Good morning, investors! As you’ll soon see, today’s report is an experiment with new formatting and substance. We’re still testing various ways to provide concise due diligence — your time is valuable, and we know reading through 3,000 words of stock analysis isn’t exactly a light read.

If you enjoy this new “mini” report structure, let us know by liking the newsletter at the bottom of the page. (If you really like it, why not share it with another investor?)

Now, without further ado...

The Business

Jabil (JBL) is a turnkey electronics manufacturer with an expansive presence across the globe. Headquartered in St. Petersburg, FL, Jabil employs over 260,000 employees across 30 countries.

Jabil designs, tests, and produces electronic devices across a lengthy list of industries. Jabil’s services help its customers reduce manufacturing costs, improve supply chain management, reduce inventory obsolescence, lower transportation costs, and reduce product fulfillment time.

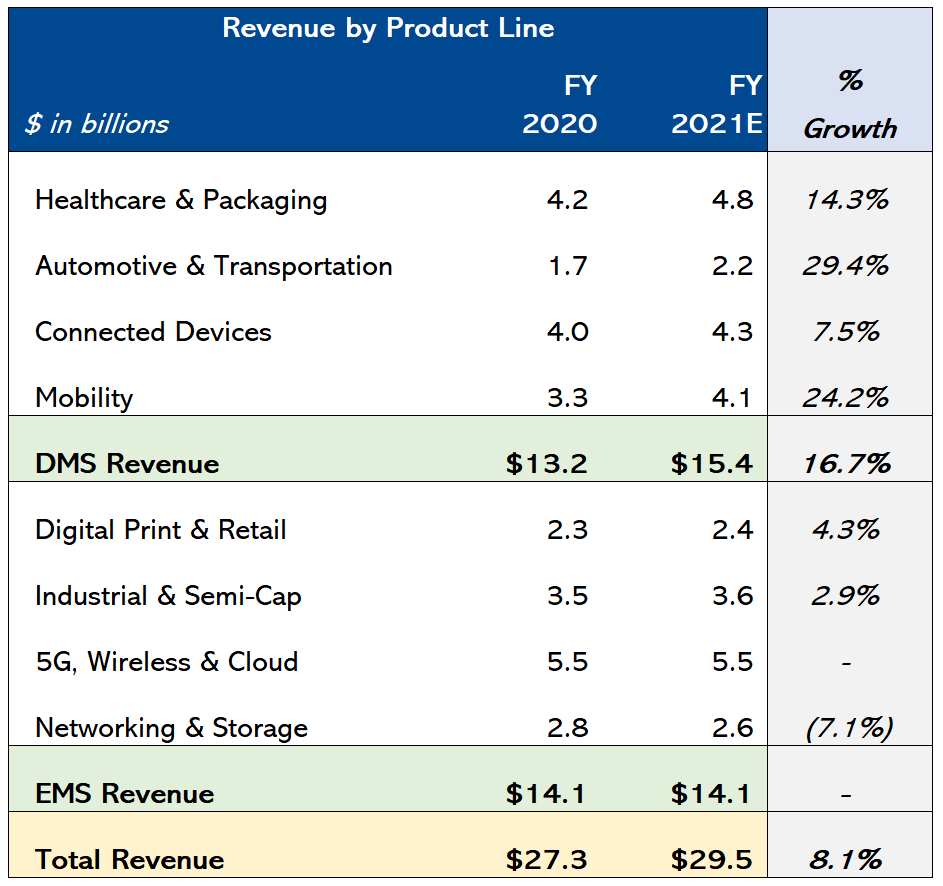

Jabil’s business is divided into two reporting segments: Electronics Manufacturing Services (EMS) and Diversified Manufacturing Services (DMS). EMS includes customers in the following industries: automotive and transportation, capital equipment, cloud, networking and storage, defense and aerospace, industrial and energy, print and retail, and smart home and appliances. DMS provides engineering solutions to customers primarily in the connected devices, healthcare, mobility, and packaging industries.

Jabil serves some of the largest companies in the world, including Apple, Amazon, Cisco, Hewlett-Packard, Johnson & Johnson, and Tesla.

Stock Overview

Jabil’s market cap is $8.1 billion. Here’s how its peers stack up: Flex is a close second at $8.0 billion, while Sanmina ($2.4 billion), and Celestica ($943 million) are a fraction of Jabil’s size.

Jabil’s 50-day moving average exceeds its 200-day moving average, which is a positive signal. Note: many investors use the relationship between these averages as a technical indicator to gauge price trends.

Jabil has an attractive price-to-earnings ratio (P/E) relative to its industry (30.1) and is roughly consistent with its peers (Flex: 9.9; Sanmina: 9.5; Celestica: 12.8). Note: P/E essentially calculates the amount investors are willing to pay for $1 of a company’s earnings. This is a common valuation metric to compare to peers and broader industry and index benchmarks.

Jabil’s price/earnings-to-growth ratio (PEG) for the next five years is also favorable at 0.78. Note: PEG also factors in the company’s expected earnings growth over a certain time period. Anything above one is considered to be overvalued and anything below one is considered to be undervalued.

Jabil’s consensus price target relative to its last close implies a 17.2% increase.

The High-Level Finances

Income Highlights:

Over the last three years, Jabil has averaged annual revenue growth of 13%; gross profit has grown an average of 8% per year in the same timeframe.

In FY20, Jabil restructured its business and reduced its worldwide workforce, incurring $156.6 million of restructuring costs (including severance and benefit costs) — which inflated its Operating Expenses. Going forward, Jabil expects annual savings of $40-50 million per year.

Through three quarters of 2021 (its fiscal year ends in August), Jabil is well-positioned to deliver strong annual results. Per Jabil’s last earnings release, the company expects 4Q revenue to be between $7.3 billion to $7.9 billion; operating income is expected to be between $242 million to $302 million. From the sound of it, Jabil’s earnings should greatly surpass prior years.

Balance Sheet & Cash Flow Highlights:

As of May, Jabil had $1.2 billion of cash on hand relative to $2.9 billion of total debt. While that’s not an ideal ratio, the company generates plenty of cash flow to cover debt payments.

In April 2021, Jabil issued $500 million of senior notes with an attractive interest rate of 1.7%, paying off a more expensive term loan. This will help reduce interest expenses going forward.

In FY20, Jabil generated $1.3 billion of operating cash flow, much of which was used for maintenance capital expenditures ($921 million in FY20). Historically, Jabil generates significant free cash flow — $460.9 million, $503.1 million, and $247.5 million in FY20, FY19, and FY18, respectively.

Earnings Trends

Jabil’s EPS results have continually grown over the last year. Over the last 21 quarters, Jabil has exceeded earnings estimates 20 times (2Q of last year was the lone miss).

The Primary Strengths

Portfolio diversification. Jabil has a diverse portfolio of products across multiple product lines. This diversification bodes well for the company’s growth potential — especially in budding industries like 5G, and cloud computing. Likewise, Jabil as a whole should remain resilient to any individual market headwinds.

Healthcare growth. In 2018, Jabil and Johnson & Johnson agreed to a strategic partnership; Jabil acquired select J&J facilities, implanting itself in the medical devices space. On the company’s Q3 earnings call, management expressed that Healthcare is performing above plan. Here’s a good analysis of the transaction.

Liquidity. Jabil has ample liquidity — $1.2 billion of cash and cash equivalents as well as $3.2 billion of unused capacity under its revolving credit loans (which are like massive credit cards for businesses). Also, the company generates strong levels of free cash flow ($460.9 million in FY20), which indicates that its operations are healthy and it has plenty of capital to fund additional projects, acquisitions, etc.

The Primary Risks

COVID-19 fallout & supply chain susceptibility. As a worldwide manufacturer, Jabil’s financial success is directly tied to its supply chain efficiency. Any disruptions have an adverse domino effect all the way to the company’s bottom line. Since Jabil has tight profit margins, any major disruption would significantly impact the company’s earnings. During the COVID-19 pandemic, the company has faced headwinds in this regard, including difficulty sourcing materials to fulfill production and difficulties transporting completed products to end customers. Reduced factory utilization and slowed inventory turnover also led to increased costs.

Customer concentration. In FY20, two of Jabil’s customers accounted for 31% of the company’s net revenue: Apple (20%) and Amazon (11%). Those figures are quite staggering when you consider we’re talking about multiple billions of dollars (Apple: $5.9 billion; Amazon: $3.25 billion). However, the company has made marked improvements in this area, as Apple by itself represented 28% of total net revenue in FY18.

Tight margins. Jabil’s operating margin over the last four fiscal years has been 2.3% on average. That’s before taxes and interest. Since Jabil is a turnkey manufacturer with an expansive supply chain, tight margins aren’t a surprise. However, under the theme of needing supply chain resilience, the company’s profitability will be hampered by any business disruptions.

The Street’s Opinion

JBL registers an “Overweight” consensus rating thanks to seven “Buys” and three “Holds.” JBL’s average price target implies a 17.2% upside, while the lowest price target suggests that JBL has peaked for the time being.

Bullish or Bearish?

We’re bullish on Jabil for the following reasons:

Jabil operates in a variety of sustainable spaces with recurring growth potential (e.g. 5G, healthcare tech, cloud, etc.). The need for electronic devices isn’t going to disappear any time soon.

Despite facing arguably one of the biggest supply chain hurdles possible (the pandemic), the company still increased revenue and generated a profit.

Although its customer concentration is high, its main two customers are two of the world’s largest companies (Amazon and Apple).

Valuation metrics indicate it’s still undervalued, despite its 52-week performance.

These reports are free.

You know what else is free?

Subscribing to this newsletter.