Good morning investors!

“Cutting the cord” is just as relevant of a phrase now as it was 15 years ago. Since 2013, the total number of traditional pay TV households has shrunk by about 26 million.

While many have shunned live TV altogether, a lot of viewers pivoted to more cost-efficient alternatives with fewer channels.

Like fuboTV.

If this is your first time with us, feel free to subscribe here. If you enjoy today’s newsletter, please hit the heart button at the end of the report.

Now, without further ado...

The Business

Founded in 2015, fuboTV is a live television streaming platform that primarily caters to sports fans — although it also offers news and entertainment channels.

The television distribution industry has a litany of overlapping and confusing labels for its various TV providers, including MVPD, vMVPD, OTT, and CTV. Here’s a quick synopsis:

MVPD stands for multichannel video programming distributor. These are traditional TV providers that rely on satellite and cable to deliver programming. Think Comcast, DirecTV, and DISH.

vMVPD stands for virtual multichannel video programming distributor (what a horrible acronym). The key difference between MVPD and vMPVD is how the content is delivered — vMPVDs deliver content via the internet. fuboTV is av vMPVD, as is YouTube TV and Hulu TV. While these providers don’t offer nearly as many channels as traditional MVPDs, they’re usually much cheaper as a result. vMVPDs ballooned in popularity as consumers wanted more cost-efficient alternatives to their traditional cable packages. Hence the phrase “cutting the cord.”

OTT stands for over-the-top television (another confusing acronym). This simply means content that’s delivered via existing internet services, such as fuboTV. If you already pay for internet, you can access OTT content. As you can piece together, there’s overlap between vMVPD and OTT.

CTV stands for connected television. This is a subcategory of OTT — it refers to consuming content through TVs that are connected to the internet. Think of smart TVs and attachable streaming devices (Fire Sticks, Rokus, Apple TV).

Why do these terms matter? Simply defining them gives you a pretty good indication of where the industry has been trending and why. People want television — that hasn’t changed. How they consume it has changed. The typical consumer is more likely to have a Fire Stick or a smart TV than a satellite dish.

fuboTV’s goal is to be at the forefront of that change in their particular niche — it’s positioned as a more affordable alternative to traditional cable and satellite TV packages for sports content.

fuboTV merger

In April 2020, fuboTV merged with Facebank Group; upon completion of the business combination, Facebank Group changed its name to fuboTV Inc., which eventually went public on the NYSE in October 2020. Facebank’s history is a little complex due to acquisitions and subsequent name changes, but here’s a good summary. This isn’t totally relevant to evaluating fuboTV as an investment, but it sheds light on how FUBO came to be a public company with international aspirations.

fuboTV offerings

FUBO offers multiple TV packages with varying levels of content access across sports, entertainment, and news; prices range from $64.99 per month to $79.99 (or $32.99 for Spanish channels). The company also upsells “attachments” like feature upgrades (e.g. Unlimited Screens) and premium add-ons (e.g. Starz, Showtime, Epix).

Most of fuboTV’s content is only available in the U.S. and related territories — there’s also some availability in Canada and Spain.

fuboTV customers

fuboTV’s primary customers and revenue-generators are subscribers. According to the company’s latest earnings call, fuboTV’s subscriber base skews male and the average subscribe is 42 years old with an annual income of $85,000.

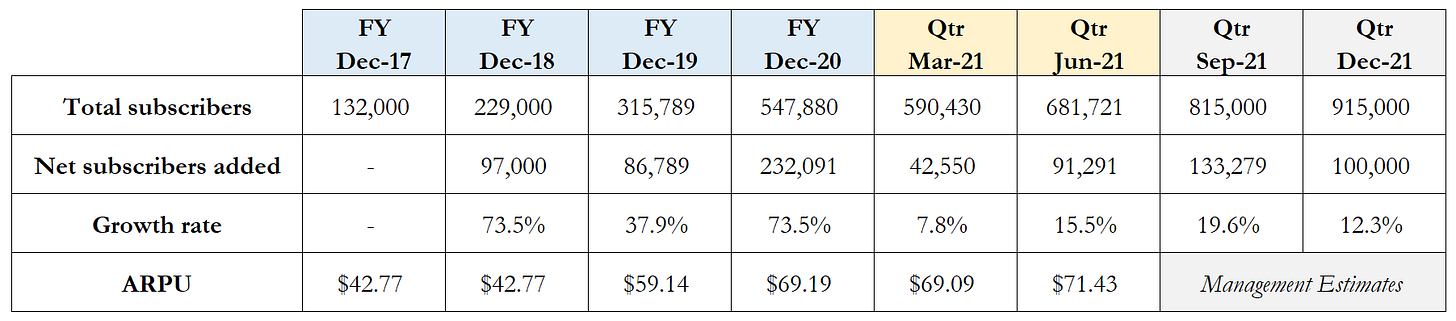

From December 2017 to June 2021, fuboTV increased its subscriber base from 132,000 to 681,721; it also steadily increased its monthly average revenue per user from $42.77 to $71.43 during the same time span. And that growth doesn’t appear to be slowing down, as management estimates between 910,000 and 920,000 subscribers by the end of 2021.

The Narrative

fuboTV’s first year as a public company has been active. Here are three big storylines to follow:

Can fuboTV tap deeper into other sports markets?

Cord-cutting benefits fuboTV in more ways than one

Sports betting is on the rise. Is fuboTV ahead of the curve?

Can fuboTV tap into other sports markets?

Much of fuboTV’s subscriber growth can be attributed to soccer fans. For instance, during the second quarter, fuboTV provided the exclusive streams of the South American Qatar World Cup qualifying matches (CONMEBOL). Unsurprisingly, this exclusivity helped drive net subscriber additions of 91,291. The company’s subscriber base could see a similar boost next year during the World Cup.

Soccer is arguably the world’s most popular sport, but that’s not the case in the U.S. While soccer is growing in popularity, it typically ranks as the fourth or fifth most popular sport. That’s significant because most of fuboTV’s content is only available in the U.S. and related territories — so there’s a smaller market to gain subscribers from.

The third quarter marks the beginning of the NFL’s season, which fuboTV subscribers can stream. It’ll be worth monitoring whether new subscriptions taper off relative to last quarter or continue trending upward.

Cord-cutting benefits fuboTV in more ways than one

fuboTV’s total addressable market increases as more people realize they don’t want to pay for thousands of channels and “cut the cord.” The benefits of this trend are two-fold. For starters, as a cable TV replacement service, fuboTV could gain more paying subscribers. Second, fuboTV also benefits from the broader consumer switch to OTT platforms in the form of additional advertising revenue. Ad money flows to where the consumers are.

Here’s fuboTV’s advertising revenue growth since the beginning of 2020.

Sports betting is on the rise. Is fuboTV ahead of the curve?

During its exclusive stream of CONMEBOL matches earlier this summer, fuboTV launched new product features to a select cohort of users — FanView and free-to-play predictive gaming. FanView enabled users to view scores and stats in real time on the FUBO app, while predictive gaming involved predicting certain aspects of soccer matches for a chance to win cash prizes. According to management, FanView improved engagement by 25% to 37%, depending on the content. The underlying goal was to test these features and gather data on usability ahead of fuboTV’s launch of Fubo Sportsbook.

In February 2021, fuboTV acquired Vigtory, a sports betting and interactive gaming company. Since the acquisition, fuboTV has announced plans to rollout Fubo Sportsbook, a “frictionless betting experience” for fuboTV’s customers.

The rollout will be gradual, as fuboTV has market access agreements in only four states thus far (Pennsylvania, Indiana, New Jersey, Iowa). However, on the latest earnings call, CEO David Gandler expressed the company’s goal to increase market access to 50% of fuboTV’s total subscriber base by the end of 2023:

We are looking to develop a business unit that’s going to deliver 50% gross margins. Our goal in terms of market access is to be able to provide access to our subscriber base by the end of 2023 of up to 50% of our total sub-base. So you can imagine at 915,000, which is our guidance for the end of this year, that becomes a pretty sizable cohort.

The move is well-timed, as sports betting has surged in the U.S. ever since the Supreme Court repealed the Professional and Amateur Sports Protection Act of 1992 in May 2018.

Stock Overview

No matter how you spin it, FUBO is expensive by conventional valuation standards. But, then again, these are rarely relevant or appropriate for growth companies since value is attributed to what could be rather than what is.

Note: P/S essentially calculates the amount investors are willing to pay for $1 of a company’s sales. This is a common valuation metric for unprofitable companies to compare to peers and broader industry and index benchmarks.

Note: P/B compares a company’s market value to its book value — the net assets of a company (i.e. if a company liquidated its assets and paid off all of its debt, the remainder would be book value).

The Finances

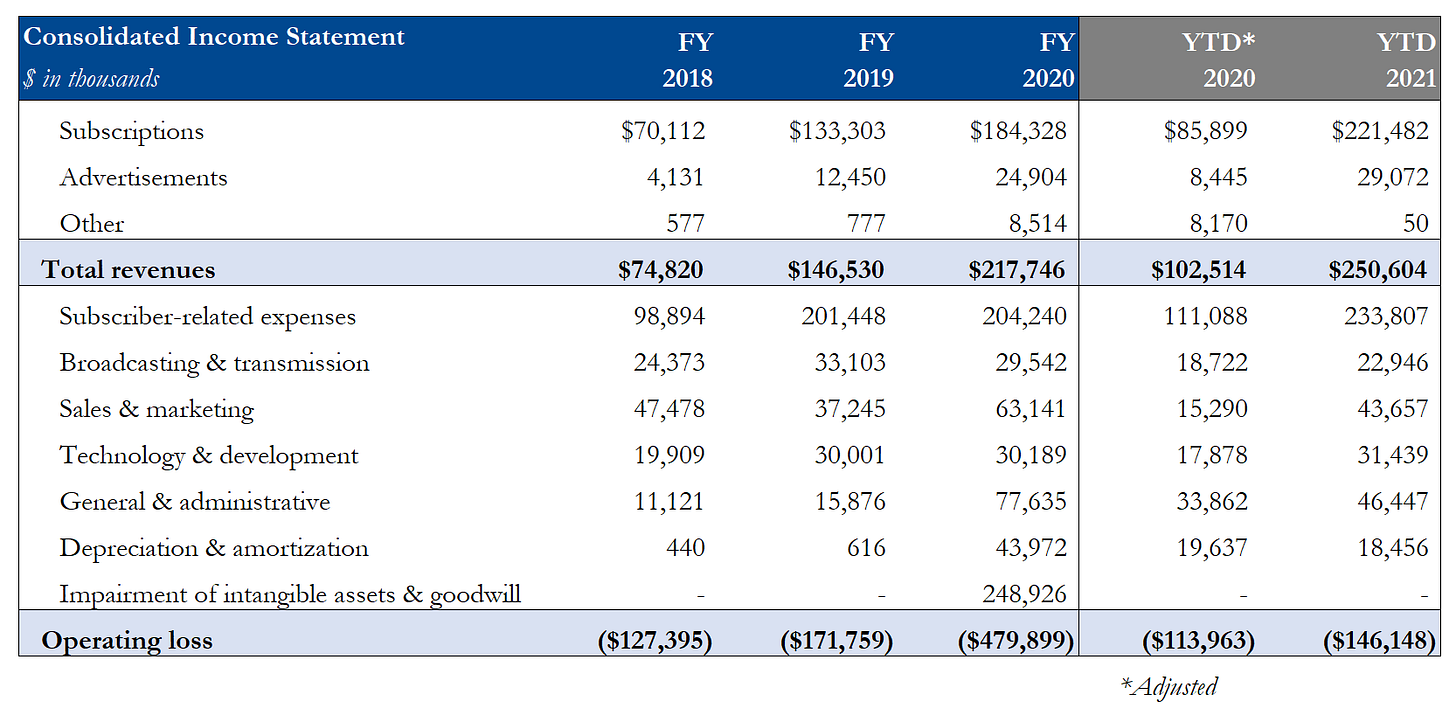

The merger-via-acquisition between fuboTV and Facebank made for some complex financials in 2020 — primarily due to John Textor’s (the former CEO of Facebank) transition out of the company.

On July 31, 2020, John Textor stepped down from the company’s board and took over as Head of Studio for Facebank’s legacy business (human animation and digital likeness). Shortly after, he resigned (amicably); as a result, fuboTV had to recognize an impairment of the Facebank reporting unit. These assets aren’t integral to fuboTV’s operation, nor do they generate revenue, but they’re still involved within the entity’s consolidated finances.

Long story short, the impairment wasn’t significant to fuboTV’s operations, but it made FY20 look horrible.

Additionally, since the “new” fuboTV Inc. (that is, the post-merger entity) commenced operations in April 2020, the company’s latest public filings don’t include the operating results from January 2020 through March 2020. So, I pulled first quarter fuboTV results (the pre-merger entity) from FUBO’s 2020 prospectus and combined the two to estimate “YTD 2020” in the below table. Otherwise, we’d be comparing six months of 2021 operations to three months of 2020 operations.

Lastly, the merger and subsequent IPO triggered several fair value adjustments within fuboTV’s non-operating results. We’re going to focus on fuboTV’s operating results (losses) instead:

Revenue Highlights:

fuboTV’s burgeoning subscriber base spurred significant sales growth over the last few years. fuboTV has already surpassed FY21 revenue in the first six months of 2021.

That growth is also driven by increasing advertising revenue, which has also surpassed FY20 totals.

Management increased its revenue guidance to a range of $560-570 million for FY21, up from $520-530 million.

Note that “other” revenue represents software licensing sales from Facebank operations, which are irrelevant to fuboTV’s operations.

Profit Highlights:

Subscriber-related expenses primarily refer to the distribution rights fees the company must pay to be able to air its content offerings — for instance, fuboTV does not own ABC or its intellectual property, the company must pay for the right to air related channels/content.

Advertising expenses were $48.2 million in FY20. Sales and marketing expenses have increased over the last two years as the company expands its subscriber base.

Prioritizing growth initiatives and marketing campaigns is normal, but the implied cost to acquire net new subscribers is something to keep an eye on. Over the last three quarters (4Q20, 1Q21, 2Q22), we can roughly estimate fuboTV’s individual subscriber acquisition cost to be $319, $520, and $236 by dividing its sales and marketing spend by net new subscribers. fuboTV’s sales department’s marketing efficiency will play a role in whether the company can eventually turn a profit.

This underlines the significance of FUBO driving additional revenue per subscriber as well as expanding its other revenue streams — advertising and sports betting.

Balance Sheet & Cash Flow Highlights:

fuboTV operations burned through $149 million of cash flow in FY20 and $87.4 million in the first half of FY21. While that’s not surprising for a growth-oriented company that’s investing in marketing campaigns and product features, it’s something to monitor.

The company Issued $402.5 million of convertible notes in February 2021; this will help fund the company’s ongoing cash burn. As of June 30, fuboTV had $406.7 million of cash on hand.

Earnings Trends

Since FUBO is in growth mode, EPS results are exceedingly negative. It still remains to be seen whether FUBO can generate any profits, let alone sustainable profits.

The Primary Strengths

Growth trends. If the company hits its targets for FY21, paid subscribers will have grown by 593% since 2017 and total revenue will have more than doubled relative to FY20.

Positioning with sports betting. In May 2018, the Supreme Court axed the Professional and Amateur Sports Protection Act of 1992, which opened the door for sports betting to expand to other states beyond Nevada. From May 2018 to May 2020, more than $20 billion flowed through U.S. sportsbooks. With its new sports betting feature, fuboTV will be uniquely positioned to take advantage of this industry trend.

Untapped international markets. This is less of a strength and more of an opportunity. To date, fuboTV’s growth has been predominantly spurred by soccer enthusiasts thanks to content like the CONMEBOL qualifiers. While soccer is growing in the U.S., it’s the fourth or fifth most popular sport behind the big three of football, baseball, and basketball. If fuboTV can expand internationally and tap into markets in which soccer is the premier sport, their subscriber growth could experience exponential growth.

The Primary Risks

Growth concerns. There’s no doubt that fuboTV’s in growth mode — but there are still concerns about its ability to generate sustainable and profitable growth. fuboTV spends a lot of money to acquire new customers and retain them with enticing, relevant content.

Liability potential. Entering the betting sphere could be lucrative but also opens the doors to litigation, pricing and trading risks, liability management, etc. There’s overlap between live sports broadcasting and sports betting, but there are also unique risks.

Competition. fuboTV competes across multiple phases, including for customer eyes, distribution rights, and advertisers. Although fuboTV is oriented to sports fans, it’s not the only platform that offers live sports. For instance, if you’ve ever seen a Hulu TV commercial, you know that Hulu also has live sports.

Material weaknesses in internal controls. In 2020, the company identified material weaknesses in its internal controls environment, specifically related to non-routine transactions (such as mergers and acquisitions). Here’s the statement from the company’s 10-K:

We did not have appropriately designed internal controls in place at the time the Merger was consummated on April 1, 2020 with respect to the accounting for the business combination and the allocation of consideration to the acquired assets and assumed liabilities, including deferred income taxes; and

Our internal controls over the review of accounting considerations for non-routine transactions and events were not appropriately designed with respect to the timing and consistency of performance.

What does this really mean?

The company didn’t have proper reviews and appropriately documented approvals in place to ensure accurate reporting and asset valuation. fuboTV’s remediation plan included a lengthy list of corrective actions, such as hiring an experienced tax specialist, hiring a valuation specialist, implementing additional supervision and review activities, and hiring a third-party to function as the company’s internal auditor.

According to a CPA I spoke with, who works in audit, material weaknesses in internal controls are more common for newly public companies; however, the primary concern going forward is the company’s ability to “not lose their shirt” when evaluating non-routine transactions like acquisitions. That said, KPMG tested the financial statements and found that they were fairly presented in all material respects.

In other words, the material weakness didn’t impact its bottom line or cash flows.

The Street’s Opinion

FUBO registers a “Buy” consensus rating thanks to six buys and one hold. The stock’s average price target of $43.86 implies an upside of 59.2%, while the lowest price target implies an 8.9% upside.

Bullish or Bearish?

FUBO has several industry trends working in its favor:

Cord-cutting

Ad dollars flowing into streaming

Ballooning demand for sports betting

But I think there’s a simpler way to evaluate the company.

Do you pay for fubo? Do you know anyone that does?

One advantage of evaluating a B2C company is access and perspective — we can look at the company from their customers’ perspective because, well, we could be their customers.

What’s stopping you from subscribing? If you do, what’s keeping you attached to the platform?

I actually subscribed to a free trial of fuboTV a few years ago. I don’t remember exactly why, but I think it was to watch something I couldn’t access otherwise. Then I canceled my subscription.

As a paid TV provider, churn will remain an obstacle (the rate at which people unsubscribe), especially since sports are seasonal. Price-conscious consumers will question the need to pay for a subscription if they’re only using it three to six months out of the year. However, the entertainment, news, and premium channel add-ons help insulate the company from this. More importantly, the sports betting aspect could drive revenue and add some stickiness to the platform — I estimate that people will feel less inclined to stop their subscriptions if they’re routinely using this feature.

An investment in FUBO is an investment in the long-term future of its platform. Because, today, the company burns through money. The long-term potential is appealing though. For now, I’m interested to see how the company performs in Q3, particularly the impact of NFL content on subscriber growth. If more (American) football fans flock to the platform, that could bode well, especially once the company’s sports betting functionality launches.

While it’s impossible to predict the stock’s short-term volatility, I still think there could still be a good price-point entry after we get more insight into this quarter’s results.

For that reason, we’re bullish from a long-term potential — but holding off until we see more.

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.