The Big Picture

For most consumer-dependent industries, 2020 was supposed to be a bad year. That wasn’t the case for the home improvement market. I guess that’s what happens when you’re forced to stay at home all year — you come up with DIY projects.

According to a Black & Decker survey, 78% of Americans honed their home improvement skills in 2020. While homeowners enhanced their kitchen fixtures and backyards, Lowe’s bolstered its profits.

Lowe’s concluded 2020 with $5.8 billion of net income. Considering Lowe’s 60-year streak of dividend payouts, shareholders have profited quite nicely too; the company’s next dividend payout will be $0.80 per share — a 33% increase quarter-over-quarter.

To date, shares of LOW are anything but low — reaching a high of $215.22 in May.

Will Lowe’s stock keep improving?

The Business

Lowe’s Companies, Inc. (LOW) has come a long way since it was originally founded. In 1921, it was a small-town hardware store in North Wilkinson, North Carolina. Today, it’s a Fortune 50 company and the second largest home improvement retailer in the world with 1,972 stores — behind its primary competitor, The Home Depot (2,296 stores as of January).

Lowe’s also operates additional stores in Canada under various brand names, which the company acquired via its acquisition of RONA inc. in 2016. The average Lowe’s-branded home improvement store stocks approximately 40,000 items, while Lowe’s online selling channels enable customers to access an additional two million items.

Lowe’s divides its customer base into three segments: homeowners, renters, and professional customers (“Pro customers”). The former two customer types complete a wide array of DIY projects, while Pro customers comprise two broad categories: (1) construction trades and maintenance and (2) repair and operations.

To meet these customers’ needs, Lowe’s offers brand-name merchandise and Lowe’s-owned private brands (e.g. Kobalt tools) across 15 home improvement product categories. We’ve outlined net sales by product category in FY20 below:

Selling Channels

Lowe’s has invested in delivering an omnichannel experience, enabling customers to move seamlessly between digital and physical channels. For example, Lowe’s customers tend to conduct research online before making an in-store purchase. For purchases made on the company’s website, customers can pick up their items in-store at either the customer service desk, curbside pick-up, or touchless lockers. The commitment to seamless transitions between channels has improved the company’s ability to meet demand.

In addition, Lowe’s has employed a similar approach with its supply chain. For instance, the company has an improved freight flow app that helps associates prioritize incoming merchandise and position high-demand products on sales floors.

COVID-related support

Although Lowe’s, as a company, powered through the pandemic, that doesn’t mean individual employees were as impervious to the economic fallout. To support its front-line hourly associates, Lowe’s launched a “Winning Together” profit-sharing initiative in FY20, which included seven discretionary payments of $300 for full-time hourly associates and $150 for part-timers, as well as a $2 per hour wage increase in April 2020.

Lowe’s COVID-related support topped $1.3 billion last year. The giving continued in 1Q21, as Lowe’s distributed another $152 million payout to frontline associates.

The Narrative

From a shareholder’s perspective, Lowe’s narrative has two key storylines:

The housing market is booming, again.

Lowe’s likes to share the wealth.

The housing market is booming again

Sales of existing homes rose to 6.48 million last year — a 5.6% year-over-year increase relative to 2019 and the highest level since 2006...at the height of the housing boom. However, experts believe this housing market is different from the tenuous one that preceded the Great Recession. For starters, millennials have finally started to dip their toes into home ownership. On top of that, while it’s harder to buy a house at the moment, there are more stringent lending standards that provide vital stability this time around.

That’s good news for Lowe’s and the rest of its competitors — more homes lead to more home remodeling activity, maintenance needs, and general DIY projects.

Lowe’s was ready to take advantage.

In December, the company held an investor update presentation, sharing its strategy to capture additional market share and maximize margins. The four catalysts are (1) expanding its supply chain network, (2) increasing store labor productivity and engagement, (3) improving its Canada store network’s operations, and (4) enhancing omnichannel capabilities.

Within the presentation, management also forewarned that it expected the home improvement market to pull back in 2021; even in a bullish scenario, the company anticipated reduced annual net sales ($86 billion versus $89.6 billion in FY20) — although it did expect an increased operating income margin (12% vs 10.8% in FY20).

In the first quarter of 2021, Lowe’s net sales were $24.4 billion, a 24% increase relative to 1Q20, and its operating income margin was 13.29%. Historically, the company’s best quarter is Q2.

So, yeah, what about that pullback?

On the company’s Q1 earnings call, CFO Dave Denton commented on Lowe’s outperformance, “The underlying drivers of home improvement demand appear to be more resilient and stable than we originally forecasted. Those factors build our confidence in our ability to deliver strong results on top of an exceptional year in 2020, including 12% operating margins and flat gross margin rates for the year.”

The housing market is booming...and so is Lowe’s.

Lowe’s likes to share the wealth

Lowe’s hasn’t missed a cash dividend since it went public in 1961. That’s 60 consecutive years of dividends. Considering its recent success, Lowe’s opted to drastically increase its dividend payout this year. The company announced an upcoming payout of $0.80 per share for Q2, which is a 33% increase relative to Q1 and nearly a 100% increase from just four years ago.

In addition to earmarking 35% of net earnings for dividends, Lowe’s also instituted a share repurchase program in 2018, which it re-upped in 2020 as part of the company’s strategic update. As of April 2021, Lowe’s had approximately $17 billion remaining under its share repurchase authorization.

Combined, Lowe’s returned $3.5 billion to its shareholders through dividends and share repurchases in Q1 alone.

The Competitors

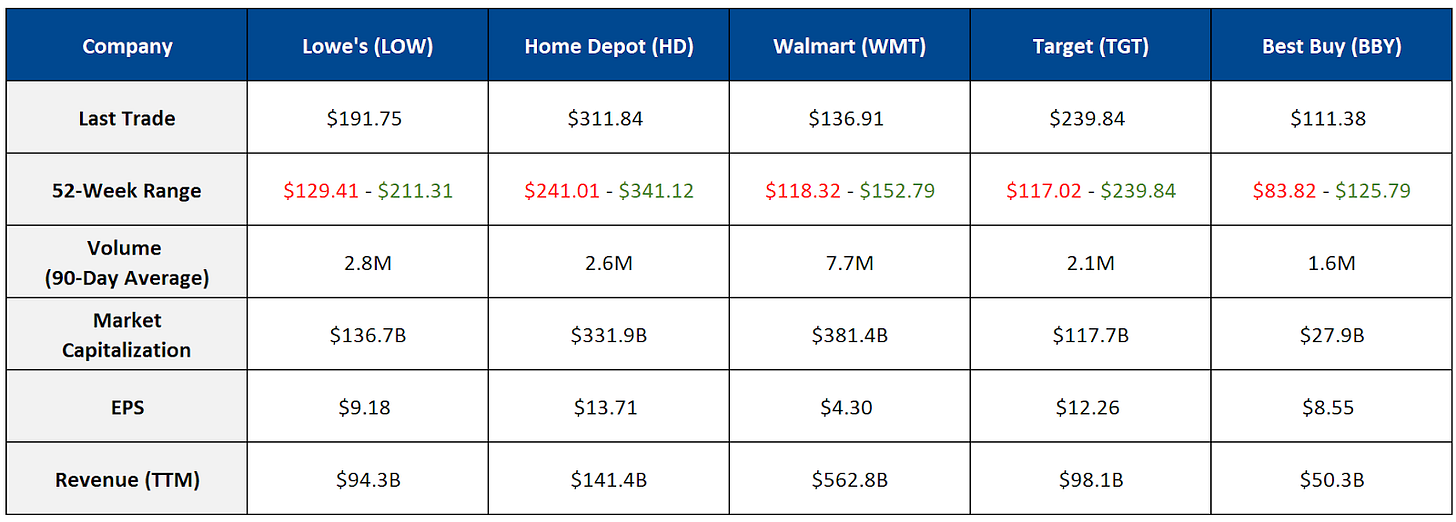

The specialty retail space isn’t exactly going to surprise you — the names are well-known and the companies are quite profitable. Lowe’s primary competitor is Home Depot, which holds the title of largest home improvement store. Walmart and Target also dabble in the home improvement space, but obviously — assuming you’ve been to a Walmart and/or Target in your lifetime — to a lesser extent.

The High-Level Finances

Note that all dollar amounts are illustrated in millions.

Revenue

Lowe’s net sales skyrocketed in FY20. It helps to be in the home improvement business when everyone’s stuck at home. Every product category — that’s 15 categories — experienced increased year-over-year sales. From a geographic standpoint, every U.S. region experienced sales increases of at least 20% relative to FY19; Canada’s increase was 15%.

The story continued during the first quarter of FY21. Lowe’s net sales increased by 24% year-over year, driven by robust demand for the company’s home improvement products.

Adjusted EBITDA

EBITDA (earnings before interest, taxes, depreciation, and amortization) is a metric used to gauge a company’s operating performance. A company’s operations can appear worse due to certain non-cash expenses, such as depreciation and amortization. We’ve illustrated our calculation of Lowe’s Adjusted EBITDA, which also adds back share-based compensation (a non-cash expense).

In addition to the significant revenue lift, Lowe’s leveraged improved store operating efficiencies to decrease its selling, general, and administrative expenses as a percentage of sales. As a result, the company’s Adjusted EBITDA increased 46% year-over-year.

Net Income

For FY20, the company’s net income was $5.8 billion, representing a 36% increase relative to FY19. Had the company not recognized a $1.1 billion loss on extinguishment of debt (a non-cash expense), net earnings would have been even higher.

Lowe’s robust financial performance continued to bolster its bottom line in the first quarter of 2021, as Lowe’s generated more profit in 1Q21 than it did in all of FY18.

The Primary Strengths

Housing market growth. People are buying houses and home improvement projects are on many families’ to-do lists — that’s good news for Lowe’s. During 1Q21, Lowe’s net sales grew nearly 25% year-over-year, and the company hasn’t shown any signs of slowing down.

Online shopping capabilities. Lowe’s has worked on developing an omnichannel customer experience for a while, so it’s well-positioned to take advantage of a shift toward online shopping. It’s already paying off. The company’s online sales increased by 36.5% in 1Q21.

Shareholder-focused initiatives. In line with its share-buyback plan, Lowe’s repurchased $3.1 billion of shares in 1Q21. On top of that, it not only maintained its 60-year run of dividend payouts but also upped dividends to $0.60 per share, equating to $440 million of dividends in Q1. That figure will increase to $0.80 per share in Q2.

The Primary Risks

Macroeconomic susceptibility. Lowe’s not only weathered the pandemic but also thrived. However, as a retailer and B2C company, it’s still susceptible to consumer behavior and spending. Negative macroeconomic events could lead consumers to delay home improvement projects, which would have an adverse impact on Lowe’s bottom line.

Debt levels. Lowe’s total outstanding debt as of April 30 was $23.2 billion. That’s a sizable obligation, especially when compared to its current cash on hand of $6.7 billion. While the company’s operations generate positive cash flow, it’s still worth monitoring Lowe’s debt levels, which become more burdensome during economic downturns.

Competition. Lowe’s is a strong, mature company with an expansive network of stores and underlying supply chain. That said, it still faces stiff competition from the likes of Home Depot and niche stores like Ace Hardware.

The Street’s Opinion

Lowe’s isn’t sneaking by anyone — 34 analysts cover the home improvement stock. The vast majority of them believe the company is a worthwhile investment, as LOW received 24 “Buy” ratings and 4 “Overweight” ratings.

The Street’s price targets indicate the stock has plenty of room to appreciate; the average price target ($228.20) is 19% above the stock’s current price of $191.75.

Recent News

Lowe's President And CEO Marvin R. Ellison Named Chairman Of Board Of Directors

Lowe's Companies, Inc. Announces 33 Percent Increase To Quarterly Cash Dividend

Will Lowe’s Stock Keep Improving?

Lowe’s has a track record of weathering the market’s worst storms — but who would’ve guessed that they’d look this strong coming out of the pandemic? So long as new homeowners and established residents alike continue pouring money into their homes and yards, Lowe’s future looks bright.

No one can definitively say that the housing market will continue its torrid pace, but prominent publications and analysts like Lowe’s chances to take advantage of the hot streak, especially considering the indefinite nature of the remote work environment, which encourages the undertaking of home projects.

Lowe’s is an established company in a stable industry, so it’s not exactly catching your eye as a tantalizing growth stock. However, shares of LOW are up 141% over the last five years and the company continues to return value to its shareholders in the form of dividend payouts and share repurchases (which apply upward pressure to its share price).

We like Lowe’s — especially if you’re looking for reliable growth, stability, and some passive income.

Keep an eye on (1) the U.S. housing market and home sales, (2) updates regarding the company’s growth strategy and its impact on operating income, and (3) the development of Lowe’s digital channels and corresponding sales.