ETF Report: ARK Innovation

Can Cathie Wood's flagship fund keep outperforming the market?

Good morning, investors!

Today, we’re going to explore a different type of security: exchange-traded funds (ETFs).

More specifically, ARK Innovation ETF — one of Cathie Wood’s active funds.

If this is your first time with us, feel free to subscribe here. If you enjoy today’s newsletter, please hit the heart button at the end of the report.

Without further ado…

What is an active ETF?

Unlike a passive index fund, which typically matches the performance of an underlying basket of assets, active ETFs do what their label implies — they’re actively managed in an attempt to exceed market returns. The fund’s portfolio manager regularly monitors, researches, and trades based on a predetermined investment thesis.

Several studies have suggested that “active” isn’t really synonymous with “better” though. One such study produced a truly staggering statistic: 86% of US funds underperformed the S&P Composite 1500 index from 2001 through 2020.

Yet, ARK funds have been in the minority.

Due Diligence: ARKK

Ark Investment Management (“ARK” or “Ark Invest”) is a US-based firm that emphasizes tech-enabled innovation, such as electric vehicles and DNA-sequencing. The firm actively manages several ETFs:

ARK Innovation ETF (ARKK)

ARK Genomic Revolution ETF (ARKG)

ARK Fintech Innovation ETF (ARKF)

Ark Invest also oversees three passive index funds: the 3D Printing ETF (PRNT), ARK Israel Innovative Technology ETF (IZRL), and ARK Transparency ETF (CTRU). Note that CTRU is expected to launch in December 2021.

Who’s at the helm of Ark Invest? Cathie Wood, who holds the titles of Chief Executive Officer and Chief Investment Officer for the firm. Before founding Ark in 2014, Cathine served as the CIO of Global Thematic Strategies for AllianceBernstein, overseeing $5 billion in assets. Prior to that, she co-founded a hedge fund by the name of Tupelo Capital Management. Collectively, she has 40+ years of investment management experience.

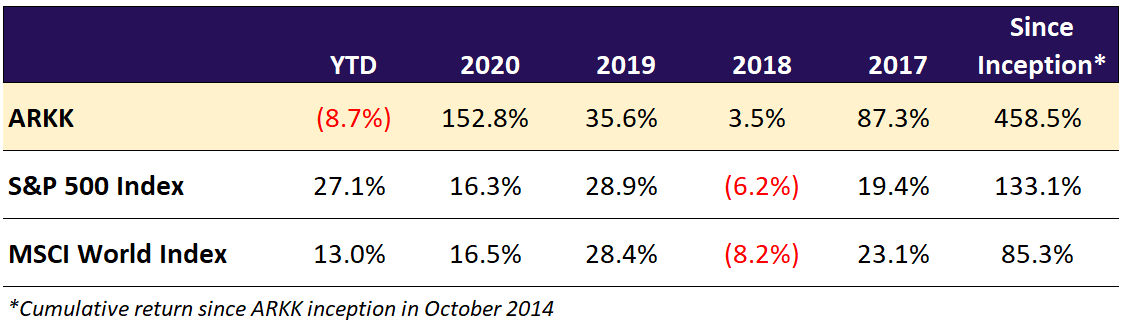

Her flagship fund, ARK Innovation ETF (ARKK) has generated a 29.7% average annual return since its inception, easily outpacing the S&P 500 in that same timeframe (14%). But 2020 was another animal as the fund posted sizzling gains of 153%, catapulting Cathie and Ark Invest into the investing spotlight.

How ARK approaches investments

ARK points to four inefficiencies in the market, which it believes can be exploited for long-term capital gains. Here’s an overview:

The market’s short-term time horizon. Investors tend to hone in on short-term price fluctuations and underestimate the long-term impact of disruptive technology.

Passive public markets. The broader shift to passive investing strategies has led to inefficiently priced, yet innovative companies.

The solo-ization of Wall Street. Index strategies make it difficult to spot forward-looking growth opportunities.

The closed-off research and investment mentality. Many institutions and retail investors employ a limited approach to investing research, relying on traditional — but perhaps outdated — sources and metrics as screeners.

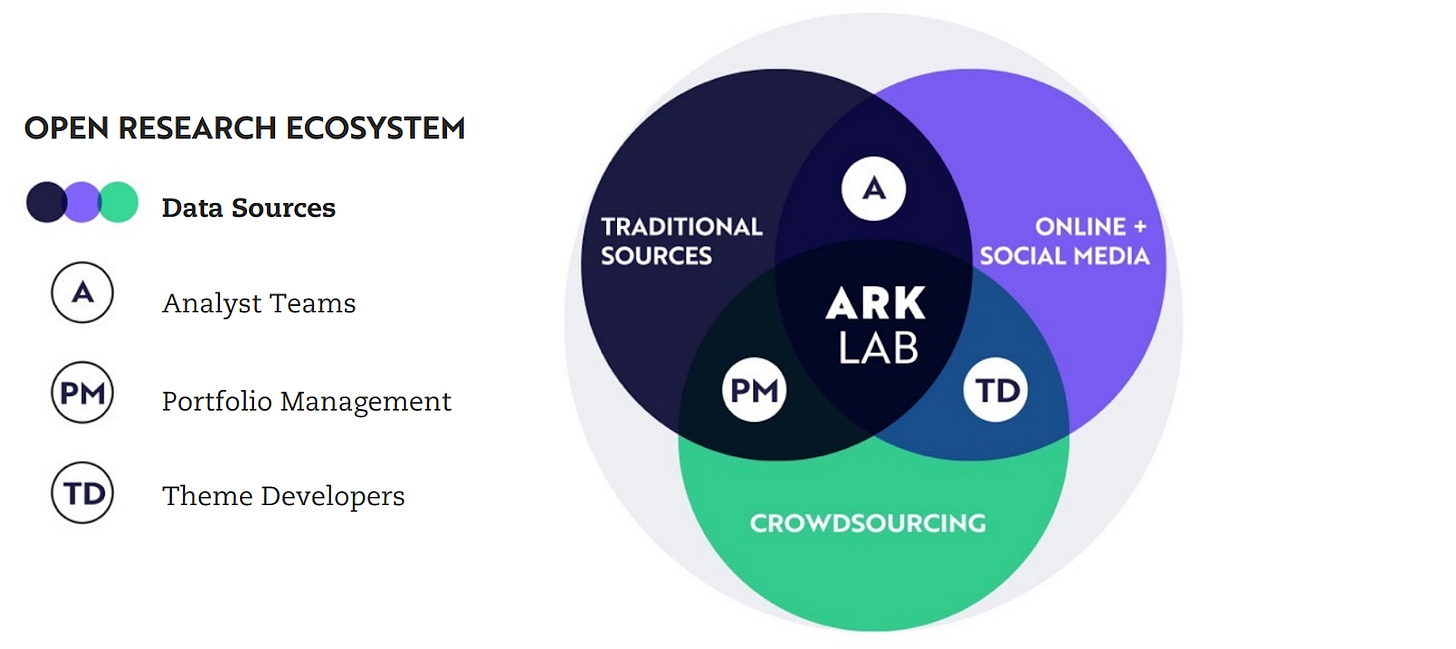

Let’s explore the last point a bit more. ARK is very transparent about its investment philosophy and research process. Cathie and her team use a system that they’ve coined as an Open Research Ecosystem:

Keeping an open mind about investment research sources seems wise in the current market. Companies can achieve astronomical valuations based on the potential to accomplish something rather than actual results and fundamentals. The auto industry is a prime example. Tesla and Rivian are the first and sixth largest auto manufacturers by market cap, yet their production numbers pale in comparison to the likes of Volvo, Toyota, Ford, GM, etc. Rivian hasn’t even delivered a vehicle yet.

Markets — and the investors that influence them — have detached, in many ways, from conventional wisdom and investing philosophies. ARK seeks to take advantage of that.

ARKK investment thesis

ARK employs a hybrid investment strategy: a blend of top-down and bottom-up analysis to locate its investments. ARK uses the “top-down” approach for ideation and viability purposes. Then it uses the “bottom-up” approach to fundamentally and quantitatively value a potential investment.

ARKK’s investment theme is disruptive innovation, which boils down to tech products or services that might change how the world works. More specifically, ARKK narrows its scope to the following segments:

Genomic Revolution Companies: companies that strive to enhance the quality of life by incorporating genomics into their business model (e.g., genomic sequencing). Examples from ARKK’s portfolio include Exact Sciences (3.21% weight) and Intellia Therapeutics (3.13%).

Automation Transformation Companies: companies that could capitalize on the productivity of machines, such as automated processes that would otherwise require human labor. For instance, 3D Systems and its 3D printers.

Energy Transformation Companies: companies that innovate the way energy is stored, used, collected, and implemented. For instance, the development and production of lithium ion batteries.

Artificial Intelligence Companies: companies that leverage robotics, autonomous technology, etc. Tesla (10.18%) and its autopilot program are a prime example.

Next Generation Internet Companies: companies that benefit from the broader shift to software infrastructure, such as cloud computing, shared technology, internet-based businesses, etc. (e.g., Twilio).

FinTech Innovation Companies: financial companies that are poised to benefit from technological advancements, such as fraud reduction, peer-to-peer lending, or frictionless funding. Robinhood (1.62%) is a prominent example. (Although I’m still not a believer in this particular platform.)

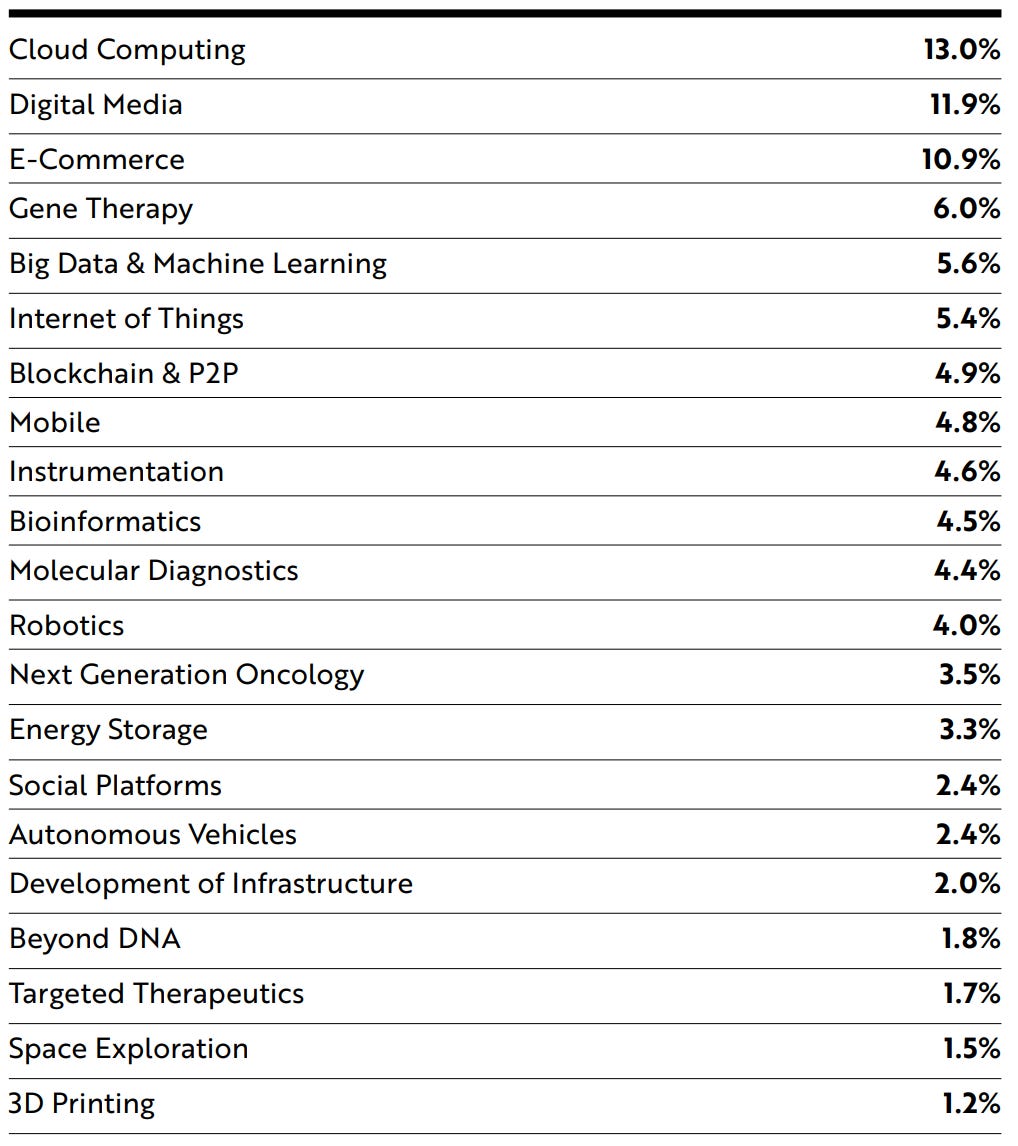

Here’s a technological breakdown of ARKK’s portfolio as of 9/30:

ARKK holdings

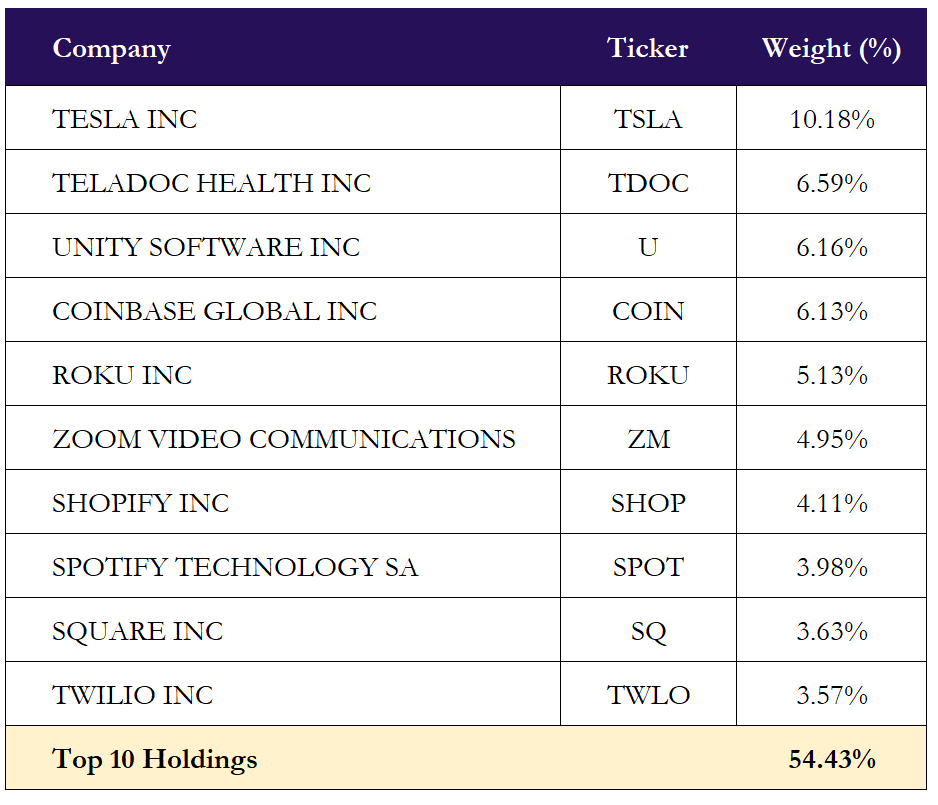

Scanning ARKK’s holdings, it’s not hard to see the innovation theme. As of this writing, there are 45 positions in ARKK’s portfolio — Tesla commands the largest position by far at 10.18%. Oddly enough, Elon’s auto manufacturer arguably has the largest physical presence relative to the remaining tech-heavy and digitally-focused companies within the top 10 holdings.

You can find all 45 holdings here.

ARKK performance

Although ARKK returns vastly exceeded market benchmarks last year, 2021 has been another story. Through yesterday, ARKK has generated an 8.7% loss — a stark contrast relative to the S&P’s 27.1% gain. However, ARKK’s performance since its inception has put the broader markets in the rearview mirror (hence why Cathie Wood and ARK have skyrocketed in popularity).

The bottom three stocks in terms of 2021 performance have been Teladoc, Roku, and Zoom. Note that Zillow wasn’t far behind; ARKK recently sold off almost its entire position in Zillow.

Teladoc

Teladoc Health offers virtual healthcare, which — as you can imagine — was a highly sought service during the pandemic. TDOC is down 59.7% from its 52-week high of $308, closing at $120 on Thursday. Here’s what ARK had to say about TDOC in its latest quarterly report.

Teladoc Health seems to have underperformed because of investor fears that its top-line growth will continue to slow down in a post-pandemic world, especially as other virtual care companies emerge as potential competitors. Investors also seem to be waiting for evidence that Teledoc is integrating with recently acquired Livongo successfully.

In our view, the pandemic has accelerated the secular shift towards virtual care, a trend in which Teladoc is best positioned among telemedicine providers to benefit thanks to its channel access, service offerings, geography, and data advantage.

Roku

Roku manufacturers digital media players for streaming purposes. (If you haven’t heard of them, I bet you have heard of Amazon’s Fire Stick — Roku is a direct competitor.) ROKU is down 51.9% from its 52-week high of $490.76, closing at $235.85 on Thursday. Here’s what ARK had to say about ROKU in its latest quarterly report

Roku declined after reporting second quarter earnings because the reopening of the economy caused slower than expected user growth. ARK maintains high conviction that Roku is well-positioned to capitalize on the shift from linear TV to connected TVs and streaming.

Zoom

There’s a good chance you’ve used Zoom in the last year and a half. The videotelephony platform was an absolute hit during the pandemic. But, much like Teladoc, its stock has taken a hit as society reemerges from its stay-at-home hiatus. ZM is down 47.5% from its 52-week high of $486.53, closing at $255.75 on Thursday. Here’s what ARK had to say about ZM in its latest quarterly report

Zoom detracted from performance following an earnings report that pointed to a deceleration in the growth of its core Meetings product in the SMB/individual segment. That said, revenues increased a better than expected 54% on a year-over-year basis against a blistering 355% surge during the depths of the coronavirus crisis last year. Moreover, the number of Zoom customers with more than 10 employees increased 36%.

Meanwhile, with roughly two million seats, Zoom Phone appears to be gaining momentum. While higher churn from lower-end markets is not surprising as the global economy reopens, ARK believes that Zoom is likely to overcome the slowdown with share gains in the massive enterprise communications space as it evolves what appears to be the most technologically advanced offering for video conferencing and PBX. Zoom is a leader in cloud communications, providing solutions for video conferencing, voice, and chat worldwide.

ARK commentary on markets and economic activity

In a recent interview with Barron’s, Wood was asked why her fund was down this year. She pointed to rising inflation as a catalyst, which she believes encouraged investors to shift from growth stocks to value stocks (ARK is considered a growth fund). Despite widespread fears that inflation will run rampant for the foreseeable future, Cathie Wood and ARK Invest believe the opposite is true — arguing that deflation is more likely in the coming months.

Wood specifically cited the returns of the financial and energy sectors, which have outpaced other areas of the market, as key indicators that investors don’t believe inflation’s torrid pace will continue.

Here’s additional commentary from ARK’s quarterly report:

In ARK’s view, inflation fears have been overblown and are likely to give way to the risks of deflation. Thanks to both the base effect of collapsing prices during the coronavirus crisis last year and to supply chain bottlenecks that could be causing businesses to double- and triple-order supplies this year, inventories have been building, perhaps not in stores or on dealer lots but in households and garages. During the next six months, if economic growth were to disappoint in response to higher oil prices, lower confidence, and China’s crackdown on technology and financial services, global consumption could hit an air pocket, causing a collapse in commodity prices.

According to our analysis, two secular sources will exacerbate the shift from inflation to deflation, one good and another bad for economic activity. Innovation is the source of good deflation, as learning curves cut costs, increase productivity, and create exponential growth opportunities. Yet, instead of investing to capitalize on these opportunities, we believe many companies have catered to short-term oriented shareholders who demand results “now” and have leveraged their balance sheets to buy back stock, bolster earnings, and increase dividends. Facing the disintermediation and disruption associated with aging products and services, they could be forced to cut prices to service bloated debt, resulting in the kind of deflation that hurts economic activity.

ARKK alternatives

ARK’s theme-based ETFs spurred the creation of several similar funds last year. Each of the below alternative funds originated in fall 2020, as ARKK’s popularity began to spread.

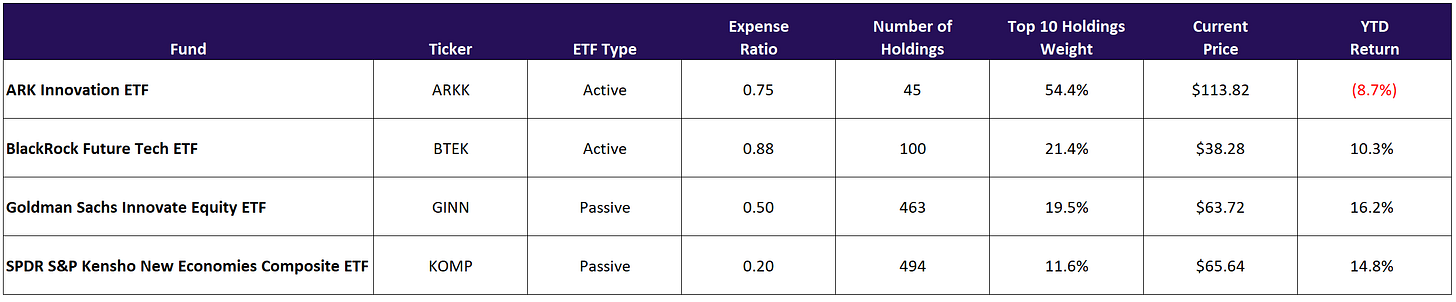

Active funds typically have higher management fees, so it’s not a surprise to see ARKK’s expense ratio at 0.75%, which is higher than passive alternatives.

ARKK is by far the most concentrated fund of the bunch; its top 10 holdings comprise 54.4% of its portfolio. As a result, it’s far more susceptible to the movement of select companies (e.g., Tesla). Of course, that can work in their favor or against them.

Although BTEK has a higher expense ratio, it does offer a more attractive price entry point at $38.28.

KOMP is the cheapest alternative to ARKK, primarily because it’s a passive fund and there’s less turnover. There’s also the most overlap between ARKK and KOMP — 24 of ARKK’s holdings are within KOMP’s portfolio.

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.