UPDATE (8/27/21): Since releasing this report, EV stocks took a beating and ChargePoint operations experienced several new developments. You can read more here.

The Big Picture

Electric vehicles (EVs) are often labeled as “the cars of the future” — but they actually have a lengthy past. Did you know electric vehicles were first introduced in the U.S. in the 1880s?

Over the ensuing century or so, they never quite got a strong enough foothold to make a dent in the auto industry.

Needless to say, EVs are finally a viable and commercialized option. People want them. Automakers have publicly committed to all-EV lineups. Governments not only incentivize consumers to buy EVs, but they’re also pushing massive infrastructure bills to accelerate the adoption.

ChargePoint is more than the “gas station of the future” — it’s a rapidly expanding tech company with a transparent subscription-focused business model. Plus, ChargePoint commands the largest network of Level 2 chargers in North America, so it has an early mover advantage. But there are still plenty of hurdles in its way.

Will ChargePoint shock the market?

The Business

Founded in 2007 and based in California, ChargePoint (CHPT) provides EV charging networks and charging solutions in the United States and Europe. The company has three lines of business and corresponding customer segments: commercial, fleet (i.e. a business’s group of vehicles, such as FedEx trucks), and residential.

ChargePoint has a diverse list of customers spread across these categories, such as Netflix, 3M, and Microsoft within the commercial segment. As of 1Q22 (i.e. April 30), the company provided products and services to more than 5,000 customers. Here’s an overview of their products offerings by business line:

ChargePoint’s revenue is segmented into the following categories. Note that the company’s fiscal year ends on January 31, so 1Q22 ended on April 30, 2021.

Networked charging stations: the upfront purchase of physical stations; this category accounted for 66% of 1Q22 revenue.

Subscriptions: the company’s cloud services, parts & labor warranties, and service offerings, which are bundled into recurring subscriptions. ChargePoint’s subscriptions accounted for 27% of 1Q22 revenue.

Other: the company’s energy credits, professional services, and non-material revenue streams. This category accounted for 7% of 1Q22 revenue.

We’ve outlined each revenue line item’s contribution, gross profit, and margins.

Charging stations

ChargePoint’s biggest source of revenue is the one-time sale of its charging stations (its “hardware”) to a variety of customers. The company does not own its charging stations, but it sells the hardware and the necessary software separately. The company also does not monetize energy or profit off of drivers (unless they own a home charging station).

ChargePoint’s charging stations are a mix of Level 2 (alternating current, or AC) and direct current (DC) fast charging. Like the different grades of gasoline, there are three levels of EV charging levels: Level 1 (AC), Level 2 (AC), and DC fast charging. Level 1 is the slowest and least expensive, while DC fast charging is the fattest and most expensive. (Here’s a better overview.)

In the first quarter of FY22, ChargePoint added another 6,000 active charging stations, bringing its total to 112,000 (including both private and public access stations). Of that total, 3,500 are DC fast charges; these stations are intended for fast-fill settings and fleet depots.

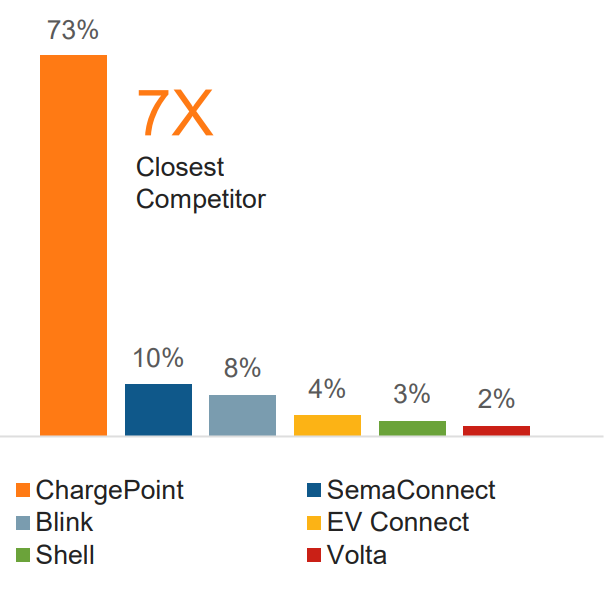

As of January, ChargePoint boasted a 71% market share of network level 2 charging stations in North America, which significantly outpaced the rest of the industry.

Subscriptions

The company’s long-term sustainability will hinge on its subscription revenue. ChargePoint employs a recurring software-as-a-service (SaaS) model in that its software is 100% attached to its hardware. In other words, ChargePoint customers buy the hardware and then pay for annual subscriptions to access the software.

Subscription services also include parts and labor warranties and cloud services.

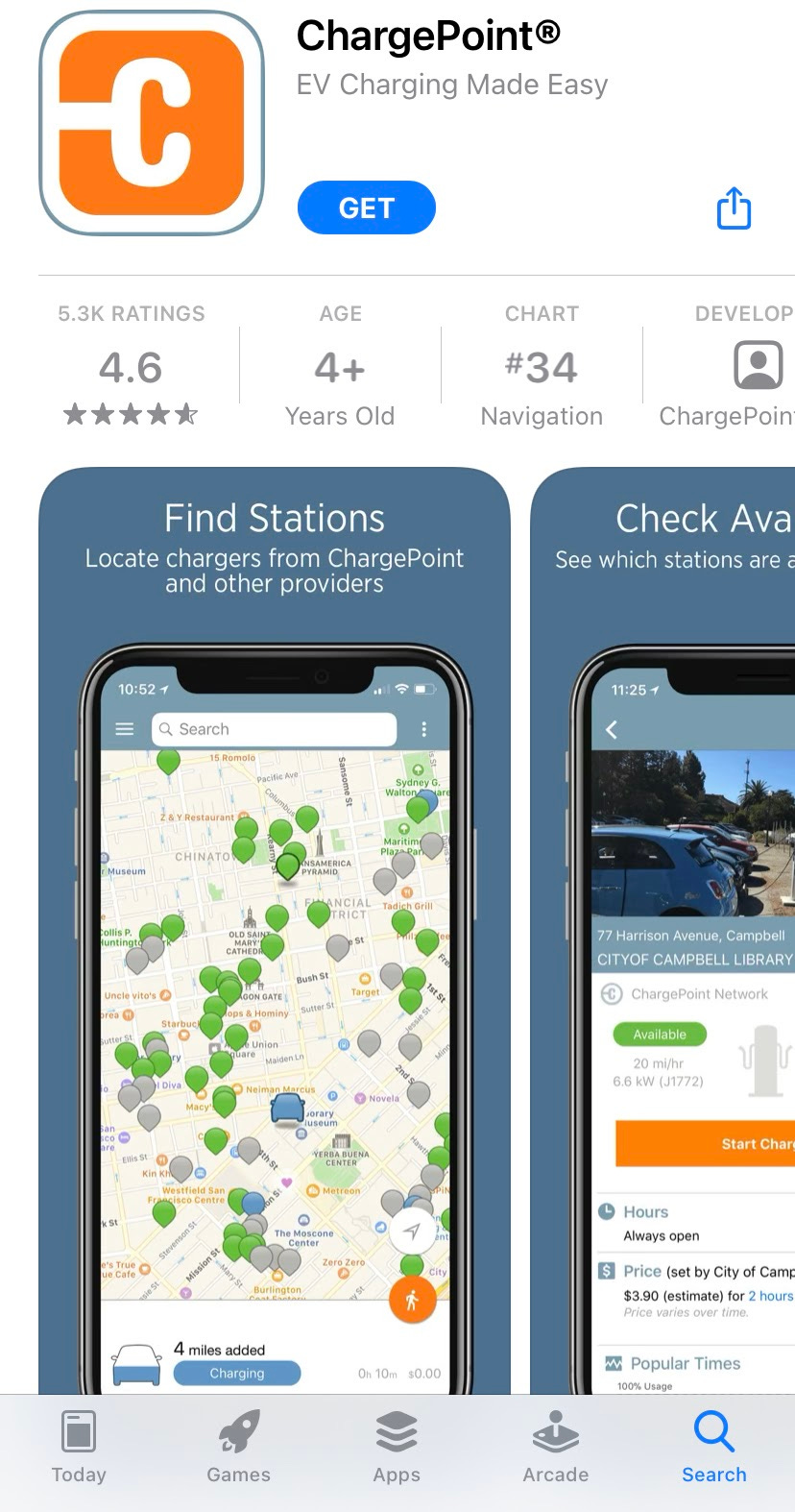

User reviews

ChargePoint’s end-user is the EV driver. So, the company’s mobile app and auto integrations are key factors behind user satisfaction and growth. To date, ChargePoint has accumulated more than 5,300 ratings within the Apple Store for an aggregate rating of 4.6 out of 5.

In addition, ChargePoint recently announced a partnership with Android Auto to integrate charging functionally into EVs, allowing Android-using drivers to access the ChargePoint app directly on their displays. In turn, they can map out charging locations and check station statuses.

Merger & IPO

In March, ChargePoint completed its merger with Switchback Energy Acquisition Corporation, a special purpose acquisition company (SPAC). The SPAC structure enables a reverse merger, which involves a public shell company merging with a successful private company. The private company becomes the publicly traded entity and escapes a lengthy IPO process. For a more detailed overview of SPACs, check out our report on EVBox and TPGY — another EV/SPAC transaction.

ChargePoint’s IPO helped the company raise $480 million in net proceeds, which brought its cash balance to $650 million — more cash than the company had spent in its 13-year history at the time, according to CEO Pasquale Romano.

The Narrative

Based on a 2020 investment presentation, ChargePoint anticipates revenue to increase at a 60% compound annual growth rate between 2021 and 2026 — which would equate to almost $2.1 billion of revenue at the tail-end of that forecast.

Again, that’s from a bullish investor presentation prepared by the company. It’s effectively a marketing asset. While no one can predict the future, realistically, the company’s annual revenue growth over the next five years will not average out to 60%. That said, it’s still a high-growth industry with massive upside. There’s a clear prioritization of EVs among governments, car manufacturers, and consumers. The shift is in process.

Honda expects to exclusively offer electric vehicles by 2040.

Ford said 100% of its passenger vehicles will be all-electric in Europe by 2030.

Volkswagen expects 70% of its European sales to be EVs by 2030.

The list keeps going — here’s a comprehensive overview of car manufacturers’ EV production plans over the next 20 years.

Although it’s a burgeoning industry, ChargePoint benefits from being an early-mover. They already have an extensive network of charging stations, which provide recurring revenue in the form of subscriptions. Plus, they’re flushed with capital to continue scaling operations.

Much like Coinbase grows with the adoption of cryptocurrency, ChargePoint grows with the expansion of the EV industry. Except, in this case, without the same regulatory hurdles or extreme volatility; governments want more environmentally sustainable EV stations.

That includes the Biden administration, which is actively trying to pass an infrastructure bill. As it stands, the bill would use $174 billion to promote EVs — and roughly 10% of that amount would be used to fund the installment of 500,000 chargers across the country. However, recent talks crumbled as both parties couldn’t agree on a topline dollar figure for the bill — President Biden wants at least $1 trillion for the bill, while Republicans are pushing for a much lower amount.

ChargePoint has a much steeper climb ahead of it in Europe. During the company’s Q4 earnings call, management mentioned that ChargePoint’s market share in Europe was “in the low- to mid-single digits.” However, they believe the market is fragmented, and they think they can take advantage of that.

The Competitors

The EV infrastructure space contains a lot of emerging growth companies, many of which also elected to go public via the SPAC route. As a result, public information is limited across the board. Even though CHPT is now a publicly traded company, there still isn’t much official information to parse through. Beyond Blink Charging, ChargePoint’s primary competitors are still private.

We did not include Tesla (TSLA) below, but it’s also an infrastructure competitor — albeit at a much smaller scale. As of 6/10, Tesla had 2,778 worldwide SuperCharger stations (Tesla’s equivalent of DC fast charging), including 1,066 in the U.S.; Tesla also has 4,500+ Destination Charging sites (Level 2 stations) in urban areas and rural locations across North America.

Note that data is as of 6/10.

*We’ve listed the names of the private EV infrastructure companies rather than the SPACs attempting to merge with them. Volume and market capitalization data are based on the listed SPAC tickers.

Until EVBox, Volta, and EVgo become public companies, investors won’t have much information. We’ve listed the revenues included within each company’s investor presentation for 2020. Otherwise, the biggest takeaway is ChargePoint’s revenue, which absolutely dwarfs these other companies.

The High-Level Finances

Note that all dollar amounts are illustrated in thousands.

Revenue

Despite pandemic challenges, revenue increased year-over-year in FY21 thanks to a 40% increase in subscription revenue, which offset a 9% decline in network charging systems revenue and a 4% decline in Other revenue (see “The Business” for revenue line item descriptions).

ChargePoint’s business lines contributed the following percentages to billings: commercial at 70%, fleet at 11%, residential at 14%, and other at 5%. For the year, North America represented 93% of revenue, while Europe represented the remaining 7%.

Growth in network charging systems revenue (up 36%) and subscription revenue (up 20%) drove the 24% year-over-year increase in 1Q22.

Gross Profit

Although we usually provide EBITDA, this metric doesn’t provide much value since ChargePoint is an emerging growth company. (For the record, like net income, EBITDA is extremely negative.) Gross profit at least gives us an idea of how much money ChargePoint’s products/services generate relative to the cost to produce/provide them. Growing subscription revenue, which is a high-margin service, has bolstered the company’s gross profit.

Net Income

As a growth-oriented company, ChargePoint spends a lot of money, which leads to massive losses. The main expense contributors are R&D ($75 million in FY21) and the company’s marketing efforts ($53 million in FY21). Ultimately, these operating expenses are anticipated to drive revenue growth and (hopefully) profitability, but only time will tell.

Also, a $73.1 million fair value change of a warrant liability — a non-cash expense — amplified the loss.

The Primary Strengths

Market potential. The EV market has a lot of potential. It doesn’t take much thought to wrap your head around it: there’s a growing push to adopt EV vehicles and infrastructure. People want it. Governments want it. Automakers are trying to get ahead of it. In our opinion, it’s not a matter of if but when. According to BloombergNEF, EVs are projected to account for roughly 10% of new vehicles sold in 2025 and 29% in 2030 in the U.S. and Europe. That’s compared to 2.6% in 2019.

Market positioning. ChargePoint is an early mover in the EV infrastructure space, particularly in North America where they outpace their competitors by a sizable margin. Further, the company’s vertically integrated portfolio of products and services targets a wide array of customers, including corporations, municipalities, fleets, and consumers. It’s still early, but the company is well-positioned.

Recurring revenue model. ChargePoint’s sales of charging stations drive the majority of revenue; however, its subscription services are embedded within its hardware, providing financial sustainability through recurring revenue. Also, the company doesn’t monetize energy, so its revenue is not directly susceptible to fluctuating costs.

Capital. ChargePoint has plenty of capital to execute its growth strategy. The company netted $480 million from its IPO; as of 4/30, it had $609.8 million of cash on hand versus zero debt. ChargePoint repaid its outstanding loans in 1Q22, so its balance sheet is very healthy — even from a broader obligation standpoint, as the company had $22.9 million of operating lease liabilities (a small sum compared to its cash balance).

The Primary Risks

Market dependence. It’s not up for debate; ChargePoint’s growth potential is heavily dependent on the adoption of EVs — particularly in North America and Europe. Plus, the EV industry is constantly evolving — there are a lot of factors that could adversely impact ChargePoint’s plans, such as regulatory changes (e.g. rebates or tax credits), downward pricing pressures due to additional market entrants, and the introduction of more innovative EV technology by competitors.

Rapidly innovating technology. Speaking of technology, ChargePoint invests a ton of money in the research and development of new products and innovative services. The company’s R&D expenses were $75.0 million, $69.5 million, $50.5 million, and $42.7 million during FY21, FY20, FY19, and FY18, respectively. That’s only their R&D expenses. Delays, missteps, or blatant misses could cost the company a fortune — and market share/positioning.

Competition. Although ChargePoint appears to have an early mover advantage in North America, the EV industry is still rapidly expanding. The consolidation of other major players would challenge the company’s current domestic advantage and potentially limit the company’s growth abroad. On top of that, much larger companies that have vested interests in EVs like Ford, GM, Tesla, Shell, or Exxon could increase their involvement in the infrastructure space.

The Street’s Opinion

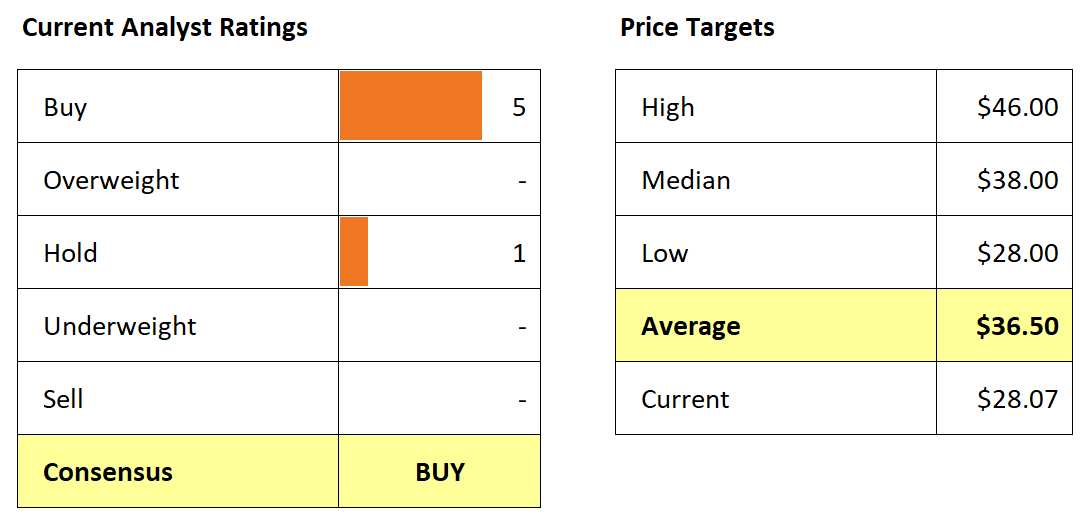

ChargePoint may not be a young company, but it operates in an early stage industry. On top of that, it only recently became a public company, so there isn’t a ton of accessible financial information.

In short, Wall Street doesn’t have a ton of coverage of CHPT — but five out of six analysts have indicated that they like the company with five “Buy” ratings and one “Hold” rating.

Further, the average price target ($36.50) is well above the stock’s current price of $28.07 — although the lowest price target is similar.

Recent News

ChargePoint Appoints Technology and Revenue Leader Susan Heystee to Board of Directors

ChargePoint Continues to Enhance the EV Driver Experience with Android Auto Integration

ChargePoint and Polestar Team Up to Transform the Future of Vehicle Ownership

ChargePoint’s Earnings Show Some SPACs Are Just Fine (Barron’s)

Will ChargePoint shock the market?

The future is bright for the EV infrastructure industry. Considering ChargePoint currently maintains the largest network of charging stations in North America, ChargePoint’s future is bright too.

But, if you didn’t notice, look back at the dates we’ve thrown out there.

2025.

2030.

2040.

We may be in the 2020s (still feels weird to acknowledge), but there’s a lot of road between here and 2040. Because there’s so much time, investment, and expansion in between now and the widespread adoption of EVs, ChargePoint is a risky short-term play. However, if you’re investing in ChargePoint, you’re eying 2030 and beyond.

While no one can predict the future, there’s too much momentum working in the EV industry’s favor to bet against it. We like ChargePoint as a long-term play.

Keep an eye on (1) the infrastructure bill, which would accelerate the adoption of EVs; (2) ChargePoint’s network growth in North America and Europe; (3) the company’s revenue growth to ensure R&D is paying off; and (4) automakers progress toward 100% EV-model lineups.