Unplugged? Why investors are losing confidence in Plug Power

Is Plug Power's Hydrogen Dream Too Ambitious?

Welcome back to Market Movers. Did you miss this segment?

Before we dive in, I want to extend a colossal thank you to everyone who participated in last week’s survey. If you didn’t get a chance to share your thoughts, you can do so here (average time to complete is 4.2 minutes).

The people get what the people want, and, based on initial feedback, the community overwhelmingly prefers Market Movers and Stock Reports. So, in an effort to appease everyone, I’ve combined portions of both content styles into one — the background, analysis, and outlook of long-form reports with the trend-spotting, topical nature of Market Movers.

If this is your first time with us, don’t forget to subscribe here. If you enjoy today’s issue, please hit the heart button at the end of the report.

Without further ado…

Plug Power PLUG 0.00%↑, a well-known name in the hydrogen space, could use a jolt. Shares closed at $9.67 on Wednesday, down 17.5% since last Friday, 22% YTD, and 69% from its 52-week high of $31.56.

Ultimately, a company’s share price is only as valuable as the investors that place value in it. What’s driving investors to lose confidence in PLUG?

Before we can address that, let’s quickly summarize Plug’s business.

What Does Plug Power Do?

Plug Power is a leading provider of hydrogen fuel cell systems, focusing primarily on the material handling (e.g., forklifts) and electric vehicle markets. Their business strategy revolves around the development, manufacture, and deployment of hydrogen fuel cell systems as a clean and efficient alternative to traditional combustion engines and batteries.

Here’s a four-point summary of their business strategy:

Expanding market presence in material handling: Plug Power has a strong presence in the material handling industry, with its GenDrive fuel cell systems powering forklifts and other warehouse equipment. Some of their major customers include Amazon, Walmart, and New Fortress Energy.

Diversifying into new markets: Plug Power aims to expand into new markets where hydrogen fuel cell technology can be a viable solution. For instance, they have ventured into the on-road electric vehicle market with their ProGen fuel cell engines, targeting delivery vans, buses, and trucks. Additionally, they have explored applications in stationary power, such as backup power systems for data centers and telecommunications.

Vertical integration and strategic partnerships: Plug Power seeks to vertically integrate its operations to control costs and improve efficiency. They have acquired several companies, like United Hydrogen and Giner ELX, to strengthen their hydrogen generation, liquefaction, and distribution capabilities. Additionally, they have formed strategic partnerships with companies like Renault, SK Group, and Airbus to expand their global reach and tap into new markets.

Investing in research and development: Considering hydrogen technology is still in its early stages, Plug Power continues to invest in R&D to enhance the performance and efficiency of its fuel cell systems, reduce costs, and develop new products for emerging applications.

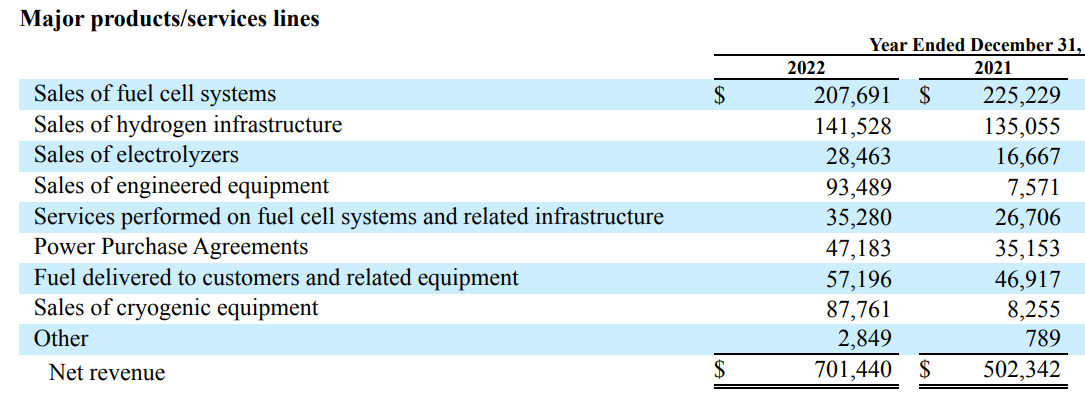

How Does Plug Power Make Money?

Whenever I look into a company for the first time, I like to begin by figuring out how they make money. To me, it’s the easiest way to form an initial perspective and understanding of a business. In this case, Plug Power makes hydrogen fuel cell systems, which are used for things like forklifts, delivery vehicles, and stationary power generation. They provide these solutions to customers across a variety of industries, such as retail, manufacturing, and distribution centers.

In addition to selling fuel cell systems, Plug Power also generates revenue from associated services, such as maintenance and hydrogen supply for their fuel cell products. These services are often included in the initial sales contracts and contribute to the company's overall revenue stream. (But, as we’ll touch on shortly, these contracts aren’t exactly profitable.)

Perhaps more importantly, Plug Power has its eyes fixed on expanding its business by investing in green hydrogen production facilities and developing new products like electrolyzer platforms and on-road vehicles through partnerships and joint ventures. Essentially, the company wants to cover the entire hydrogen value chain, ranging from production, storage, and delivery to energy distribution — for instance, electrolyzers that create hydrogen, liquifiers to convert that hydrogen into liquid fuel, and tankers for storage.

Why Is Plug Power Stock Going Down?

Skeptics can make a convincing case against Plug.

As it stands today, not all hydrogen is “green.” Quite the opposite. Most of the world’s hydrogen production (about 95%) still relies on natural gas and generates greenhouse gas emissions. Why? While more environmentally friendly, green hydrogen still isn’t as commercially viable.

Although Plug Power was an early player in the space, its first-mover advantage is questionable due to the competitive nature of the energy space and lack of a competitive moat. For example, a simple Google search yields a list of 19 other recognized electrolyzer manufacturers.

On the company’s Q4 earnings call, CEO Andy Marsh made an enthusiastic prediction: “I believe, the end of 2023, no one will question Plug's ability to scale the hydrogen economy.” But growth often comes at the cost of cash, and Plug bears point to its sizable cash burn as a point of operational weakness. For reference, Plug operations burned through $358 million in FY21 and $829 million in FY22 (130% change, the bad kind of growth).

Along the same lines, execution has been a problem, with management tending to overpromise and underdeliver. For FY22, management initially projected revenue of $900–$925 million, before revising that guidance in October to “5% to 10% lower.” Then Plug fell quite short of the marked-down revision, with revenue of $701 million.

Plug Power's recent earnings call highlighted their less-than-ideal performance — they chalked it up to new product hiccups, hydrogen plant delays, and macroeconomic factors causing hydrogen costs to skyrocket. However, despite the multitude of bumps in the road, the company remained confident that their 2022 efforts will tell a different story (see Marsh’s quote above).

Plug is currently targeting $1.4 billion of revenue with 10% gross margins. That would be a remarkable improvement, considering gross margins were awful in FY22 (-22%). The company’s fuel cells are the only materially profitable segment — everything else is sold at a loss.

What’s driving the company’s expected margin improvements? Plug’s shareholder letter highlighted the catalysts:

Commissioning green hydrogen facilities, with internal cost of production one-third of third-party vendor costs

Scaling mature and new fuel cell product platforms

Scaling world-class manufacturing to create substantial operating leverage

Continuing reliability enhancements across deployed material handling fleet, which is expected to benefit both service and PPA (power purchase agreements)

Realizing Inflation Reduction Act (IRA) benefits, which are expected to positively affect margins across businesses.

Naturally, it remains to be seen whether Plug can accomplish these feats. On that note, the company has some rather optimistic targets for the rest of the decade:

Plug Power Outlook

We’ve spoken at length about the government-backed clean energy push. It’d be naive of us to ignore such a robust, secular tailwind. Tax incentives and private investments will provide a much-needed boost and help bridge the gap to cost efficiency. With that in mind, Plug Power's outlook is generally positive, from a 30,000-foot, long-term perspective. The company has a strong foothold in the material handling market and is actively expanding its operations to become an end-to-end hydrogen solution.

“Our first green hydrogen plant in Georgia is set to begin hydrogen production early this year. However, this is just the start of our plan to expand our production of 500 tons per day across the United States by 2025. We're also building green plants in Europe, including projects in the port of Antwerp, Bruges, and in collaboration with our ACCIONA in Spain. Our plants will utilize Plug electrolyzers and cryogenic equipment to produce and deliver liquid hydrogen, the Plug trailers.”

— Andy Marsh, Plug Power CEO, on the Q4 earnings call

However, there are plenty of challenges to consider. The hydrogen fuel cell industry's growth is contingent on advancements in technology, infrastructure, and policy support. Plug Power will need to continue investing in R&D and forging strategic partnerships to address these challenges and maintain a competitive edge. At the same time, being prudent stewards of capital and optimizing margins will be critical to not only the company’s positioning but also survival. Something it hasn’t proven capable of quite yet.

PLUG is not a value stock — it’s a speculative bet on both hydrogen’s place in the clean energy economy as well as Plug’s role in that ecosystem. Frankly, management’s margin forecasts for the next several years seem way too aggressive, so don’t be shocked to see margins struggle to reach lofty expectations.

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.

One word. Excellent!