has swelled. This wasn’t a surprise heading into 2020, especially with the much-anticipated rollout of 5G devices. However, COVID-19 was a surprise — a surprise that disrupted supply chains and manufacturing outputs everywhere.

With millions of people hunkering down at home, demand for computers, gaming devices, and internet infrastructure shot through the roof. And this demand isn’t going anywhere. While the shortage is anticipated to remain in the short-term (factories can’t be built in a day), chipmakers are pouring capital into additional foundries to increase their production capabilities. For instance, Taiwan Semiconductor Manufacturing announced a massive $25-28 billion expansion of production capacity in January.

Who’s the only company that can outfit new foundries with the latest equipment? ASML.

According to ASML’s research, there are more than 40 billion connected devices in use as of today. That number is expected to balloon to 350 billion by 2030.

That’s a lot of microchips.

Based on different market scenarios, the company expects to grow its annual revenue to anywhere from €15 billion to €24 billion by 2025.

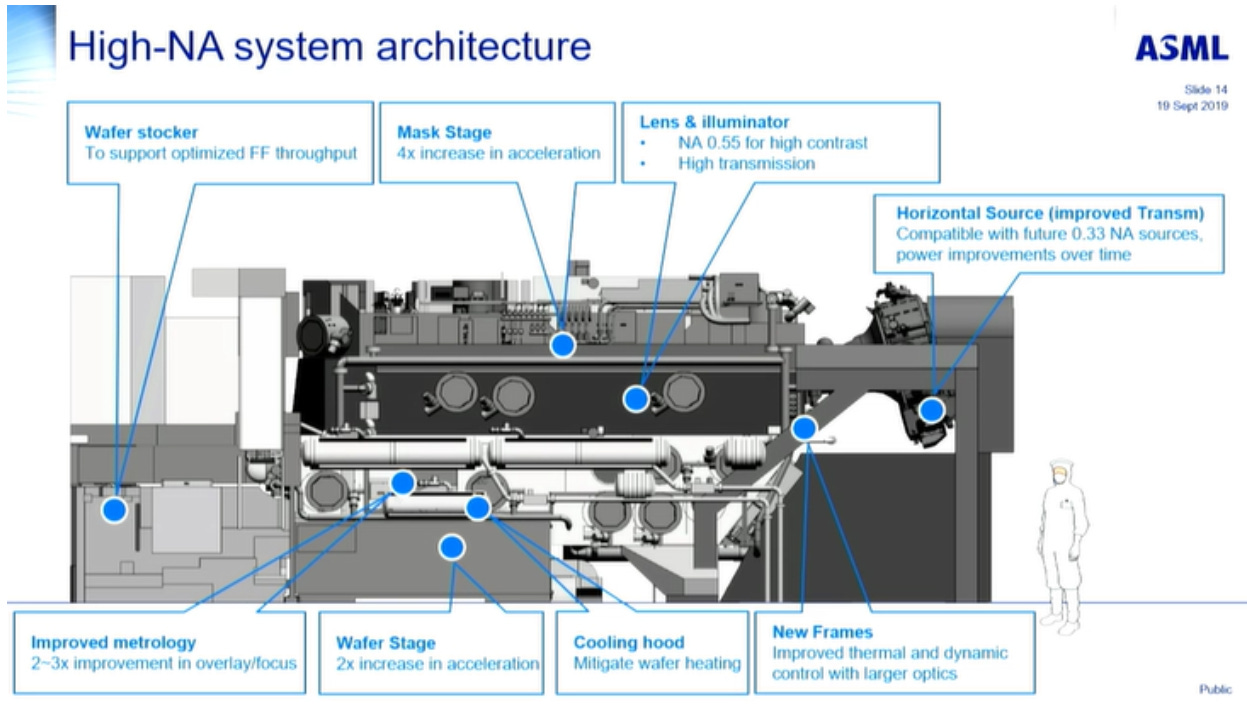

High-NA machines

The demand for EUV systems is steadily rising, but the semiconductor industry is constantly looking ahead. From the equipment side of things, the next generation after extreme ultraviolet lithography is...drumroll...High-NA technology.

As a reminder, higher numerical aperture (NA) translates to smaller structures. The company expects this technology to be 70% more effective at increasing resolution and overlay capability than the existing EUV platform. So, continuing with Moore’s Law, chipmakers can pack more resistors into the same-size chips or the same number of transistors into smaller chips — at the same cost. Theoretically.

According to CEO Peter Wennink on the company’s Q4 earnings call, the initial installation of the first High-NA system is expected to be in 2023; volume production is estimated to be in 2025-2026. However, there are concerns that this roadmap could be delayed — which is something to keep an eye on. The EUV system took years to develop to a point of commercial viability; throughput (i.e. production rate of wafers) needs to be high enough to be cost-effective and to meet supply needs. The company will provide a more detailed update on its High-NA program during its Investor Day in September.

The Competitors

No other company in the world can produce EUV lithography systems. Nikon and Canon tried, but they scrapped development efforts. However, that doesn’t mean ASML is a lone wolf in the semiconductor equipment space. Nikon and Canon — yes, the camera companies — both sell DUV equipment. For instance, Nikon’s “Precision Equipment” business line (which includes its semiconductor-related sales) generated the equivalent of €1.4 billion during its last fiscal year.

ASML’s hardware business is practically unrivaled due to its monopoly, but the company faces stiffer competition from an applications software standpoint, specifically from Applied Materials and KLA-Tencor.

The High-Level Finances

Note that all euro amounts are illustrated in millions.

Net sales

It doesn’t hurt to be at the forefront of cutting-edge semiconductor technology development. In FY20, ASML’s net sales increased 18% year-over-year from €11.8 billion to €14.0 billion, as it sold more lithography systems (395 units vs 344 units); in addition, it sold more EUV systems (31 vs 26) at higher average selling prices (€144 million vs. €107 million).

On top of more units, ASML services and upgrades experienced notable increases thanks to an ever-increasing network of in-use systems; for FY20, Installed Base Management sales (i.e. the business from upgrades and services)) were €3.7 billion, a 29.6% increase from €2.8 billion in FY19.

Net sales have increased at a compound annual growth rate of 19.4% over the last five years.

For the company’s first quarter of 2021, net sales increased 79% year-over-year thanks to EUV system sales and higher installed base sales, which were driven by software upgrades that can increase system productivity.

EBITDA

The primary drivers of the company’s EBITDA growth are improved gross profit margins (48.6% in FY20 vs 44.7% in FY19) and relatively steady SG&A, demonstrating ASML’s commitment to cost efficiencies.

Beyond the cost of sales, the company’s primary expense is R&D. ASML’s R&D costs have been €1.3 billion, €1.6 billion, €2.0 billion, and €2.2 billion over the last four years, growing at an average annual rate of nearly 19%. The semiconductor industry is constantly prioritizing innovation, so that’s no surprise.

Net Income

From 2016 to 2020, ASML’s net income has increased by 122%. In addition to the above commentary, ASML’s interest expense is fairly low relative to the company’s size, benefiting its bottom line.

Despite being an R&D-focused company, ASML also issues quarterly dividends; in FY20, the company’s total dividend was €1.1 billion (€2.75 per ordinary share).

In short, business is good.

The Primary Strengths

Tech leadership. ASML has an incredible competitive advantage: it’s the only company in the world that offers EUV lithography systems. On top of that, lithography research is cumulative and requires progressive improvement — in other words, it’s practically impossible to overtake an industry leader because you can’t skip a generation of manufacturing technology.

Industry opportunity. The world is in the midst of a chip shortage, which has driven chipmakers to invest in additional foundries to up their production capabilities. As the sole provider of EUV lithography systems, ASML is the only semiconductor equipment manufacturer that can supply these foundries.

Financial position. Financially, the company is very healthy. Margins are high (operating margin was 29% in FY20). Cash flow from operations is not only positive but robust (€4.6 billion in FY20. Long-term debt is moderately low (€4.6 billion as of April 4), especially relative to cash and short-term investments (also €4.6 billion).

The Primary Risks

Expanding R&D. Innovation isn’t cheap. Over the last five years, ASML has invested over €8 billion in R&D. Although ASML operates at comfortable margins, failing to produce the next generation of semiconductor equipment would adversely impact the company’s bottom line. Innovation also isn’t guaranteed. It’s one thing to produce cutting-edge equipment, it’s another to produce commercially viable equipment.

Geopolitical tensions. Specifically, the trade war between U.S. and China. Trade restrictions and export barriers can hurt ASML’s ability to transact with certain customers. In 2019, the Trump administration pressured the Dutch government into preventing ASML from selling its EUV units to China. (ASML’s equipment has been called a “choke point” in the supply chain of chips; see this New York Times article for a holistic explanation.)

According to management, the trade war isn’t anticipated to slow down DUV unit sales in China. Despite the restrictions, China still accounted for 16.6% of the company’s FY20 sales, up from 11.7% in FY19, as ASML continued selling DUV systems.

Industry delays and disruption. ASML is susceptible to the needs, progress, and design capabilities of its ecosystem partners. ASML’s customers can delay their investment in new technology systems if it’s not economical or doesn’t align with their product cycles. Similarly, ASML’s customers (namely, Intel) have faced product roadmap delays in the past, which slows down the overall transition for the introduction of new chips and — in turn — new systems.

The Street’s Opinion

ASML is somewhat all over the board, but the majority of analysts consider the stock a “Buy,” leading to a consensus “Overweight” rating. A few analysts are less optimistic, probably as a result of the ongoing trade war and unpredictable nature of future systems rollouts.

Similarly, the Street’s price targets are somewhat scattered but mostly trend upward; the average price target ($705.36) is a hair under 5% above the stock’s current price of $672.59. Data as of 7/8/2021.

Recent News

The semiconductor shortage is here to stay, but it will affect chip companies differently (MarketWatch)

ASML Is a Critical Chip Stock. It Doesn’t Even Make Them. (Barrons)

Can ASML maintain its lithography monopoly?

It’s hard to bet against technological innovation — and the semiconductor equipment frontrunner that, as of today, is the exclusive manufacturer of EUV lithography machines.

The biggest risk is the unknown. Moore’s “law” is hardly a law, it’s an observation based on historical results. Who knows how close humankind is to the fundamental limits of physics? ASML’s management seems to think we aren’t that close. Since they’re a bunch of physicists and really smart people who’ve made boatloads of money every year testing these limits, I’m inclined to believe them.

We like ASML, especially as a long-term play.

Keep an eye on (1) ASML’s upcoming Investor Day (September 29, 2021), which will provide more detail around the company’s High-NA program; (2) the ongoing trade war between the U.S. and China; (3) the development of additional foundries — especially in China; (4) the innovation progress of other equipment makers.

If you haven’t already, don’t forget to subscribe to the Due Diligence newsletter to receive these reports in your inbox.