The Big Picture

Just like many of its peers in the tech realm, Square has experienced tremendous growth in all avenues of the business. The electronic payment company processed over $112 billion last fiscal year, which helped its stock price skyrocket to an all-time high — all while assisting its customers navigate the global pandemic and widespread lockdowns.

As the digital economy continues to shape how businesses and consumers interact, Square has continued to stay at the forefront of financial services.

So, is it hip to be Square?

The Business

In February 2008, just as the world was being consumed by the devastating effects of the Financial Crisis, Jack Dorsey and Jim McKelvey set out to change the way businesses small and large would transact with their customers.

Even though businesses were closing and consumers were looking for ways to spend less, the Square founders were not deterred. They combined hardware and software to help build a commerce ecosystem for business owners to set up shop, serve customers efficiently, and grow their businesses.

Today, Square reports its operations under two main business segments;

Seller. This is the payment software and hardware businesses use to initiate transactions from the small cubes you plug into your iPhone to the touch-screen terminals you see at registers. Revenue is generated through transaction, subscription, and service fees. This category accounted for 37% of FY20 revenues.

Cash App. Where Seller is for businesses, Cash App is aligned to individuals as a financial tool with peer-to-peer payment functionality and investing services to buy stocks and Bitcoin. The segment also includes the Cash Card product. This accounted for 63% of FY20 revenues.

Software

The company’s software portfolio covers a wide range of solutions including Online Sales, Point of Sale, Customer Relationship Management, and Team management products. Square’s goal is to touch every aspect of the transaction process no matter what. How? With over 10 unique applications ranging from barcode scanning and inventory management in the retail industry to building a payment system for an online store.

Hardware

Square’s hardware offerings focus on point-of-sale transactions for any business to transact anywhere. This includes: a magstripe reader, a contactless & chip reader, a Square stand for iPads, a Square Register equipped with its point-of-sale software and payment technology, and a portable Square Terminal device with a receipt printer.

Square Capital

Another bank!? Sort of. Square Capital facilitates loans to businesses that qualify based on their payment processing history. While a traditional bank looks at a borrower’s credit history, Square analyzes customer transaction history for the loan underwriting process. Since Square can access data directly, the lengthy and often unsuccessful loan application process is almost completely eliminated. Businesses are able to receive needed funds as quickly as the next business day.

Since 2014, Square Capital has lent over $8.1 billion to other companies. Square doesn’t intend to compete directly with traditional banks in this line of work. They are more focused on a market these banks don’t usually go after: small businesses that need quick capital to keep their operations moving forward. This is a win-win; customers can easily get capital and Square avoids fierce competition.

Cash App

Peer-to-peer payment functionality is the main staple of Cash App. This enabled the company to expand on its financial services offerings to customers; for example, Cash App users can now buy and sell bitcoin, invest in stocks and ETFs, and use the Cash Card to make payments and withdraw funds from ATMs. Thanks to the recent cryptocurrency craze, Bitcoin transaction fees accounted for over $4 billion of Square’s FY20 revenue growth.

The Narrative

Many businesses ranging across many different industries were forced to “temporarily” close in 2020 due to the pandemic. Eventually, some called it quits and shut down for good. A major catalyst was the precipitous drop in consumer spending.

According to the U.S. Bureau of Economic Analysis, the personal savings rate is the highest it’s been since the mid-’70s, as consumers are spending less and holding on to their cash. Despite this great setback to the economy, Square not only recovered well but hit records in several key metrics, such as stock return and revenue growth.

For starters, the share price for SQ has returned almost 600% since mid-March 2020; it’s not only outperformed the S&P 500 and S&P North American Technology indices in 2020, but also consistently for the past several years. Shareholders have indeed been rewarded for their investment.

Exhibit I: SQ Stock Price

When inspecting under the hood, this growth starts to make a little more sense. Active monthly customers in Cash App increased almost 50% from 2019 to 2020, as peer-to-peer transaction popularity continues to climb. Cash App operations are very scalable too. The gross profit per monthly transacting active customer is around $41; in comparison, the average acquisition cost per customer is less than $5.

Over the years, Square has prioritized diversification by offering new products and services in new and under-served markets. On the Seller side of the business, the company has continued to expand its clientele to serve both small and large businesses, as well as cater to a wide variety of industries from Retail to Healthcare. The exhibit below offers a snapshot of how Square has altered its customer mix on a Gross Payment Volume basis — a key metric in the company’s reporting.

Exhibit II: Gross Payment Volume Mix by Seller Size

Exhibit III: Gross Payment Volume % by Industry

PPP Loan

As a result of the COVID-19 pandemic macroeconomic conditions, Square Capital temporarily halted its lending operations in the second quarter of 2020. Later that summer, Square Capital was approved to borrow under the Paycheck Protection Program (PPP) from the Federal Reserve Bank of San Francisco at an extremely low interest rate of 0.35%. Accounting for both rounds of PPP, Square Capital can borrow up to $1 billion.

Square Capital acts as a facilitator for these PPP loans. Small businesses, independent contractors, and self-employed with up to 300 employees can apply and, if approved, receive funding through Square. As of the end of February 2021, Square had approximately $376 million of PPP loan advances outstanding.

Even though these loans are guaranteed by the U.S. government, this does expose Square to new uncertainties since this is a relatively new program with in-development processes.

Convertible Notes

At the end of 2020, Square Inc. issued $1.15 billion worth of convertible senior notes. Taking advantage of historically low interest rates, the company was able to offer this debt at a rate of 0% for the notes maturing in 2026 and 0.25% for the ones maturing in 2027. How were they able to finance this cheap?

As mentioned in our last edition, convertible notes enable investors to exchange debt into shares at a predetermined price. In this case, the initial conversion rate of 3.343 shares of common stock per $1,000 principal amount equates to $299.13 per share of stock.

Interest expense has been growing at a rapid rate according to Square’s financials ($56.9 million in 2020, compared to $21.5 million and $17.9 million in 2019 and 2018, respectively). This appears to be a prudent move, as the company gets cash from the market without further adding to its debt expenses, while investors get an opportunity for future equity with a little bit of protection (these notes have priority in the event of liquidation).

Product Expansion

With the issuance of these convertible notes, Square’s Cash & Short-Term investments account for about 40% of its total assets — now, where to spend this money?

Expect funding to flow into Product Development and Marketing initiatives to further support the Cash App ecosystem. Right now, Square is dabbling in short-term borrowing for Cash App users via small loan amounts between $20 - $200 dollars. Users would get instant funding and would be expected to repay the loan in a few weeks (plus interest) — better to ask Cash App for a quick IOU instead of your cousin, right?

Square has also expanded offerings on the merchant side. Now, customers can immediately receive payments instead of waiting through the settlement period. In addition, the company also opened a Utah-based bank — Square Financial Services — to offer deposit accounts to small businesses.

The Competitors

Square Inc. intends to be in everything tied to money, but money is a popular subject. The financial services industry has quite a few heavy hitters also looking to change the way we operate our finances. These competitors are big household names (there’s a good chance you already use their services today), so SQ will have its hands full for the foreseeable future.

Data as of 4/15/2021

A rather alarming number to highlight is Square’s P/E (price to earnings) ratio of 898 compared to its competition. (For those of you that bought into Square early on, congratulations.) Unfortunately for the rest of us, the exorbitant ratio could mean the current trading price is hella expensive relative to current earnings.

Another metric that catches our eye is the 2.4 Beta aligned to Square, which is twice as much as the next competing firms (Mastercard & PayPal each with 1.2). Beta values greater than 1 indicate a stock’s price is more volatile than the overall market (think S&P 500), while a value less than 1 means the stock may be less risky. If a stock has a Beta of 1, expect it to move with the market.

In Square’s case, history has shown any movements in the overall market should theoretically have a very large impact on the company’s stock price, which is reflected in its Beta. Good news if the stock market does well (e.g. a market return of 10% theoretically suggests a return of 24% return for SQ) but not so much if there is another selloff.

The High-Level Finances

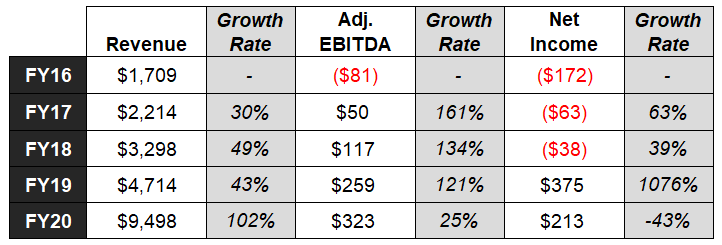

Note that all dollar amounts are illustrated in millions.

Revenue

Square generates revenue from transaction-based fees (% of total transaction amount processed), subscription and service-based fees within Cash App and Square Capital, sales of hardware products, and Bitcoin transactions (Square purchases the coin from private broker-dealers and Cash App users and applies a small margin before selling it to customers).

Revenue has consistently grown at a rapid rate; FY20 saw a triple-digit increase that was mainly driven by its Bitcoin operations, as the cryptocurrency attracted a ton of demand throughout the year.

EBITDA

EBITDA (earnings before interest, taxes, depreciation, and amortization) is a metric used to gauge a company’s operating performance. A company’s operations can appear worse due to certain non-cash expenses, such as depreciation and amortization.

Square’s EBITDA has been adjusted for (a) share-based compensation expense and (b) gain on sale of asset groups not related to core operations.

Until FY20, SQ had been expanding EBITDA at an impressive triple-digit growth rate. Even then, the firm managed to pull off 25% year-over-year growth as the market rebounded and the economy turned back around.

Net Income

For the first time since taking the company public, Square turned a profit in FY19. Despite the pandemic crushing industries and changing consumer behaviors, Square was still able to take advantage of its key strengths and turn a profit again in FY20. One of the main contributing factors to the decrease in Net Income in FY20 compared to FY19 was the increased spend of Sales & Marketing — almost $500 million dollars higher year-over-year (a 77% increase). Although customer acquisition costs are low relative to per-customer profits, Square still made moves to gain market share.

The Primary Strengths

Product Portfolio. With a diversified product portfolio, ranging from payment management software to physical credit card readers, Square covers almost all fronts when it comes to money. As it tests more services and initiatives, the company should have many opportunities to grow its customer base.

Cash on Hand. At the end of 2020, SQ had over $3.1 billion of cash and cash equivalents. Even though a good portion of this funding came from the convertible senior notes and PPP advances, Square is in a good position in terms of liquidity to not only continue current operations but also expand via projects and initiatives.

Going Cashless. As individuals and commerce continue to embrace the cashless culture, Square is in a perfect position to touch both sides of the aisle — this is the company’s mission after all. Technology is making it more and more accessible to go cashless, not to mention the fact that the pandemic accelerated the trend to move away from handing over physical cash to using touch-free payments.

The Primary Risks

Regulation. Behind the scenes, the money movement game has a lot of rules and regulations. To make matters more complex, Square operates in a variety of countries, each with varying levels of laws across jurisdictions. To further add to the complexity, regions such as the EU and the state of California have enacted more and more regulations around data protection with hefty monetary penalties for violations. For example, the General Data Protection Regulation within the EU imposes a penalty of up to €20 million for non-compliance with its data protection requirements. Further expansion on a global scale will come with many regulatory hurdles.

Bitcoin Volatility. Since Square holds responsibility for delivery of Bitcoin purchases to customers, the company is exposed to price fluctuation risk before delivering to customers. Considering Bitcoin revenue was a very large portion of the most recent fiscal year’s revenue, any major change in cryptocurrency demand or the market price of Bitcoin could have big impact on Square’s revenue.

Reliance on Market Activity. The very high Beta value of 2.4 indicates that any downturn or setback in the market should impact the performance of Square at a greater magnitude compared to its peers. So, expect your dollars to be a lot more volatile when in the form of SQ stock.

The Street’s Opinion

Overall, the Street appears to be optimistic about Square, as evidenced by the price projections. However, analysts seem to be split between Buy and Hold, resulting in the Overweight consensus. Might as well have just labeled it as “Buld.”

Data as of 4/15/2021

Recent News

Square for Restaurants Launches in Canada to Help Recovering Industry

New Square Data Reveals Cashless Businesses Has More Than Doubled

Be there or Buy Square?

Square Inc. might as well change its name to “Square Mania” at this point to capture its outstanding stock returns and expansion across a diverse ecosystem. Year by year, the company seems to find a way to break into, or at least dip its feet, into new markets and innovate in new ways regarding all things money.

While we’re very impressed with the performance of SQ and really like the direction the company is taking with its products and services, we’re wary of existing price levels relative to earnings along with their speculative tie to Bitcoin at the moment.

As a result, we are staying “cautiously optimistic” in the near term and prefer to see Square’s operations show continual earnings growth to justify current valuations. At this point in time, there’s a possibility of a “showing up late to the party” scenario.

Keep an eye on (1) continued customer growth with Cash App, a business segment that is still young enough where acquiring new customers will be key to future success; (2) Bitcoin’s movements as Square’s revenue growth becomes increasingly tied to the cryptocurrency craze — and it appears CEO Jack Dorsey and management are committed to BTC as the currency of the internet; and (3) cashless transactions across the economy; dollar bills will likely exist a while longer but pay attention to the share of cashless payments over time.

Sources

Want our free stock coverage in your inbox? Sign up now so you don’t miss our reports.