The National Defense Stockpile is low. Good news for MP?

It's a good time to be the only operational REE mine in the great U.S. of A.

Good morning, investors!

In case you missed last week’s newsletter, we’re narrowing our scope to follow a simple investment theme: follow the money.

And who controls the most money? The government.

If Uncle Sam wants something to succeed, he has the power to throw ludicrous sums at the problem until it’s resolved. With that in mind, we’ll dive into industries that stand to benefit from public policies over the next decade.

If this is your first time with us, don’t forget to subscribe here. If you enjoy today’s issue, please hit the heart button at the end of the report.

Without further ado…

Let’s take a stroll down memory lane.

Think back to your middle school years, specifically science class. Remember when you learned about the periodic table of elements? Picture that group of segregated elements at the bottom of said table — you know, the ones with ridiculous names.

Pop quiz: Can you name one element from that group?

Don’t worry if you can’t.

While these elements may not stick out to you, these “lanthanides” and “actinides” are actually quite important. In fact, they’re pretty well represented within the National Defense Stockpile (NDS) — essentially, an emergency reserve of critical materials just in case international relations sour. For instance, if foreign suppliers voluntarily or involuntarily stopped trading with us (something China did to Japan in 2010), we wouldn’t be totally screwed.

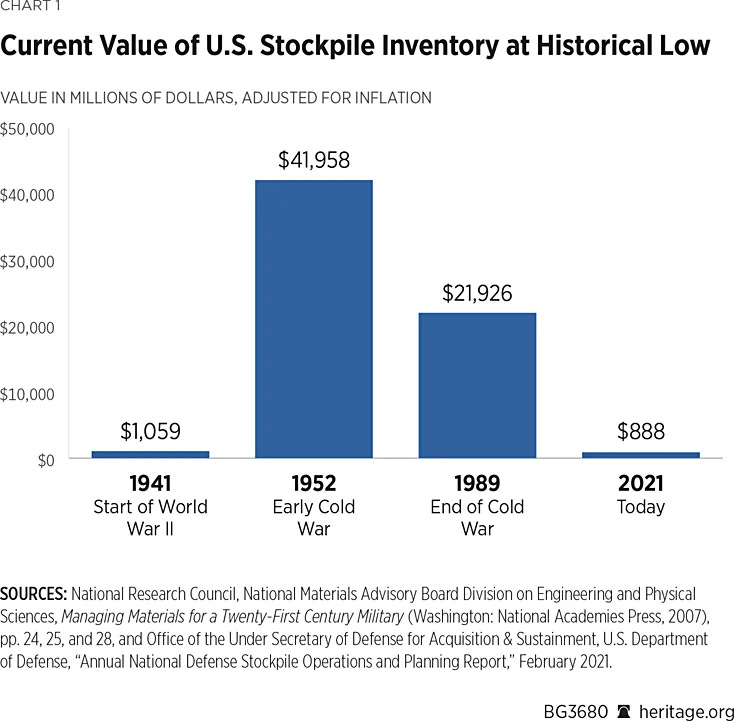

The NDS was introduced near the beginning of WW2, escalated rapidly during the early stages of the Cold War, before slimming down by the time the Berlin Wall fell in 1989.

Roughly three decades later, well, inventories are lower than when it was created.

Considering our dependence on China for rare-earth elements has been labeled a national emergency, it’s about time to restock the stockpile.

In late December, the Biden administration passed the National Defense Authorization Act. A small but notable portion ($1 billion) of the budget was earmarked for bolstering critical materials within the National Defense Stockpile.

Those materials are:

Neodymium oxide, praseodymium oxide, and neodymium iron boron (NdFeB) magnet block.

Titanium.

Energetic materials.

Iso-molded graphite.

Grain-oriented electric steel.

Tire cord steel.

Cadmium zinc telluride.

Scandium.

These are valuable, highly-coveted elements, particularly neodymium oxide, praseodymium oxide, and NdFeB — and there aren’t many economical ways to acquire them, which is exactly why we have a stockpile.

In fact, there’s only one operational REE mine in the great U.S. of A.

And it belongs to MP Materials.

MP Materials Could Benefit From the National Defense Authorization Act

MP Materials (MP) is a rare-earth mining company — the only one of its kind operating at scale in North America — that owns the Mountain Pass near Las Vegas, Nevada.

If you aren’t familiar with the company, we dove into MP Materials in a DD report last April.

The TLDR version boils down to three points:

The most sought-after and valuable REEs are neodymium (Nd) and praseodymium (Pr; together, NdPr or PrNd) — two key components of permanent magnets.

MP is currently progressing through a three-stage process that will conclude with a vertically integrated operation, all the way from mining REEs to producing permanent magnets and selling them to manufacturers.

[MP] is expected to produce 1,000 metric tons of finished NdFeB magnets (NdPr, iron, and boron) each year, which is enough material to power roughly 500,000 EV motors. And this would only account for roughly 10% of the company’s NdPr output, giving it much more runway to sell these magnets to other manufacturers.

While it’s by no means a guarantee, the increased budget space for the National Defense Stockpile could be an opportunity to add the government as a key customer in 2023 — especially since the Department of Defense has already awarded MP a $35 million contract to build a processing facility.

Three Eye-Opening Tweets

And finally, we close with three eye-opening tweets.

A couple uncovered one of the largest lithium deposits — and can’t mine it legally.

Sigma Lithium, another stock to watch.

Auto loan defaults and repossessions inbound.

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.