Good morning investors!

Today’s Due Diligence report covers UserTesting Inc (USER).

User testing (also known as usability testing) is exactly what it sounds like — the process of evaluating customer interactions with a particular product, service, brand, etc. In turn, businesses can glean insights from the experience and use them to improve their offerings.

UserTesting, the company, was founded in 2007 but only recently went public in November 2021. Since its IPO, USER stock has retreated. But it’s gaining momentum again in 2022.

USER’s stock price is up 17.6% this year.

Are investors overlooking it?

If this is your first time with us, feel free to subscribe here. If you enjoy today’s newsletter, please hit the heart button at the end of the report.

Now, without further ado...

Stock Report: UserTesting Inc. (USER)

What if you could see experiences through your customers’ eyes? — UserTesting prospectus

True to its name, UserTesting Inc. (USER) is a software platform that allows businesses to get immediate, genuine customer feedback. Companies can watch and listen to their customers as they engage with products, services, apps, processes, designs, brands, etc.

In short, UserTesting strives to revolutionize qualitative feedback, which has been a time-consuming and laborsome process historically (e.g., focus groups).

CEO Andy MacMillan outlined the company’s value proposition in the USER prospectus:

When I was a product executive at organizations like Oracle and Salesforce, I would have loved to get this type of rich insight from current and future customers as we iterated on product designs. We either struggled to find customers to talk to when we needed the input, or, more often, we paid agencies tens or hundreds of thousands of dollars to go talk to our customers for us!”

The value of this platform is undeniable. Here are a few examples of use cases:

Product teams can vet new markets and gauge customer needs.

Marketing teams can get instant reactions to product/service names, brand messaging, marketing campaigns, landing pages, pricing, etc.

R&D teams can analyze customer behavior and cognitive processes to pinpoint usability strengths and weaknesses.

Customer service teams can understand each touchpoint of the customer journey and work to improve each interaction.

Companies can even benchmark their customer experiences against their competitors.

How Does UserTesting Work?

Users sign up to participate in various types of consumer tests, such as surveys about a brand or the use of a new product. The UserTesting platform records the screens or actions of users via camera as they engage with whatever predetermined task, product, service, etc. The video recording captures intonation, facial expressions, body language, actions, and real-time narration.

Each test represents a Customer Experience Narrative (CxN), which is then delivered to the relevant business within a day.

Using machine learning, the UserTesting platform also identifies “key moments,” giving businesses immediate insight.

How Does UserTesting Get Users?

UserTesting’s contributor network, which was more than 600,000 contributors as of November, is arguably its biggest selling point and asset. Collectively, these contributors created 1.4 million CxNs in 2020.

The primary appeal from the “tester” side is, quite simply, money.

The platform pays contributors for each test they perform, ranging from $4 to $120 based on the test’s duration. For instance, a 5-minute survey would pay $4, while a 20-minute screen and audio recording would pay $10.

But, as Andy MacMillan noted on the company’s first earnings call, contributors from higher-earnings brackets value being heard more than being compensated. Since these CxNs go straight to the brands, people can voice their opinions with confidence that businesses will listen.

How Much Are UserTesting’s Services Compared to Competitors?

UserTesting targets major corporations. Its enterprise subscription isn’t for the financially faint of heart — starting somewhere around $18,000 to $20,000 per year based on some public feedback. (UserTesting’s site doesn’t outright state its pricing models.)

This platform is not for small businesses and startups. Still, it’s hardly the only option.

There are much more affordable alternatives out there, such as Maze and Lookback. But, for what it does, UserTesting appears to offer the best video capabilities relative to its competitors based on public feedback.

According to G2, UserTesting is the top-rated solution in the following categories:

User Research

Software Testing

Consumer Video Feedback

From a public company standpoint, there’s also Qualtrics (XM), Amplitude (AMPL), and Momentive Global (MNTV; the parent company of Survey Monkey) — but there’s not as much product overlap as private competitors. In fact, UserTesting formed a partnership with Qualtrics in 2019.

How Profitable Is UserTesting?

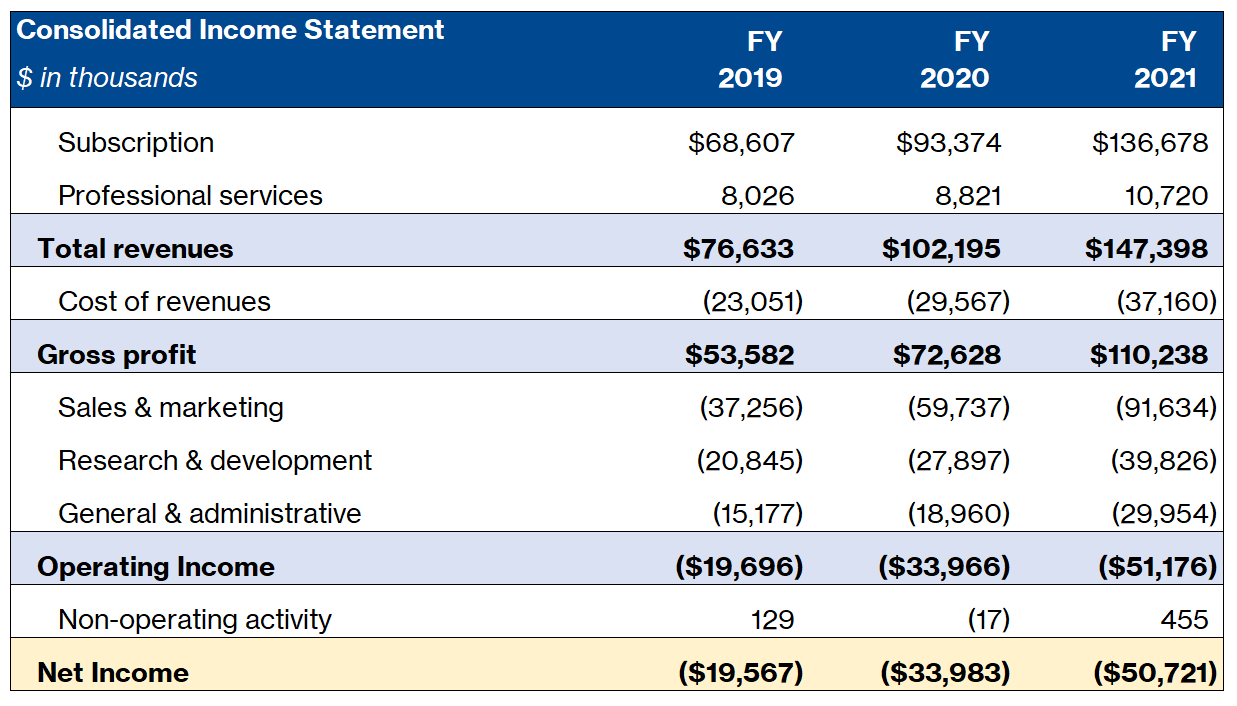

Revenue growth has been consistent, which is a benefit of their subscription model but also a testament to both their client retention and client acquisition.

UserTesting now has 2,350 customers — up 37% from a year ago. Many of which are mega enterprises; the platform serves over half of the world’s top 100 most valuable brands, according to Forbes.

In just the fourth quarter, the company “landed or expanded” customer relationships with AMC Entertainment, Anheuser-Busch, Hawaiian Airlines, Home Shop, Lowe's, MetLife, Philips, Phoenix Group, Reddit, and Vestiaire Collective SA. Full-year revenue for 2022 is expected to be around $196.5 million, which would represent 33% year-over-year growth.

Gross profit margins are healthy (a hair under 75% in FY21). (In other words, UserTesting retains about $0.75 of every dollar of revenue after netting out things like contributor payments.) But that revenue growth has come at a price — UserTesting has consistently increased its marketing spend every quarter. Sales and marketing expenses as a percentage of revenue have grown from 48.6% to 58.5% to 62.2% over the last three fiscal years. It’s easily the company’s largest expense each period ($91.6 million in FY21).

In turn, the company’s net loss ballooned from roughly $34 million for FY20 to about $50 million last year.

That’s not exactly a surprise though, considering USER is an emerging growth company trying to expand its business both domestically and internationally — the latter of which is a key element of the company’s growth strategy (international revenue was up 76% in FY21).

USER Stock Forecast

Consumer research is a highly competitive field already. On top of that, UserTesting’s solutions aren’t exactly irreplaceable, so there’s a fairly low barrier to entry. Only time will tell if UserTesting can execute its growth strategy, keep SG&A spending in check, and turn a profit. The company is currently cash flow negative, but its recent IPO helped boost liquidity.

The broader tech sell-off amidst concerns over inflation and rising interest rates has made USER more affordable. Shares of USER closed at $10.09 on Thursday — still well below its IPO issuance at $14 per share. Wall Street’s consensus price target for USER is $13.90.

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.