UPDATE (8/27/21): Since releasing this report, the proposed business combination between EVBox and TPG Pace has faced complications. You can read more here.

If this is your first time with us, feel free to subscribe here. If you enjoy today’s newsletter, please hit the heart button at the end of the report.

Now, without further ado...

The Big Picture

Over the last year, investors have flocked in droves to the EV industry, as popularity exploded for Environmental, Social, and Governance (ESG) investing. Companies like Tesla and NIO were the biggest benefactors, experiencing monumental share price gains.

Electric cars are on the verge of overtaking the roads and changing the way we experience transportation forever. With thousands if not millions of these new electric vehicles making their way to consumers, one company is working to make sure the batteries of these new cars stay powered up.

EVBox offers charging station solutions for electric vehicles in the European market with plans for global expansion. The company is in the process of going public through TPG Pace Beneficial Financial Corp, which trades under the ticker TPGY. TPG Pace is a “shell” company headquartered in Texas and incorporated in the Cayman Islands. (Don’t worry the workers aren’t relaxing on the beach drinking mimosas — the company doesn’t really have employees at all.) TPG Pace is what is known as a special purpose acquisition company, or SPAC for short. More on this in the next section.

Although EV stocks made people fortunes over the past several years, these companies’ share prices recently pulled back from recent highs.

Is now the time to take advantage of the recent selloff and buy in the EV space through TPGY?

SPACs

First things first, what are “SPACs”?

A SPAC is a company formed for the purpose of acquiring an existing company at a later date. SPACs have no real business operations and don’t necessarily have to reveal the firm they plan to buy. This reduces the paperwork, heavy lifting, and timeline to take a company public via an IPO. After the IPO is complete, the capital that was raised is placed in a trust account only to be used for the acquisition or to reimburse investors if a deal does not go through.

Right now, private companies go through a very time-consuming and intensive process to take their operations public through an IPO. (And this is “business” after all — time is money.) The nature of a SPAC can help speed up the IPO process, which is the catalyst behind the growing popularity of SPACs.

The Business

Formed in 2010, EVBox is headquartered in the Netherlands with a North American HQ set up in Illinois. EVBox primarily focuses on alternating current (AC) and direct current (DC) charging port stations for commercial and residential use. (AC and DC are essentially the two kinds of power used by electric cars.) In addition, EVBox also provides charging management software for consumers and professional services for their products.

EVBox is segmented into the following products and services:

Hardware. These are the physical charging stations installed at apartment complexes and individual homes along with retail and hospitality commercial sites. This represents the vast majority of EVBox’s revenues at 88% of FY19 revenue.

Software. Cloud-based applications with recurring subscription fees. 12% (combined with Services below) of FY19 revenue.

Services. Includes installation, maintenance, and project planning offerings for customers.

Charging Ports

The company has sold over 235,000 charging port units worldwide as of February 2021; these units are the main source of EVBox’s business. With a wide array of charging capacities, these stations supply AC power for homes and workplaces along with DC power for public sites such as bus depots and commercial fleets. These products are intended to be a one-time transaction.

Software

EVBox offers charging station management software through Everon, an online platform for businesses to create and maintain their own customizable charging networks. Site owners can perform remote testing, set different pricing scenarios, and integrate the technology with the rest of their fleet all through this application. Today, software subscriptions represent only a small portion of EVBox's revenue, but the company plans to shift its revenue mix toward this more predictable source in the coming years.

Support and Services

As this industry is still relatively new, many consumers do not have the training and expertise to effectively onboard these new EV products. This is where EVBox can offer additional assistance through consultation services such as planning, scheduling, and implementation of their charging networks. This can include helping customers successfully migrate from third-party hardware and software to EVBox’s infrastructure, as well as providing training programs & certifications for clients to obtain the knowledge needed to support their new charging ecosystem.

The Narrative

The EV market continues to experience tremendous growth with the push towards renewable energy sources. On top of that, figureheads like Elon Musk continue to drum up media hype for the “cars of the future.”

EVBox is positioned to take advantage of this rising wave by solidifying itself as an industry leader in the EU and breaking into new markets. By the end of 2020, EVBox had its footprint across Europe with offices ranging from Amsterdam, down to Madrid, and all the way to Warsaw. But the company also has its eyes on international markets. Gaining market share and expanding its products and revenue mix will be the primary drivers for EVBox’s future success in becoming a global leader of the net-zero carbon emissions mission.

Exhibit 1: Forecasting EV Share of New Car Sales

Immediacy is paramount within the EV industry, as new companies and ambitious entrepreneurs work to execute strategies to fulfill this increase in demand all around the world. For EVBox, the SPAC route accelerates their capital raise and growth strategy, so it’s a well-advised alternative to raising capital over the exhausting IPO underwriting process. Note that EVBox plans to list on the New York Stock Exchange after its merger as EVB.

United States Expansion

A key component of the company’s strategy is executing within the United States. Right now, EVBox plans to prioritize the states of California, Colorado, Connecticut, Maine, Maryland, Massachusetts, New Jersey, New York, Oregon, Rhode Island, and Vermont due to the tax credits and policies aligned to the EV industry. Overall, the company believes this is a very attractive opportunity and has the charging solutions to make an impact and secure market share.

Additional Services

EVBox intends to introduce new services to increase its revenue sources, while growing and maintaining customer relationships in the European market and new areas of interest.

This service offering expansion includes:

Annual maintenance plans for charging station repairs and diagnostics

Expedited delivery for spare parts needed for self-maintenance

Data Analytics to provide reporting and insights for site optimization

Public Policy

Governments and environmental groups want a zero-emission future to come to fruition. Such a world would significantly benefit EVBox. The company continues to work with national and international policymakers to implement the building blocks needed for the advancement of electric vehicle technology through sustained investments and industry innovation. The company is a founding member of the European-based advocacy group, the ChargeUp Alliance, which has over 10 members.

Competitors

Data as of 4/1/2021

FY19 Revenue used and converted to USD using 1.18 USD/EUR exchange rate

When compared to US competitors, EVBox stands as the smallest in terms of stock price, trading volume, and market cap — although not a complete shocker as the acquisition is still underway. Despite EVBox’s EPS being unavailable at this time, we expect this metric to be similar to the likes of Blink and ChargePoint due to the infancy of the industry as well as the High-Level Financial information to follow.

The High-level Finances

Due to limited historical information, we were only able to obtain 2018 and 2019 Balance Sheet and Income Statement pro-forma financials.

Profitability

In 2018 and 2019, EVBox was not profitable. The company’s primary expense drivers are Research & Development and Sales & Marketing (collectively, almost 75% of FY19 expenses).

Liquidity

After the merger transaction with TPG Pace, EVBox expects to have more than $425 million in cash (note US dollars here) and, thus, should have sufficient liquidity for the near future. Even though the company has relatively low levels of debt, the equity raise is necessary as EVBox needs to secure more funding to sustain its current cash outflows.

The Primary Strengths

ESG Popularity. The goal for net-neutral carbon emissions continues to be at the forefront of public policy all around the world, where strides have already been made for adopting zero-emission vehicles. Many countries have already made legislative strides toward phasing out internal combustion engine vehicles and adopting zero-emission vehicles, including Denmark, France, Ireland, the Netherlands, Norway, Sweden, and the United Kingdom It’s pretty convenient when nations plan to kick out your current competition, right?

Exhibit 2: National Internal Combustion Engine Sales Phase-out Policies

Government Incentives. Incentives are nothing new, but more and more comprehensive programs are rolling out to influence and accelerate the EV industry. For instance, in Italy, charging port installation costs are tax-deductible up to 50% for private and commercial use; very similar policies exist within the United Kingdom, Belgium, and France.

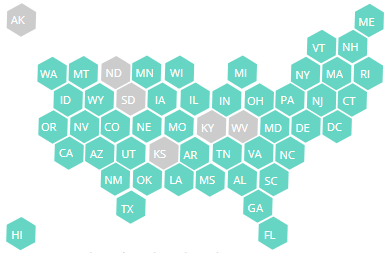

The European Union isn’t the only region focused on incentives though. According to the National Conference of State Legislatures, the U.S. has 44 states, along with the District of Columbia, offering EV incentives. For example, Vermont offers infrastructure financing at a 1% interest rate through the State Infrastructure Bank, while Colorado offers a $4,000 tax credit for buying an EV vehicle.

Exhibit 3: States with EV incentives (green colored) in the United States

EU Success. EVBox has already established itself in key customer segments and markets across the European continent. This should help the company form more integrated customer engagements across the EU, along with expanding into the United States with an already experienced business model.

The Primary Risks

Drawbacks of SPACs. Even though SPACs have been around for decades, these entities do have downsides. For starters, the transaction must (a) be completed within a two-year window and (b) use at least 80% of its capital toward the purchase of the targeted company. If not executed in time, the SPAC will dissolve and capital will be returned to shareholders. So, although SPACs are used as a way to speed up the process, they still have a deadline.

Before the targeted firm goes public, information is difficult to obtain beyond presentations and pro-forma financial documents. While the SPAC structure enables an expedited public offering, investors have less financial data and resources to piece together a comprehensive understanding and, ultimately, make a purchase decision.

Legal Investigations. After the announcement of TPG’s plans to acquire EVBox, the SPAC had a few law firms knocking on their door at the end of 2020. These investigations focus on whether TPG Pace Beneficial Finance Corp and its Board of Directors were properly informed on the valuation of EVBox, which would mean a breach of fiduciary duty occurred to its shareholders. Hmm…looks like they should have subscribed to the Due Diligence newsletter. Will anything come of this litigation? We are not exactly sure, but these lawsuits look like another hurdle as the company moves to close the deal.

Growing Competition. On the EVBox side, the company will be going up against very large and popular competition in the United States market. According to a report published by Grand View Research, the electric vehicle charging infrastructure opportunity in the States is estimated to be about $2.1 billion with the prominent players identified as Tesla and ChargePoint (one of which is already a top 10 company in terms of market cap in the US). Competition may appear “friendly” and collaborative today, as widespread investment and public policy are the main focus for growth, but do not underestimate the nature of competition over time.

The Street’s Opinion

Due to the nature of how these SPAC entities are set up, along with the fact EVBox was just recently announced as TPGY’s target for acquisition, no analyst ratings are available at the time of this writing.

Recent News

Will EVBox be...SPAC-tacular?

Overall, we are optimistic about the future of the EV market, as more investors and nations work together to make this battery-powered dream the reality of tomorrow. We believe EVBox could replicate its EU market success in the United States, but we’re taking a “wait-and-see” approach while the deal between TPG Pace Beneficial Finance Corp and EVBox is underway. Once completed, the public will gain access to more fundamental detail behind EVBox’s core operations and financials.

If you do want to buy EVBox, you must buy the current TPGY SPAC. This is until EVBox is listed on the NYSE under its own ticker after completion of the deal. It is expected the current SPAC shares will convert to common shares after acquisition.

Keep an eye on 1) The status of the acquisition deal between TPGY and EVBox, 2) Upcoming FY20 financial releases for EVBox, and 3) Revenue & profit mix of charging port unit sales vs software & services as the company looks to obtain more recurring sources of income.

Sources

EVBox - Investor Relations Presentations

Want our free stock coverage in your inbox? Sign up now so you don’t miss our reports.