Good morning investors!

Today’s Due Diligence report covers MP Materials Corp (MP), a mining company that’s on its way to becoming the first vertically integrated supplier of rare-earth products in the Western Hemisphere.

Considering rare-earth elements are integral to modern technology, that’s a pretty big deal.

Yet, shares of MP are down 16.1% this year — should investors beware or is MP stock trading at a bargain?

If this is your first time with us, feel free to subscribe here. If you enjoy today’s newsletter, please hit the heart button at the end of the report.

Now, without further ado...

Stock Report: MP Materials Corp (MP)

“HREEs are fundamental building blocks of the modern economy, enabling trillions of dollars in global economic development via a wide range of clean energy, information technology, defense, and industrial applications,” Andrew Hunter, Assistant Secretary of the Air Force (Acquisition, Technology & Logistics).

What on earth are HREEs? Heavy rare-earth elements like terbium, dysprosium, and holmium. Collectively, there are 17 rare-earth elements (REEs), several of which are integral to the production of high-tech consumer, industrial, and defense products.

From the early 1950s until the 1990s, the United States reigned supreme as the major supplier of REEs thanks to a mine located 53 miles southwest of Las Vegas: Mountain Pass. It’s one of the few economically mineable sources of REEs in the world.

A company by the name of Molycorp oversaw the mine for decades. However, the tides started to shift when stringent environmental regulations made domestic mining arduous and laden with red tape. Eventually, the US chose to shut down operations at Mountain Pass and outsource to a lower cost, less environmentally rigid source: China.

Fast forward 20 years, REEs are the backbone of modern manufacturing. Everything from smartphones and computers to EVs and military jets need these precious minerals. Except now, China has supplanted the US as the largest REE supplier and is reportedly responsible for 55% of global rare-earth mining and 85% of the refining process. Unsurprisingly, the United States and its allies do not want to be totally reliant on China for such essential materials.

Fortunately for them, in 2008, a group of forward-thinking investors realized that rejuvenating mining efforts at Mountain Pass could pay handsomely down the road. So, they purchased the rights to the mine as well as the Molycorp name in an effort to revive rare-earth mining in the US.

Over the next decade, Molycorp would invest over $1.7 billion into the mine, constructing processing and separation facilities. However, the company’s mining process flow was operationally challenged, leading to environmental issues, excessive costs, and, ultimately, bankruptcy (RIP Molycorp).

But Molycorp’s effort and immense capital input were not wasted. In 2017, MP Materials purchased Mountain Pass out of bankruptcy, still seeking to establish the US’s rare-earth supply chain.

What Does MP Materials Do?

MP Materials Corp. (MP) is a rare-earth mining company — the only one operating at scale in North America. Since purchasing Mountain Pass out of bankruptcy in 2017, MP has revamped the mine’s process flow and established a profitable, environmentally-friendlier operation. Currently, the company is still reliant on China for processing, but a three-stage plan to build out its infrastructure and become a fully-integrated supplier of REEs is underway. (We’ll explore this later.)

To truly understand what MP Materials does, we have to explore rare-earth minerals and the mining process. Before we dive into an explanation, here’s a solid video overview:

As the name implies, rare-earth elements need to be mined. That’s not easy or, in many cases, economically feasible. Why? Because they’re rare-earth elements. Not rare in terms of abundance (they’re actually quite abundant), but in terms of concentration. You won’t find an open pit of pure Neodymium anywhere. Instead, REEs comprise low percentages of other intrusive rocks (i.e., rocks formed deep under the planet’s surface).

MP Materials’ primary interest is bastnaesite ore, as rare earth typically comprises 60–70% of this mineral. The company mines bastnaesite ore from the open pit at Mountain Pass, relocates it to a crushing facility (where it’s, surprise, crushed), moves the crushed material to a mill where it’s ground even further, before finally transporting the product to a floatation plant. As of right now, the flotation process is the final phase of MP’s operation. Here, the bastnaesite is separated from unwanted materials, leaving the company with its “finished” product: rare-earth concentrate.

As the CNBC video points out, MP controls 15% of the world’s rare-earth supply. According to the company’s latest 10-K, Mountain Pass has roughly 30 million tons of proven and probable reserves with an average grade of 6.34% (meaning rare-earth makes up about 6% of these minerals). That doesn’t include about 9 million tons of indicated/inferred mineral resources (essentially, less confident estimates).

Based on these estimates and expected production, the company expected the mine to last for approximately 36 years, including a partial year in 2021 and a partial year in 2056. At that point, MP Materials would retire the mine. However, that date is subject to movement as the company continues evaluating reserves.

Who Does MP Materials Sell to?

Speaking of concentrate, MP Materials has significant customer concentration risk because, well, it only has one customer at the moment: Shenghe Resources, a Chinese rare-earth company.

Shenghe buys MP’s rare-earth concentrate, separates it into rare-earth oxides (REOs), and then sells them to refiners — which is a very simple sentence that drastically understates the extensive process of rare earth separation, especially at an industrial scale.

Shenghe was actually integral to the 2017 revamp of Mountain Pass, advancing MP Materials $110 million to help re-establish operations (and another $35.5 million in 2020). In exchange for initial funding and technical services, Shenghe received a 9.99% nonvoting interest in the company, as well as entitlement to all rare-earth concentrate from the mine until the investment was repaid.

Since then, the original agreements between MP and Shenghe have either been terminated or restructured. MP’s operations took off faster and more efficiently than expected, so the arrangement no longer appropriately valued MP’s services. On the other side, Shenghe would have been on the hook for significant funding requirements in Stage II of the company’s expansion plan.

Even though MP is not contractually obligated to sell to Shenghe once it repays them, Shenghe is likely to remain MP’s primary customer in the near future. That said, the company’s goal is to build out its infrastructure so that it can separate and refine its own concentrate, eliminating the need to sell it to Shenghe — or anyone else for that matter.

The company’s remaining unpaid balance is only $16.6 million, which should have been repaid in the first quarter of this fiscal year. Regardless, Shenghe still has an equity interest in the company.

MP Materials supply chain development

“We understand that MP Materials will be the only producer of PrNd oxide within the USA in the near future.” — SRK Consulting in MP’s Technical Report

The most sought-after and valuable REEs are neodymium (Nd) and praseodymium (Pr; together, NdPr or PrNd) — two key components of permanent magnets. If you aren’t familiar, I recommend scanning this article for an easy explanation. (TL;DR: Really important things like refrigerators, smartphones, EVs, wind turbines, and even jets and missiles need permanent magnets. But China controls most of the world’s supply.)

MP Materials (and the US government) want to change that. At the moment, thanks to Mountain Pass, the US has a bountiful source of REEs — but that’s the extent of its supply chain.

Here’s a perfect overview from a 2021 Innovation Metals Corp. investor deck.

So long as the above remains true, the US must rely on China. However, MP is currently progressing through a three-stage process that will conclude with a vertically integrated operation, all the way from mining REEs to producing permanent magnets and selling them to manufacturers.

Stage I

Naturally, the initial stage commenced with the purchase of Mountain Pass in 2017. MP leveraged the existing facility — which Molycorp had already put a sizable amount of funds into — and implemented changes to improve efficiency, plant up-time, and mineral recovery. All said and done, MP’s adjustments helped achieve 3.5x more REO production volume than the mine managed under Molycorp.

Stage II

“Upon completion of Stage II, we expect to be a global low-cost, high-volume producer of NdPr oxide, which represents a majority of the value contained in our ore.” — MP’s 10-K

Stage II is currently underway. In short, MP is expanding its operations to enable the separation of rare-earth concentrate — the “Downstream REE Refining” phase of the above supply chain graphic. As the following table outlines, this is no small feat.

MP’s upgrades to facilities and broader process flow should translate to lower cost separation and a smaller environmental footprint. The company expects to achieve full run-rate production volume for Stage II in 2023. Once the separation facility is operating, MP will be able to separate its concentrate into four products:

Neodymium-praseodymium (NdPr) oxide

Samarium, europium, and gadolinium (SEG+)

Oxalate, Lanthanum (La) carbonate

Cerium (Ce) chloride

More recently, the Department of Defense awarded MP Materials a $35 million contract to develop an HREE processing facility at Mountain Pass, which will be the first of its kind in the US.

Stage III

The final stage of this operational revamp will establish MP as the only vertically-integrated rare-earth magnets producer in the Western Hemisphere. These facilities would enable MP to convert NdPr into permanent magnets, which are integral components of EV motors. Again, referring back to the Innovation Metals Corp. graphic, MP will have built out the “Downstream REE Metals” and “Downstream REE Magnets” segments of the rare-earth supply chain.

In December 2021, MP announced the development of its initial magnet manufacturing facility in Fort Worth, Texas — as well as a long-term supplier agreement with General Motors to source and manufacture the finished magnets necessary for more than a dozen GM electric vehicle models. The company expects to begin delivering alloys in late 2023 and magnets in 2025.

The facility is expected to produce 1,000 metric tons of finished NdFeB magnets (NdPr, iron, and boron) each year, which is enough material to power roughly 500,000 EV motors. And this would only account for roughly 10% of the company’s NdPr output, giving it much more runway to sell these magnets to other manufacturers.

Who Are MP Materials’ Competitors?

“China” is an easy, albeit vague answer. There aren’t many players in the rare earth mining space, but it’s not due to a lack of interest.

China is home to most of them, although the Chinese market is undergoing consolidation. In December, Beijing approved a mega rare-earth metals merger between three state-owned enterprises and two private companies, which will operate under the name China Rare Earth Group. Per a South China Morning Post article:

The merger is the largest of its kind in the world. Based on 2021 data, the group will have 52,719 metric tonnes of mining quota, or 31% of the national total, and 47,129 metric tonnes of smelting quota, or 29% of China’s total. It accounts for about 62% of heavy rare earth supplies nationally.

The only other major rare-earth mining company operating at scale, besides MP Materials, is an Australian company by the name of Lynas Rare Earths Ltd (LYSDY). If you recall, the DoD pledged $35 million to MP to construct an HREE processing plant at Mountain Pass. Well, the DoD also awarded a $30 million contract to Lynas in support of a light rare-earth element (LREE) plant in Hondo, Texas. Per the announcement, Lynas will account for 25% of the world’s supply of REOs upon completion (est. 2025).

How Profitable Is MP Materials?

As of FY2021, MP Materials is a profitable business, generating $135 million of net income at a healthy margin (41%). The company has grown faster than the company expected, especially considering it only became commercially operational in July 2019.

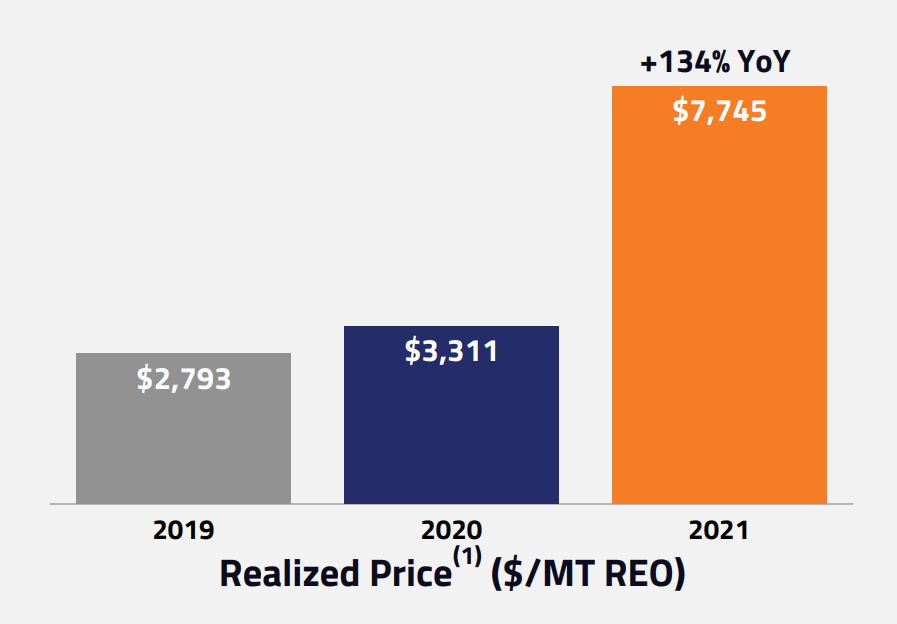

It was a good year for MP Materials — revenue grew by 147% after a 10% increase in sales volume of REOs. The company attributes the bump to process efficiencies and greater than 90% plant uptime. More importantly, retail prices of REO concentrate skyrocketed. To give you an idea, here’s NdPr oxide’s five-year price history (also referred to as PrNd).

Extreme demand for these elements helped drive up MP’s Realized Price per metric ton of REO sold by 134% year-over-year.

Two operational notes:

When MP and Shenghe modified/terminated agreements in 2020, they generated a $66.6 million non-cash settlement charge.

If you exclude the company’s repayments to Shenghe ($55 million), growth capex for Stage II ($113 million), and some minimal non-recurring plant expenses ($3 million), the company’s free cash flow for 2021 would have been $153.5 million.

How Profitable Can MP Materials Be?

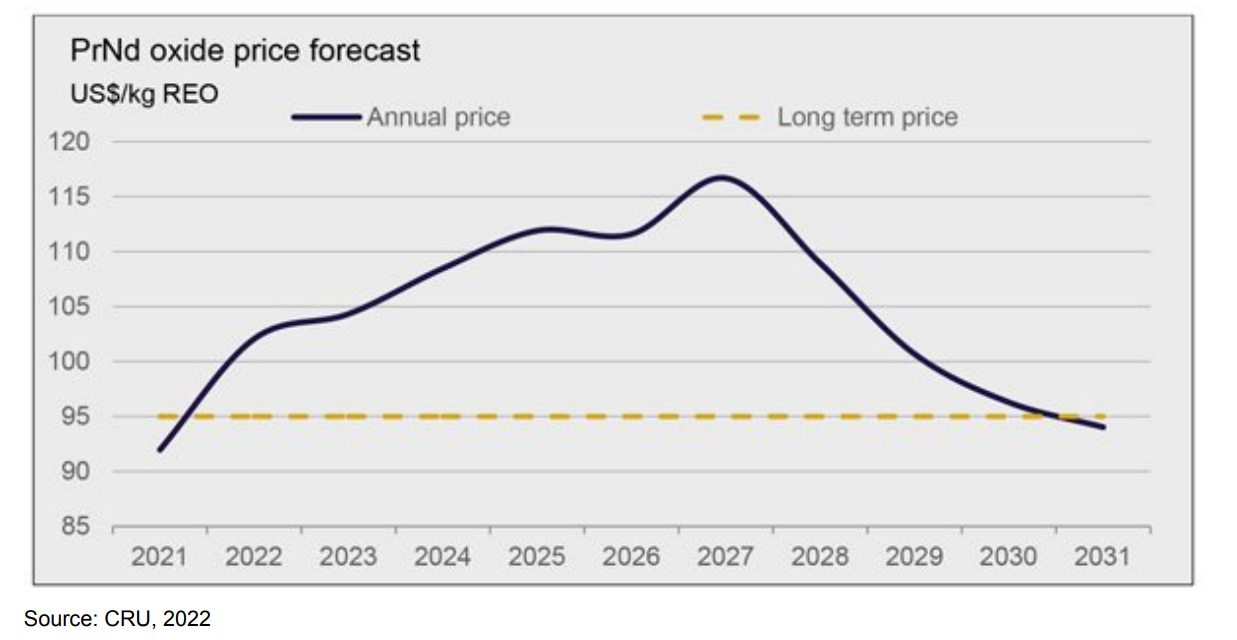

That’s the multi-billion-dollar question, isn’t it? Fortunately, we have unique insight into MP’s anticipated cash flow and potential profitability through a market report within the company’s 10-K (performed by a third-party consulting company). This report shares an economic feasibility study, including future revenue and cash flow based on mine output, projected commodity prices, etc. Needless to say, the following charts and figures are based on a long list of assumptions that may or may not pan out.

One of the key drivers of the company’s future mining profitability is the expected supply deficit of NdPr. Per the report:

Chinese rare earth production quotas have increased significantly in the last three years, from just 105kt in 2017 to 140kt in 2020. This pushed the rare earths market into oversupply. CRU expects oversupply in 2021, but from 2022 onwards we expect the market to swing back into a sustained deficit for the remainder of the forecast period. The start-up of several new projects, most notably Arafura’s Nolans project and Hastings’ Yangibana Project, will likely slow, but not prevent, the market’s steady shift into market deficit in the mid-2020s.

In response to this gap, the report projects significant upward price pressure on NdPr, which is expected to result in additional production and capacity in the latter half of the 2020s — especially with the US’s defense interest.

The price response to this market deficit is naturally uncertain, but commodity markets historically have seen upward price responses to markets where supply struggles to meet demand. As such, if these market conditions eventuate, NdFeB magnet constituents – most notably Nd, Pr and Dy – are likely to respond to this relative scarcity by increasing in price.

Long story short, the report predicts a significant supply deficit of NdPr for the majority of this decade. As such, the price for this valuable oxide is expected to skyrocket — which would be good news for MP.

Upon reaching anticipated production rates for REO and other planned downstream products at Mountain Pass, we expect to produce approximately 20,000 metric tons of separated REO per year, excluding cerium concentrate, consisting of approximately 6,075 metric tons of NdPr oxide per year. Prior to reaching expected production rates for REO and other planned downstream products at Mountain Pass, we intend to enter into short- and long-term sales contracts with new customers.

Using a simple calculation, assuming NdPr spikes to $110 per kg, that’s over $600 million of annual revenue from just NdPr oxide.

MP Materials Risks

At its current state, MP obviously faces two fairly significant risks: customer concentration risk and supply chain constraints. But that’s obviously going to change once it completes its own processing facilities.

Instead, we’re going to highlight two other prominent risks: pricing volatility and permanent magnet alternatives.

"Commodity prices are always volatile. In this sense, rare earths are no different from oil and gas, and that translates into choppy revenue and earnings." — Pavel Molchanov, analyst with Raymond James & Associates.

The former is quite simple — who knows how much the price of NdPr oxide will be in a year, five years, or 10 years. As thorough as the previous market report is, its pricing assumptions are not guaranteed to play out. For instance, China is somewhat of an unpredictable lever, as they can drastically alter supply through their own quotas. Excess supply of NdPr could put a damper on prices and, in turn, MP’s upside.

The latter risk could also pose a risk to MP’s bottom line. Rare-earth magnets are typically viewed as the most efficient way to power EVs. But they aren’t the only way — rare-earth-free permanent magnets exist, and while they aren’t as efficient, they’re cheaper. Several automakers have already elected to use them over NdPr magnets in some of their EV models.

Experts still predict that the market for NdPr-backed motors will persist and grow at a faster rate than rare-earth-free motors. That said, if rare-earth-free permanent magnets are able to scale faster than expected, that will be bad news for MP.

MP Materials Stock Forecast

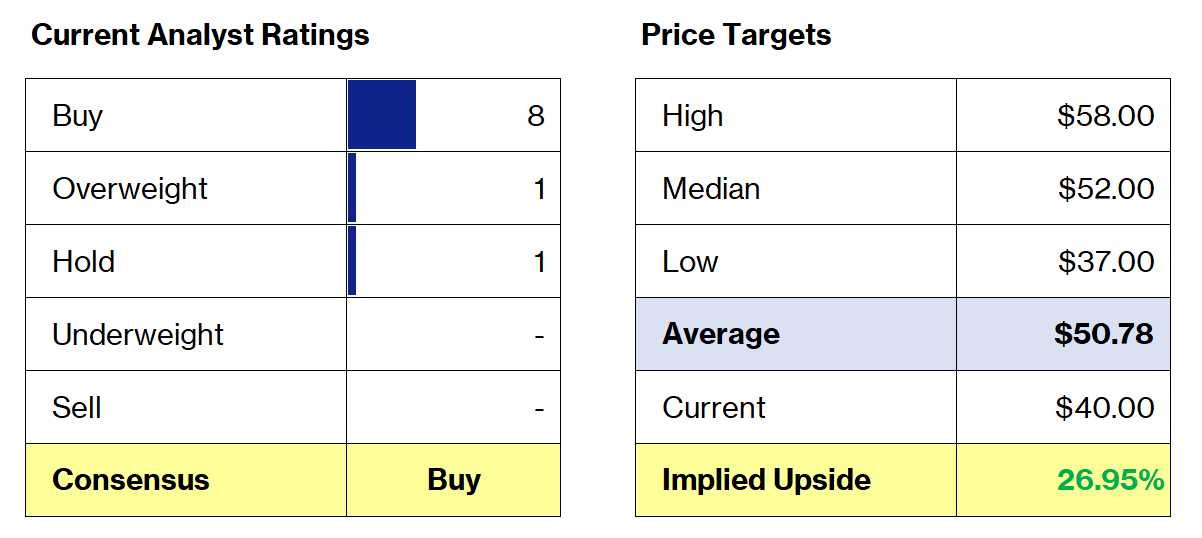

The broader downturn has made MP more affordable. Shares of MP closed at $40 on Thursday — well below its 52-week high of $60.19 per share. Wall Street’s consensus price target for MP is $50.78.

MP Materials Stock Valuation

So, how much is MP Materials stock worth, especially once you factor in completion of these stages? Management didn’t offer formal earnings guidance, but they did provide a couple of insightful tidbits that we can use to estimate the value of MP Materials’ shares. Here’s the first snippet from the 4Q earnings call:

So, what will that investment get you, our shareholders, when we are fully operating our separations capability, including heavies and our initial magnet facility is at run rate or the benchmark? And I say this with all of our caveats around forward-looking statements, where we do assume current spot pricing for the full year of 2022, we would expect to be currently at a run rate of $450 million to $500 million of annualized adjusted EBITDA from sales of concentrate, i.e., our current business.

Of course, we always have to be cautious with “Adjusted” EBITDA, but most of MP’s adjustments are the usual add-backs (e.g., stock-based comp, some non-recurring transaction costs).

The second tidbit sheds light on the potential scale of MP’s business once Stage II is complete.

After our investments in Stage II, including heavies and the achievement of full run rate in our initial magnetics facility, our model indicates expected total adjusted EBITDA for MP with nearly double through approximately $900 million to $1 billion at current spot prices.

Now, we have to make some assumptions using the company’s latest operating results, particularly its margins.

Assume MP lands in the middle of their run-rate projections.

Adjusted EBITDA margin of 66% based on FY21, which allows us to back into implied revenue.

Net income margin of 41% based on FY21, which allows us to estimate EPS based on shares outstanding at the end of 2021.

If NdPr prices remain high — and signs seem to indicate they will — REE mining can remain a very profitable business. Still, 41% is pretty high, so I’ve also included an adjusted Stage II valuation that lowers MP’s projected profit margin to 30%.

In all likelihood, MP’s current price-to-earnings ratio already factors in some of their anticipated bottom-line growth post-Stage II. So, it’s hard to imagine investors paying such a premium (50x earnings) once the company reaches that point operationally.

On the other hand, the average PE ratio of the holdings within the S&P 500 Metals & Mining Index seems more realistic at 23. This would imply that MP is reasonably priced pre-Stage II ($37.87), while it could trade between $55 and $75 upon completion of Stage II.

The usual disclaimer: this valuation approach is imperfect and not guaranteed to ever be reflected in the company’s share price. Fluctuations in the company’s margins relative to FY21 would drastically impact implied share prices.

Is MP Materials a Good Buy?

MP Materials only controls a relative sliver of the REE mining market — still, it’s a pretty impressive sliver. Within the next few years, MP Materials should have a vertically-integrated rare-earth supply chain. They already have significant backing from the US government. They already have a long-term agreement with GM to produce a dozen or so EV models (and they can sign additional partnerships beyond that with plenty of NdPr to spare). Oh, and the worldwide push to clean energy sources like wind could be a nice boon too.

In line with a projected 1100% increase in wind energy capacity addition to 2040, NdFeB magnet demand from wind energy is expected to increase to 230 kt/y. Assuming a somewhat conservative ‘wind energy grade’ NdFeB price per kg of US$90-100/kg, this would mean magnet production for wind energy alone could become a market valued more thanUS$20 billion per year.

Although Mountain Pass will be retired one day, MP is well-positioned in the “near term” (i.e., the next 10 to 20+ years) to profit handsomely from the world’s high demand for permanent magnets. I like MP as a long-term investment (5-10+ years).

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.