Are price targets meaningless? Let’s discuss.

Exploring the faults in a common industry practice.

Good morning, investors!

Recently, I asked you, my dearest readers, for your opinions on Due diligence. One addition that people wanted to see more of is Q&A and open discussion — so, today, we’re exploring the concept of price targets and forecasts, and I’d love to hear your thoughts.

If you didn’t get a chance to fill out the DD survey, you can do so here (average time to complete is 4.2 minutes).

Without further ado…

In early April, Morgan Stanley analyst Andrew Percoco lowered his price target for Plug Power from $35 to $15 — a 57% adjustment. The reasoning for Plug’s downgrade? If you read last week’s issue, it’s a familiar story: doubts that the hydrogen provider can achieve its rather bold sales and profit margin goals.

Granted, Percoco’s 12-month forecast would still imply a 61% gain, roughly six times the market’s historical average return. But it begs the question…do price targets even matter?

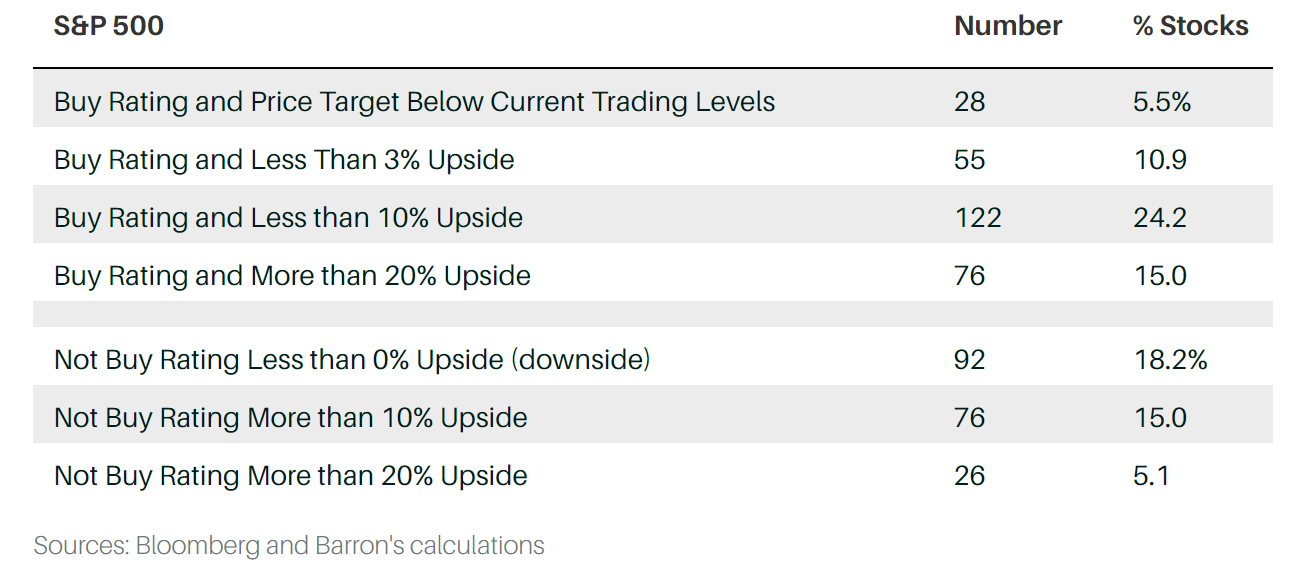

In 2019, Barron’s explored this common Wall Street practice by comparing stock ratings to their consensus price targets. They dug up some pretty interesting insights. Of the 205 stocks within the S&P 500 that had “Buy” ratings, 28 actually had price targets below their share prices at the time. Moreover, there was a surprisingly high percentage of companies that did not have “Buy” ratings but still had at least 10% upside based on their price targets.

Are Price Targets Meaningless?

What will shares of Apple be worth a year from today?

Beats me.

Yet, that’s what Wall Street analysts are charged with calculating and sharing in their research reports.

A price target is an estimate of a stock's future price, typically over a specific period (e.g., 12 months). Financial analysts set price targets based on their evaluation of a company's financials, business prospects, market conditions, and other relevant factors.

But this reference point may lack utility for several reasons:

Inherent subjectivity: Price targets are influenced by each analyst’s approach to valuing a company — not to mention their individual perspectives, biases, and opinions. There are countless ways to determine a company’s intrinsic “worth.” Price-to-earnings ratios, sum-of-the-parts analysis, discounted cash flows, EBITDA multiples, M&A multiples — the list goes on. Analysts may arrive at varying price targets for the same stock due to differences in their assumptions, methodologies, or outlooks.

Example: Tesla’s stock routinely receives wildly divergent price targets from different analysts. At the moment, they range from $85 to $320 per share, reflecting a high degree of subjectivity and differing opinions about the company's prospects.

Changing market conditions: Financial markets are dynamic and influenced by numerous factors, such as economic data, geopolitical events, and investor sentiment. Price targets are static (at least until they’re updated), so they may not account for these unpredictable factors, leading to discrepancies between projected and actual stock prices.

Example: The COVID-19 pandemic had a profound impact on global markets in 2020, causing several stocks to deviate significantly from their pre-pandemic price targets.

Overemphasis on short-term factors: Considering the time horizon (a year), analysts likely focus on short-term factors, such as quarterly earnings or near-term market trends, while overlooking a company's long-term prospects, competitive position, or the potential impact of industry disruptions.

Example: BlackBerry's stock received optimistic price targets during its peak in the late 2000s, but the emergence of smartphones like the iPhone drastically impacted BlackBerry's market position, causing its stock to fall short of analyst expectations.

To Forecast or Not to Forecast?

If you’re a long-time reader of DD, you know that I’ve included Wall Street’s price targets in past stock reports. Frankly, they’re semi-decent proxies for full-fledged models or intricate valuations — but they need to be taken with a grain of salt, especially by long-term investors.

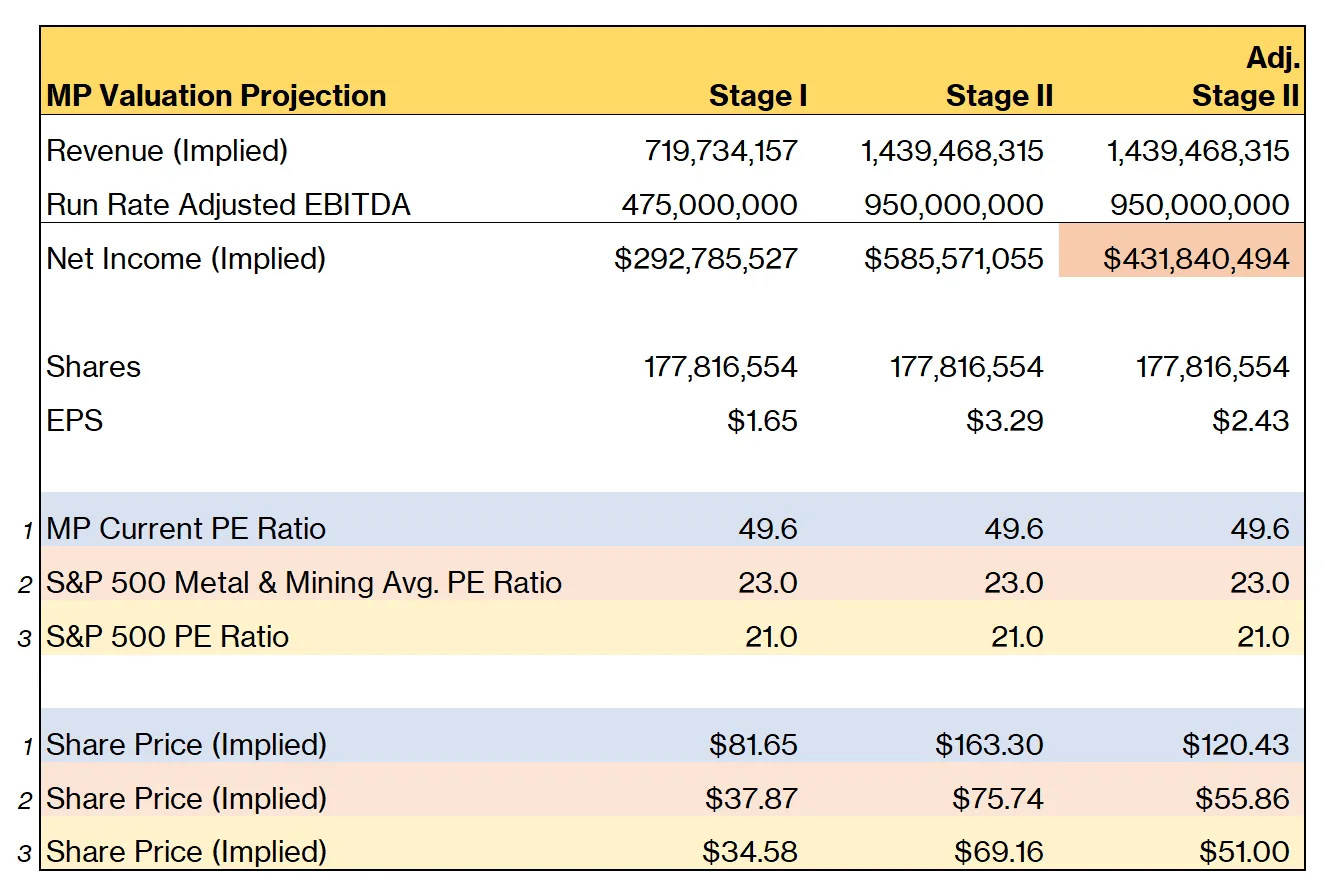

To give you an example, about a year ago, I shared my deep dive into MP Materials, one of my favorite stock reports to date. At the time, Wall Street was rather overeager, with a consensus price target of roughly $50 per share. I say “overeager” because MP was (and still is to an extent) in the initial phase of its rare-earth mining expansion.

Comparatively, my valuation approach — which applied three relevant P/E ratios to run-rate EBITDA projections to determine a possible price range— pegged MP’s stock at around $35 to $38 per share for run-rate Stage I.

MP is still progressing toward its projected volume outputs and beginning to execute Stage II plans, so $35 still feels like a good trading level. Right now, MP trades around $28 — well short of Wall Street’s average price target.

What does that tell us? If anything, unanimously bullish outlooks and constant price hikes could signal a security is overvalued.

In defense of Wall Street analysts, forecasts are rarely, if ever, spot on. There are just too many variables to account for. In that way, investing is as much an art as it is a science.

But I’ve done enough talking — I want to hear your thoughts.

Do you put any weight in price targets? Do you forecast share prices? If so, what’s your approach?

Fire away in the comment section below.

Thanks for reading. Don’t forget to hit the heart button if you enjoyed today’s report.

If you haven’t subscribed already, you can do so here.